Key takeaways:

-

An Ethereum whale made $31 million in two ETH trades in the last 44 days.

-

Unique Ethereum addresses surged by 70% in Q2, with the Base network leading activity growth.

Ether (ETH) is on the verge of breaking its monthly range, hitting a 15-week high of $2,827 on June 10. A daily close above $2,700 would mark its highest since Feb. 24.

After a month-long price consolidation between $2,300 and $2,800, one Ethereum whale capitalized on the recent rally. According to an X post from onchain tracker Lookonchain, the whale sold 30,000 ETH for $82.76 million through an over-the-counter (OTC) trade on June 10, locking in a $7.3 million profit. The sale followed a $75.56 million ETH purchase on May 27.

The same whale bought 30,000 ETH for $54.9 million at $1,830 via Wintermute OTC on April 27. On May 22, it sold the ETH at $2,621 for $78.63 million, netting $23.73 million amid a 43% price rally.

The whale has secured $31 million in profits within just 44 days.

Unique Ethereum addresses are up 70% in Q2

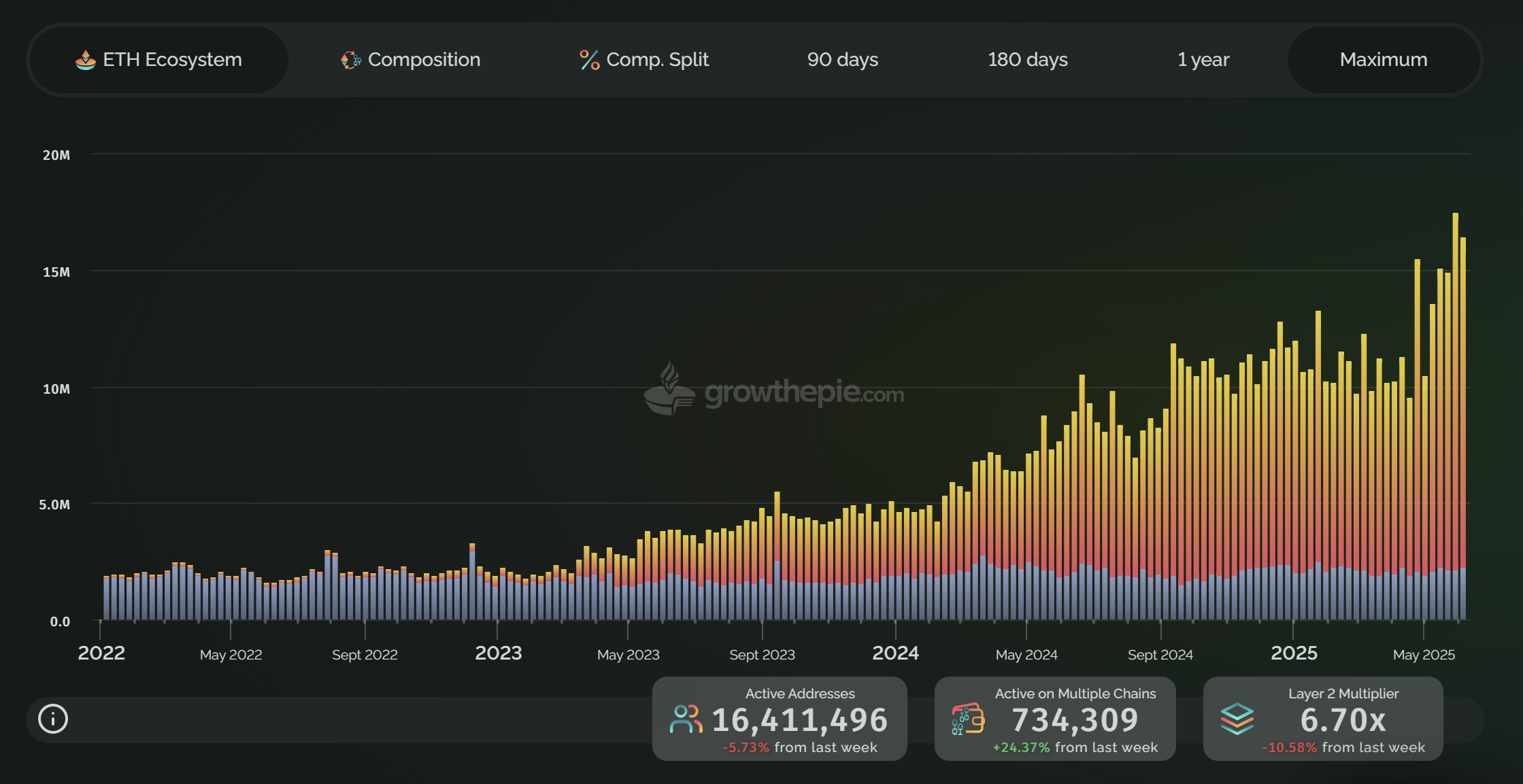

The number of unique addresses on the Ethereum network reached an all-time high of 17.4 million earlier this month. Data from growthepie highlighted that the number of ETH addresses interacting with one or multiple chains has increased by 70.5% since the beginning of Q2. ETH addresses remained elevated, with 16.4 million active addresses observed on June 10.

