Key takeaways:

-

Ether surged to $2,470, but futures and options data show weak bullish conviction from traders.

-

Despite spot ETH ETF inflows, low network fees and rising competition weigh on Ether’s price outlook.

Ether (ETH) jumped 17% to $2,470 from a Sunday low of $2,115, following investors’ response to news that a ceasefire was established between Iran and Israel. Oil prices dropped to a two-week low after markets predicted reduced geopolitical risks.

Despite the improved geopolitical climate, professional Ether traders remain hesitant to adopt a bullish stance.

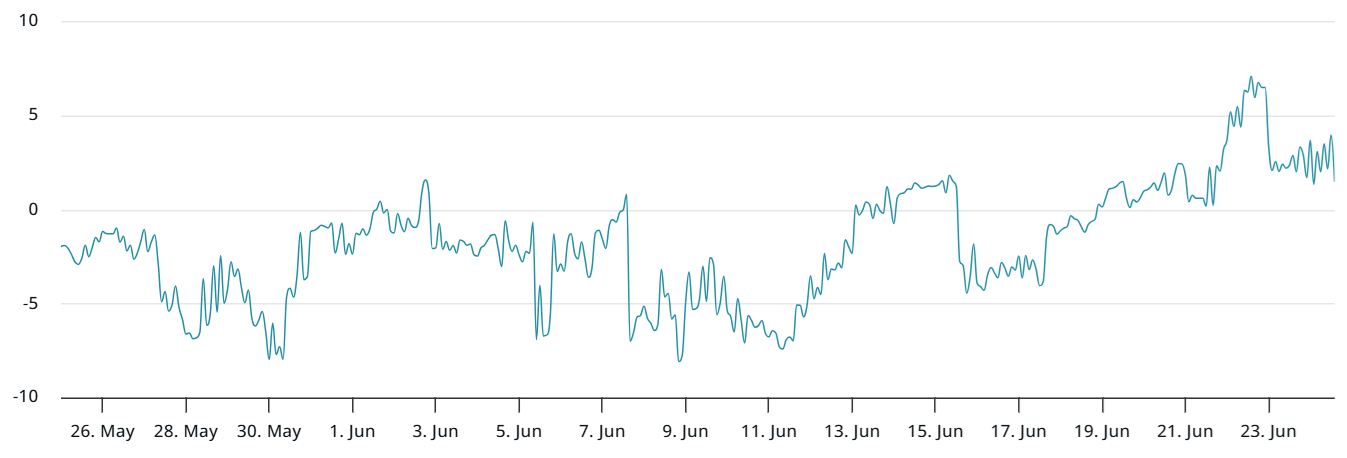

In neutral markets, ETH monthly futures typically trade at a 5% to 10% annualized premium to account for the extended settlement period. On Tuesday, this indicator slipped to a bearish 3% level. The lack of interest in leveraged long positions has persisted since June 12, after ETH failed to hold above $2,700.

Interestingly, US-listed Ether exchange-traded funds (ETFs) recorded $101 million in net inflows on Monday, reversing the $11 million in outflows seen on Friday. Still, whatever is holding back bullish leverage demand isn’t likely to shift simply because ETH rose 10% to $2,660 or because ETFs draw an additional $300 million in inflows.

Ether’s market capitalization outpaces fees, raising sustainability concerns

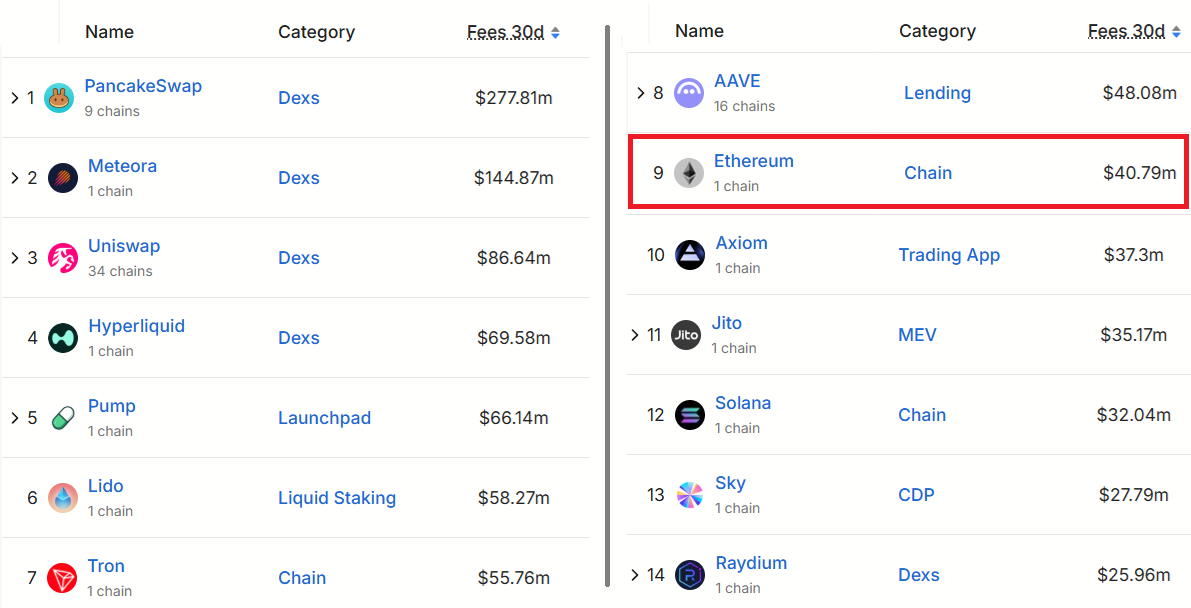

Investor concerns revolve around the mismatch between Ether’s $293 billion market capitalization and its modest $41 million in monthly network fees. Regardless of whether the reduced rollup costs were intentional, network activity must increase substantially to sustain staking rewards without inflating the ETH supply.

While Ethereum leads in total deposits, its fees are just $8 million higher than those of Solana. For context, Ethereum’s total value locked (TVL) is $66 billion, compared to Solana’s $10 billion. More strikingly, Tron collects $56 million in monthly fees despite having under $5 billion in TVL.

ETH options markets provide further insight into sentiment among large investors. In balanced conditions, the skew metric should stay between 5% and +5%. Readings above this range indicate that market makers are hesitant to provide downside protection.

Currently, the 2% skew falls well within the neutral zone, although it briefly approached bearish territory on Sunday. More notably, ETH options haven’t shown a skew below -5% since June 11, implying that traders expect a consolidation above $2,800 to trigger a bullish shift.

Related: Crypto staking in 2025: SEC’s New rules make these methods fully legal

More than 20 weeks have passed since Ether last traded above $3,000, leading to gradual erosion in trader confidence. The absence of renewed optimism also stems from intensifying competition in decentralized application (DApp) activity, particularly from Solana and BNB Chain.

It remains unclear what could reignite strong buying interest in ETH. A durable bullish trend will likely require a clear competitive edge. Unless Ethereum differentiates itself through tangible institutional adoption or network dominance, ETH is unlikely to surpass the $3,000 mark in the short term.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Read the full article here