The Ethereum token has officially entered the spotlight as it breaks out of a multi-year triangle pattern on the weekly chart. According to insights from technical analyst Captain Faibik, the breakout signals the start of the much-anticipated 2024-25 bull run. Currently trading at $4,002, ETH has surged over 7.93% in the past week, edging closer to the crucial $4,500 level.

$ETH is finally Breaking out of Massive Triangle on the Weekly TF Chart..!!

Ethereum 2024-25 bull run is Officially Started. 📈

Midterm Target: $10K!#Crypto #Ethereum #ETH #ETHUSDT pic.twitter.com/NQ3s2taX92

— Captain Faibik 🐺 (@CryptoFaibik) December 7, 2024

This breakout marks the end of a prolonged consolidation phase characterized by lower highs and higher lows, culminating in a bullish resolution. As a result, Captain Faibik points to a potential mid-term target of $10,000, aligning with historical patterns observed during Ethereum’s previous bull cycles.

ETH Bullish Pattern Targets $4,500

According to a TradingView analysis, the ETH token chart reveals a textbook cup-and-handle pattern, a bullish formation suggesting further upside potential. The pattern’s breakout height of approximately 37%, combined with Fibonacci extensions, points to a short-term target of $4,500.

As of press time, the cryptocurrency is testing the neckline resistance near $4,087, and a decisive break above this level could confirm the continuation of its rally. Moreover, the Fib retracement levels have played a key role, with the handle finding support near the 38.2% retracement zone at $3,342, reinforcing the bullish outlook.

From a technical perspective, momentum indicators further strengthen the bullish case scenario. The relative strength index, for instance, sits at 72.31, implying a heightened buying spree in the ETH cryptocurrency. Historically, Ethereum has displayed an ability to hold critical levels, consistently building on its momentum and achieving new highs in similar scenarios.

Yet these very levels often coincide with overbought conditions, signaling the potential for short-term corrections. The Directional Movement Index further solidifies the bullish case, with the +DI line, 31.7980, outpacing the -DI at 8.6811. This shows a dominant buying strength in the ETH market. Additionally, the ADX value of 47.0139 confirms the current trend’s strength and suggests that the buying momentum will likely continue soon.