The Base network led this significant growth, accounting for 72.81% of 11.29 million this week, with Ethereum’s mainnet recording 2.23 million addresses or 14.8%.

Cointelegraph noted that Ethereum continued to dominate the decentralized finance (DeFi) sector, with ETH holding a 61% share of the total value locked (TVL) with roughly $66 billion.

However, concerns remain for its sustainability due to only having $43.3 million in fees over the last 30 days. Recent updates favoring rollups with low-cost data packets (blobs) have reduced staker returns, as ETH’s supply reduction relies heavily on network fees.

Related: Staked Ethereum hits all-time high as ETH tops $2.7K

Ethereum bulls could liquidate $1.8 billion in shorts above $2,900

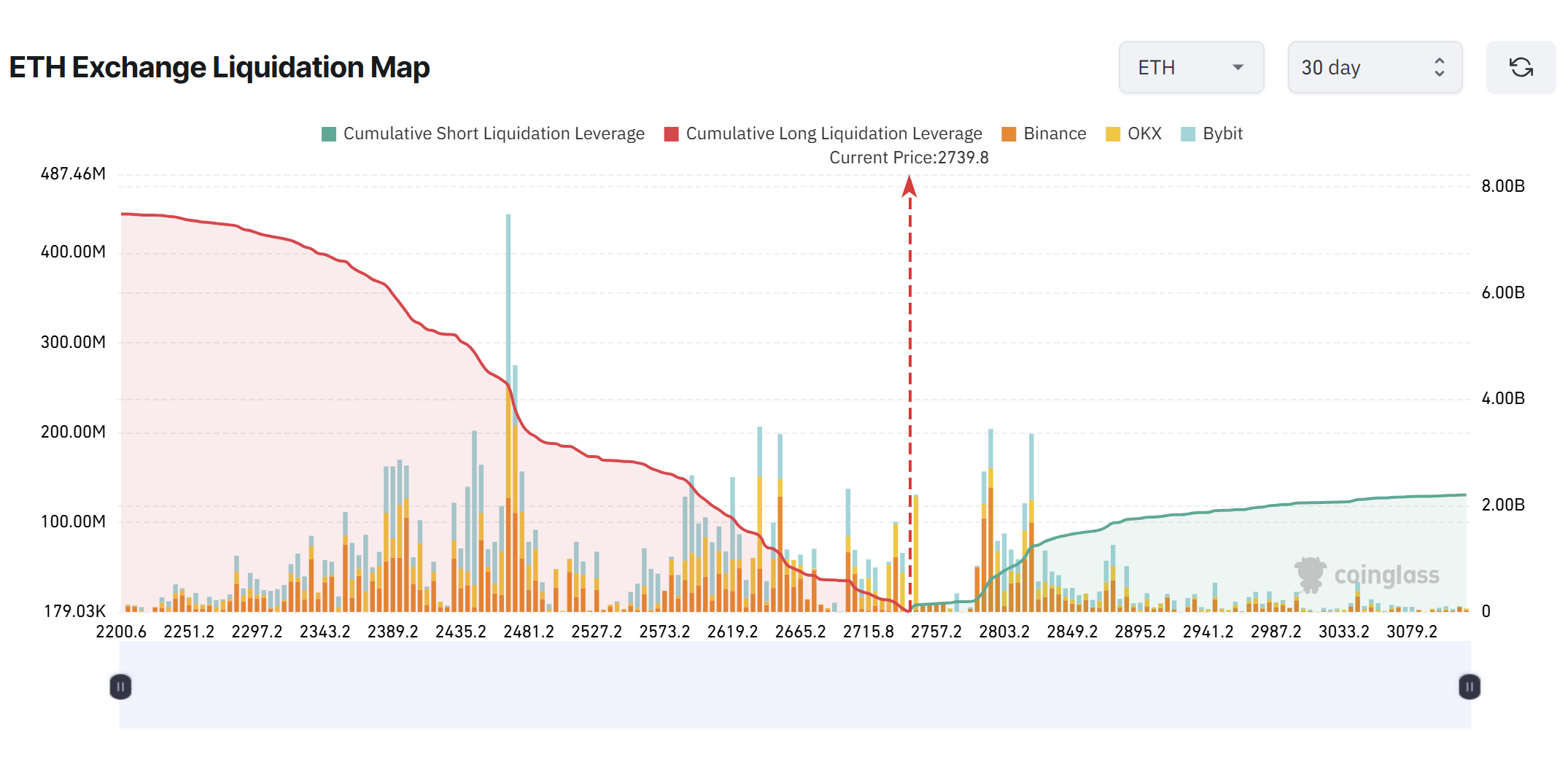

Ether’s futures open interest (OI) has surged past $40 billion for the first time in its history, signaling a heavily leveraged market. This elevated open interest suggests potential volatility.

Despite the risks, liquidity dynamics remain balanced. Data from CoinGlass shows $2 billion in long positions facing liquidation at $2,600, while $1.8 billion in shorts risk liquidation at $2,900. This equilibrium leaves market makers’ next move uncertain, as they could chase liquidity on either side.

Related: Ethereum network growth, spot ETH ETF inflows and price gains lure new investors

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here