This is a segment from the Empire newsletter. To read full editions, subscribe.

There’s endless shared trauma in crypto. But among the most common feels would be the kick to the guts that is buying a coin only to have it crash almost immediately.

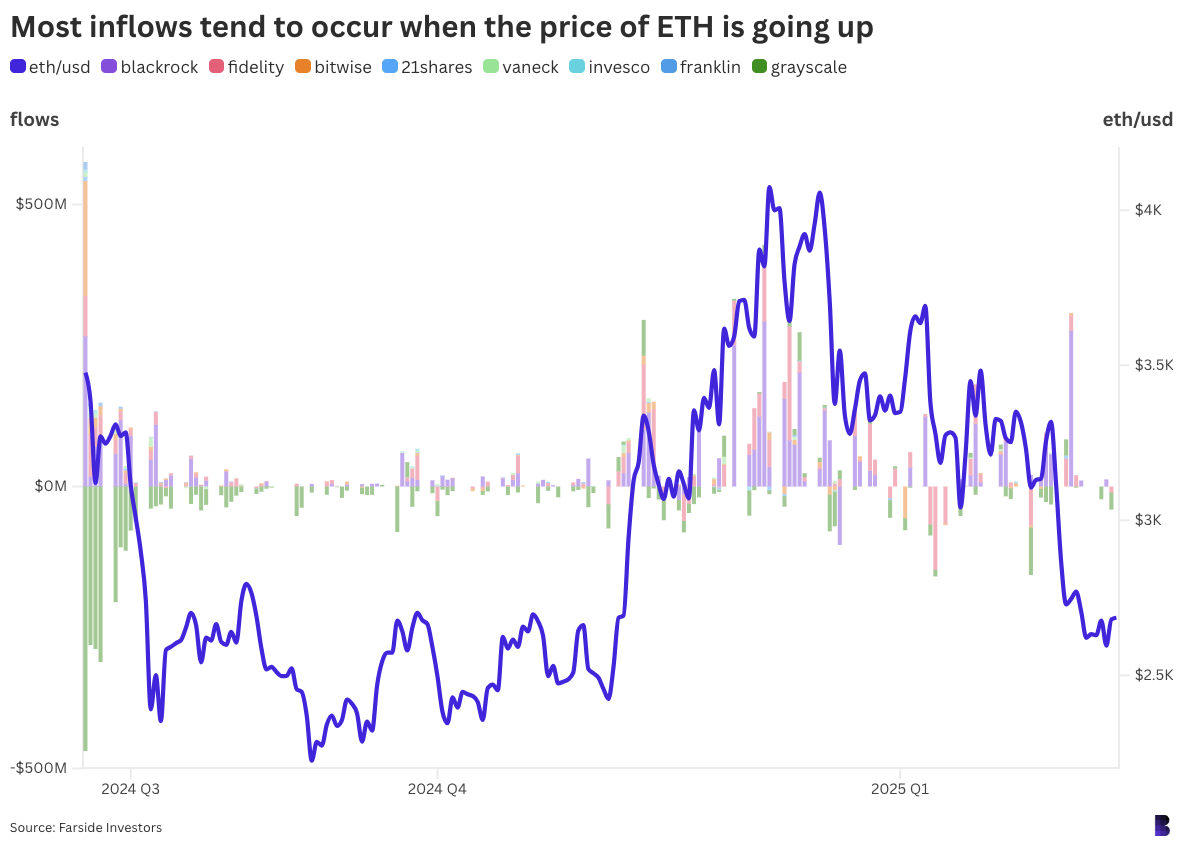

Buyers of ETH ETFs are going through it right now.

They’re collectively down an estimated $1.16 billion on their capital to date, after contributing the bulk of their inflows when the price of ETH was closer to $3,300, or around 27% higher than it is right now.

To be clear, the share prices of the ETFs themselves more-or-less track the price of ETH. The losses referred to here point to the ETH value each fund holds compared to how much was spent acquiring it.

How to calculate: Take the daily US dollar flows for each ETF and divide them by the daily reference rate. This gives a rough outline of how many ETH units the ETFs buy and sell every trading day.

Then, tally those ETH units and multiply the total by the price of ETH — that will give the current value of each fund’s ETH holdings, which technically belong to their respective shareholders.

Divide the current value of each fund’s ETH by the total amount of US dollars that have flowed into each one to date, and you’ll get a reading on how well each fund has actually performed for its shareholders so far.

Each line shows the performance of each fund. The blue line at the bottom plots the price of ETH.

(Grayscale’s ETFs weren’t included in this analysis as most of their capital flows occurred long ago, so their performance isn’t easily calculable.)

As it turns out, 21Shares’ CETH, in light blue, is the only ETF ahead on its net flows.

CETH is currently holding about $18.11 million in ETH, while its total cumulative net flows were only $16.9 million — putting it $1.21 million in the green, or nearly 7.2%.

Fidelity’s FETH is the worst performer of the bunch. It’s sitting on $1.21 billion in ETH from almost $1.5 billion in net flows, so it’s down $289.2 million or just under 20%.

BlackRock’s ETHA is otherwise down 17.6%, which is slightly better performance based on percentages, but due to the size of the fund it has lost its shareholders more dollars than any other — the equivalent of $782.5 million.

The strategy is buy low and sell high. But ETF customers haven’t quite nailed that yet. Net daily flows are the columns in the background, the blue line is the price of ETH.

Why are some funds performing better than others? Simple: it depends on when ETF customers contribute and withdraw their capital.

Take 21Shares’ CETH. Most of its inflows to date occurred between September and November last year, when ETH had traded for well under $2,500 at times.

Then, CETH customers redeemed $15 million worth of shares between November and December, when ETH had rallied by around 60% from local lows to briefly clear $4,000. Literally, CETH holders had bought low and sold high.

In any case, a clear cure-all would be for the price of ETH to go up. Vitalik’s recent tweet about “making communism great again” hasn’t gone over well — might I suggest posting almost exclusively about the roadmap, as that seems to do the trick.

Read the full article here