Ethereum price today: $2,420

- Ethereum spot and derivative markets have experienced slow movement, with investors exhibiting less buying activity over the past few days.

- Ethereum has seen growth in network usage despite prices remaining range-bound.

- ETH faced rejection at the $2,500 level after posting an inverted hammer.

Ethereum (ETH) is down 1% in early trading hours on Friday, as market activity remains cautious following low realized profit and loss, along with steady open interest. Despite this, Ethereum’s network usage has rebounded, with transaction counts rising from 1.23 million to 1.75 million on Wednesday, spurred by an increase in active addresses.

Ethereum price stays range-bound amid growth in network activity

Ethereum’s buying and selling activity across its derivatives and spot markets have been fairly neutral in the past few days, revealing that cautious sentiment still largely prevails in the market.

The Network Realized Profit/Loss and Mean Coin Age metrics indicate that investors have scaled back their trading activity, with daily losses and profits remaining below the $100 million mark, and distribution/accumulation remaining flat over the past few days.

ETH Network Realized Profit/Loss & Mean Coin Ages. Source: Santiment

The balance of whales holding between 10,000 and 100,000 ETH has also been stable since the beginning of the week, rising by a mere 7,000 ETH, according to CryptoQuant’s data. This is accompanied by an exchange reserve that has tilted upward slightly, indicating a modest increase in selling pressure in the week.

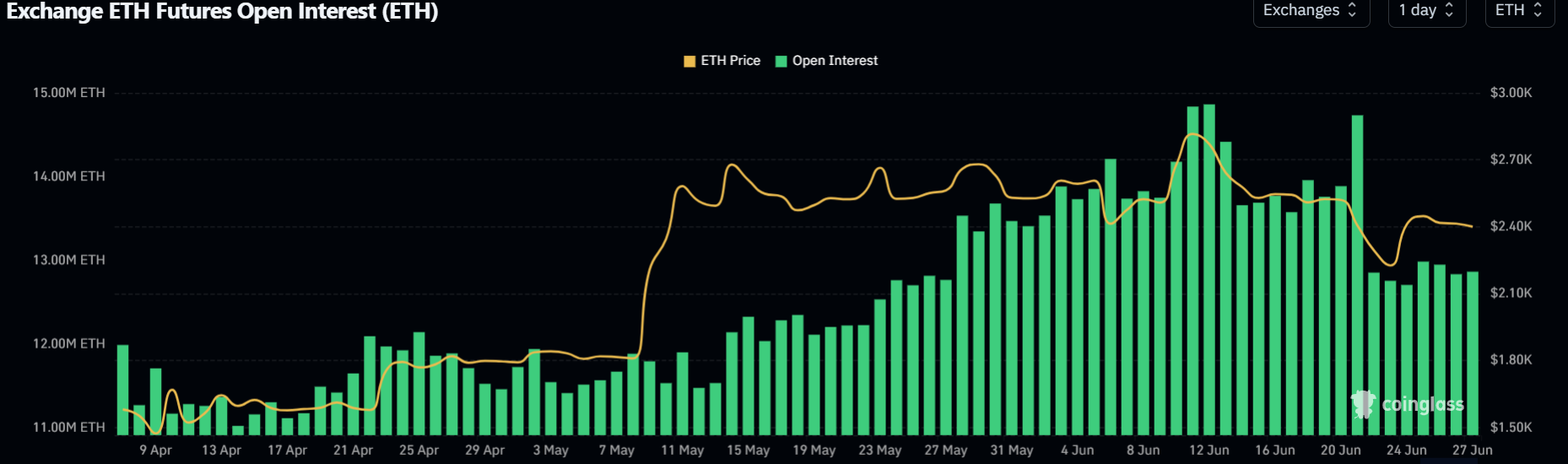

The derivatives market paints a similar picture, with open interest (OI) failing to surpass the 13 million ETH mark since it declined on Saturday. Open interest refers to the total value of outstanding or unsettled contracts in a derivatives market.

ETH Open Interest. Source: Coinglass

While these metrics paint a cautious market sentiment with a slight bias toward the downside, Ethereum’s network usage and institutional sentiment are somewhat tilted toward a bullish leaning.

Ethereum’s active addresses have been growing again, breaking its downtrend that began on June 13, despite prices remaining largely horizontal.

ETH Active Addresses. Source: CryptoQuant

These addresses have also been active in making transactions, as Ethereum’s transaction count increased from 1.23 million to 1.75 million between Sunday and Wednesday, signaling rising interest in the Ethereum ecosystem.

Such growth in network activity indicates strength and often forms the foundation for a long-term recovery if macroeconomic factors align. However, that seems unclear for now as market participants appear to be following a wait-and-see approach due to uncertainty surrounding President Trump’s 90-day tariff pause, which is nearing its July 9 deadline. This has left a bearish shadow hanging over ETH and much of the crypto market.

https://x.com/KobeissiLetter/status/1938291119483224102

Ethereum Price Forecast: ETH tests $2,500 key level after posting inverted hammer

Ethereum experienced $75.11 million in futures liquidations in the past 24 hours, with liquidated long and short positions reaching $37.08 million and $38.03 million, respectively.

After briefly reclaiming the $2,500 level for the first time in the past week, ETH saw a rejection at the 100-period Simple Moving Average (SMA), posting an inverted hammer in the process. If ETH holds the support near $2,400 and breaks the $2,510 resistance, it would validate a bullish reversal.

ETH/USDT 12-hour chart

However, a decline below the support line near $2,400 could send ETH to test the upper boundary line of a descending channel. If ETH falls below the upper boundary of the channel and the lower boundary of a symmetrical triangle, it will validate a bearish flag pattern, which could see its price drop below the $2,110 key level.

The Relative Strength Index (RSI) is testing its neutral level while the Stochastic Oscillator is above its midline. A crossover above the neutral level in the RSI could strengthen the bullish momentum.

Related news

- Ethereum Price Forecast: Bitcoin miner pivots to ETH treasury strategy

- Ethereum Price Forecast: ETH defies Powell’s hawkish tone as Israel-Iran ceasefire fuels bullish sentiment

- Crypto could be used as an asset for mortgage in 2025: Here’s why

Read the full article here