On Monday, Ethereum exchange-traded funds (ETFs) recorded their highest inflows in 30 days. This signals strong investor interest despite ETH’s lackluster price performance in recent weeks.

The surge in ETF investments coincides with increased market optimism following Donald Trump’s inauguration, which has increased investors’ confidence.

Ethereum ETF Inflows Surge

According to data from Glassnode, inflows into US ETH spot ETFs totaled $227 million on Monday. This represented the single-day highest net inflows since December 9. The spike in ETF inflows came as pro-crypto Donald Trump was sworn in as US president, which boosted confidence in overall market conditions.

The rise in ETF inflows highlights the growing institutional interest in ETH as a viable investment vehicle, even amidst the coin’s poor price performance in recent weeks. According to the latest Coinshares weekly report, ETH recorded inflows totaling $246 million last week, reversing the outflows it had experienced earlier this year.

This trend highlights the strengthening institutional demand for the altcoin, even as its price continues to trade within a narrow range.

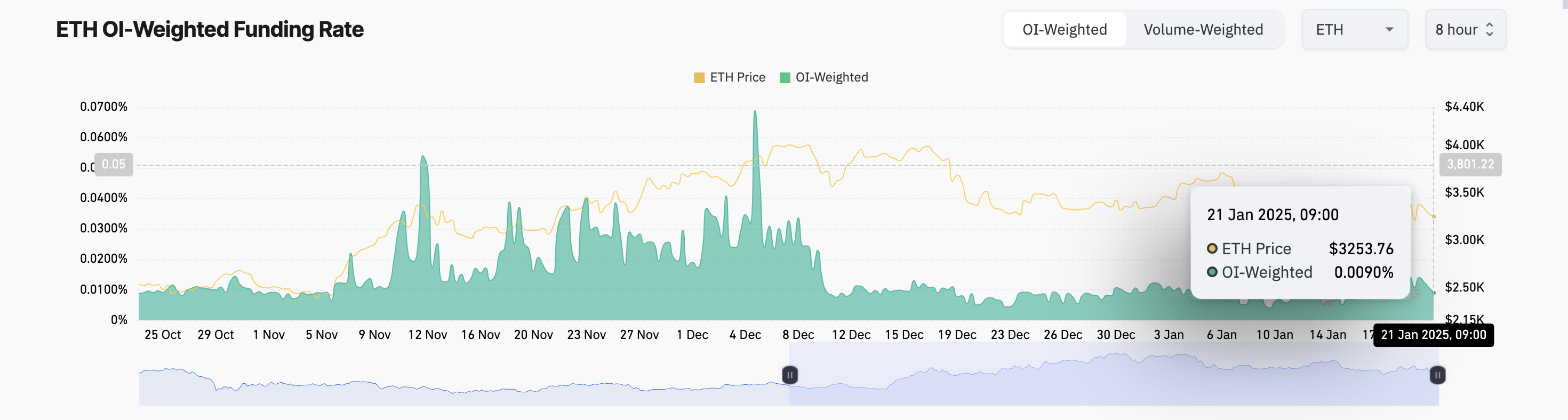

Moreover, the persistent positive funding rate in the futures market confirms the bullish bias toward the coin despite its performance. As of this writing, this stands at 0.0090%, indicating the preference for long positions among ETH’s derivatives traders.

The funding rate is a periodic fee exchanged between long and short traders in futures contracts to maintain price alignment between the futures and the underlying asset.

As with ETH, a positive funding rate indicates that long traders are paying short traders, signaling bullish sentiment as more traders are betting on the price increase.

ETH Price Prediction: Will Market Demand Push It Past $3,500?

ETH currently trades at $3,265. If market demand for the altcoin increases, its price will break out of its narrow range to trade above $3,500 and rally toward $3,675.

However, if it remains rangebound and bearish pressure strengthens, ETH’s price might break to the downside and fall to $3,022.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here