ETH’s On-Chain Metrics Reveals Minimal Resistance Ahead

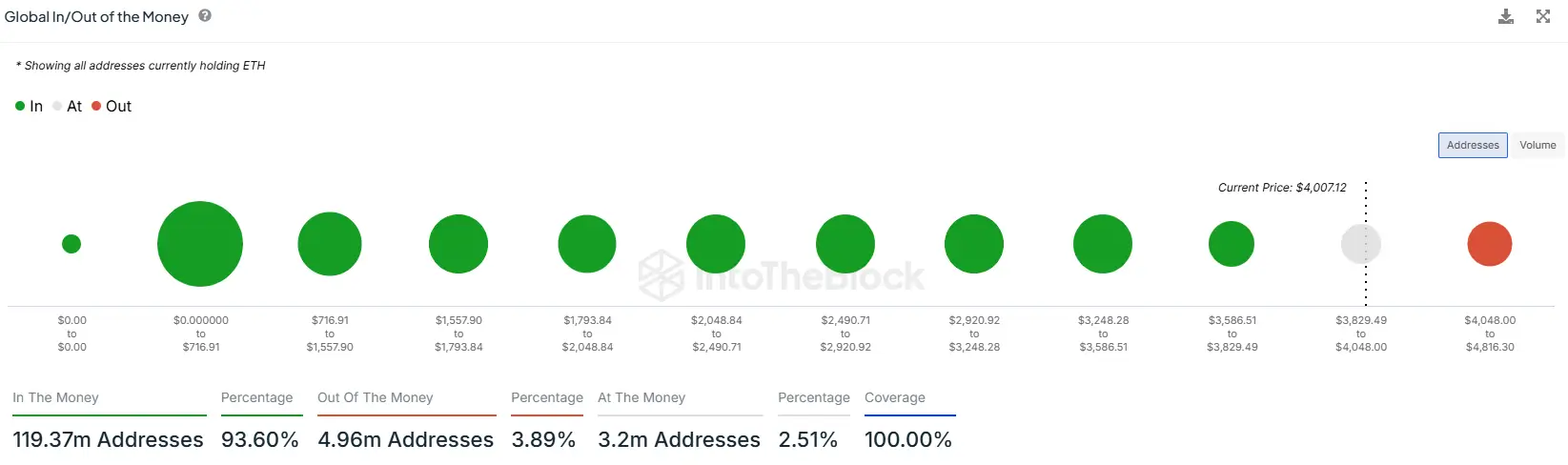

On-chain data reveals that 93.6% of Ethereum addresses, or 119.37 million, are currently “in the money,” meaning they purchased ETH at a price lower than the current $4,007.12. Meanwhile, only 3.89% of addresses, representing 4.96 million holders, are “out of the money,” indicating resistance if the cryptocurrency’s price approaches their break-even points.

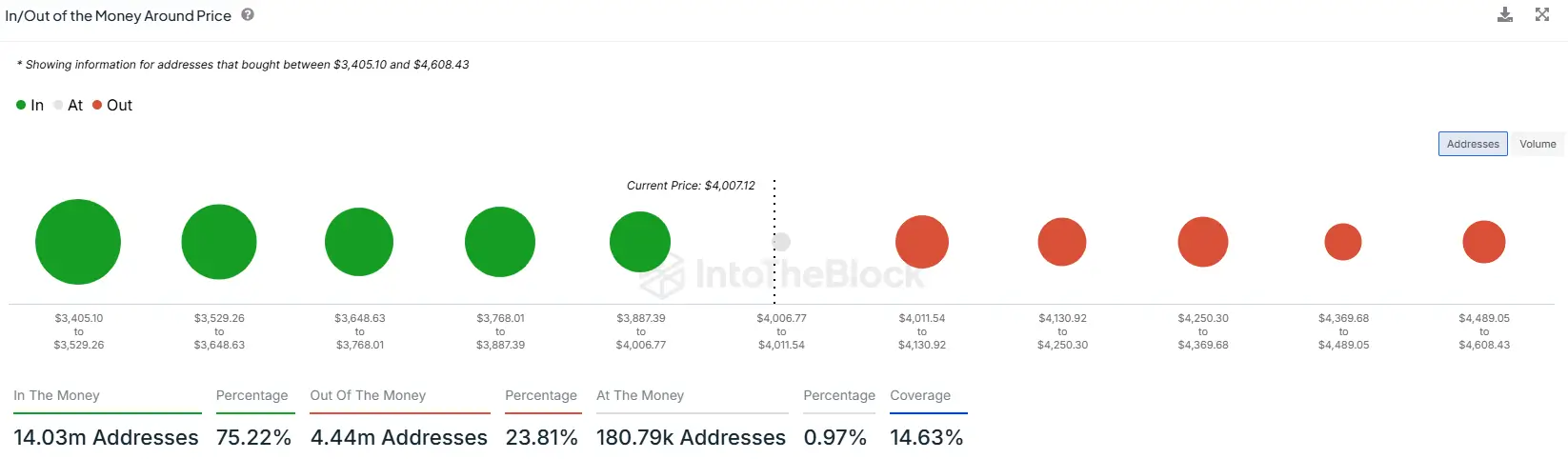

Additionally, 2.51% of addresses, or 3.2 million, are “at the money,” suggesting a critical threshold around the current price level. Focusing on the price cluster between $3,405.10 and $4,608.43, 75.22% of addresses, or 14.03 million, remain profitable.

However, 23.81%, or 4.44 million, are out of the money, which could introduce selling pressure in the upper range near $4,250–$4,500. With minimal resistance zones until the $4,500 target, the token’s breakout momentum may remain intact unless market conditions shift drastically.

Read the full article here