- BlackRock and Fidelity Ethereum ETF investors are now more than 21 percent down as ETH treads far below their entry prices.

- Since May 16, ETFs have recorded nine consecutive days of inflows of $435.6 million despite losses.

- Although Ethereum has not consolidated above $3,000 just yet, institutional demand is as high as it is.

Ethereum ($ETH) is struggling below $2,650 while most ETF holders are still deep in the red. Glassnode recorded that the average cost bases of BlackRock and Fidelity’s Ether ETFs are $3,300 and $3,500, respectively. ETH is currently trading at $2,621, taking the total amount of unrealized losses owing to the price correction to more than 20%.

📉 The average ETH ETF investor is in a BIG LOSS.

According to Glassnode, the average costs basis for the ETF investors are $3.3k & $3.5k for BlackRock & Fidelity respectively.

Do they have a chance this cycle? 🤔 pic.twitter.com/SvQvaMSFRC

— Coin Bureau (@coinbureau) May 30, 2025

However, in the past two weeks, sentiment has turned. Geopolitical tensions and U.S. tariffs had fueled a prolonged selloff from Ether, but the cryptocurrency has since risen by 44% from its yearly low of $1,472 in April.

$435.6 million was also noted in spot Ether ETFs flowing in during nine consecutive days that began on May 16. Inflows followed a U.S. federal court’s decision to block most of Trump’s import tariffs on extreme macro pressure on crypto markets.

Despite this, however, analysts at Glassnode noted that the ETF does little to affect spot price. At the time of launch, products represented only 1.5% of trade volume, hitting 2.5% only briefly in November 2024 before fading.

Institutional investors, however, wouldn’t be jumping hastily, this tepid response suggests, especially for following earlier withdrawal waves in August 2024 and Q1 2025. Since launch, cumulative inflows for Ethereum ETFs have added up to $2.94 billion, with institutional appetite genuinely remaining albeit with dialled-back enthusiasm.

Market Structure Signals Upside Potential

According to Crypto Caesar, Ethereum broke out of a prolonged downtrend in early May after confirming a market structure shift (MsS). After the breakout, ETH cleared many resistance zones to reach new support at $2,485.52. Now, analysts are looking for a continuation pattern being set with higher lows surrounding the key level.

Technical indicators further support a bullish bias. Sustained demand pushes the RSI close to growth in the overbought territory near 66. While not in the bearish area yet, MACD readings are indicating a slower bullish momentum. A potential bounce from the $2,487 support could see the market test levels around $2,880 and then $3,200 in time.

Source: Trading View

Further success for Ethereum in reclaiming the $3,000 mark would fuel renewed ETF buying that could help institutional investors wipe off their paper losses. If current support fails to hold, it may topple to $2,300 or below.

On-Chain Metrics Highlight Tight Supply

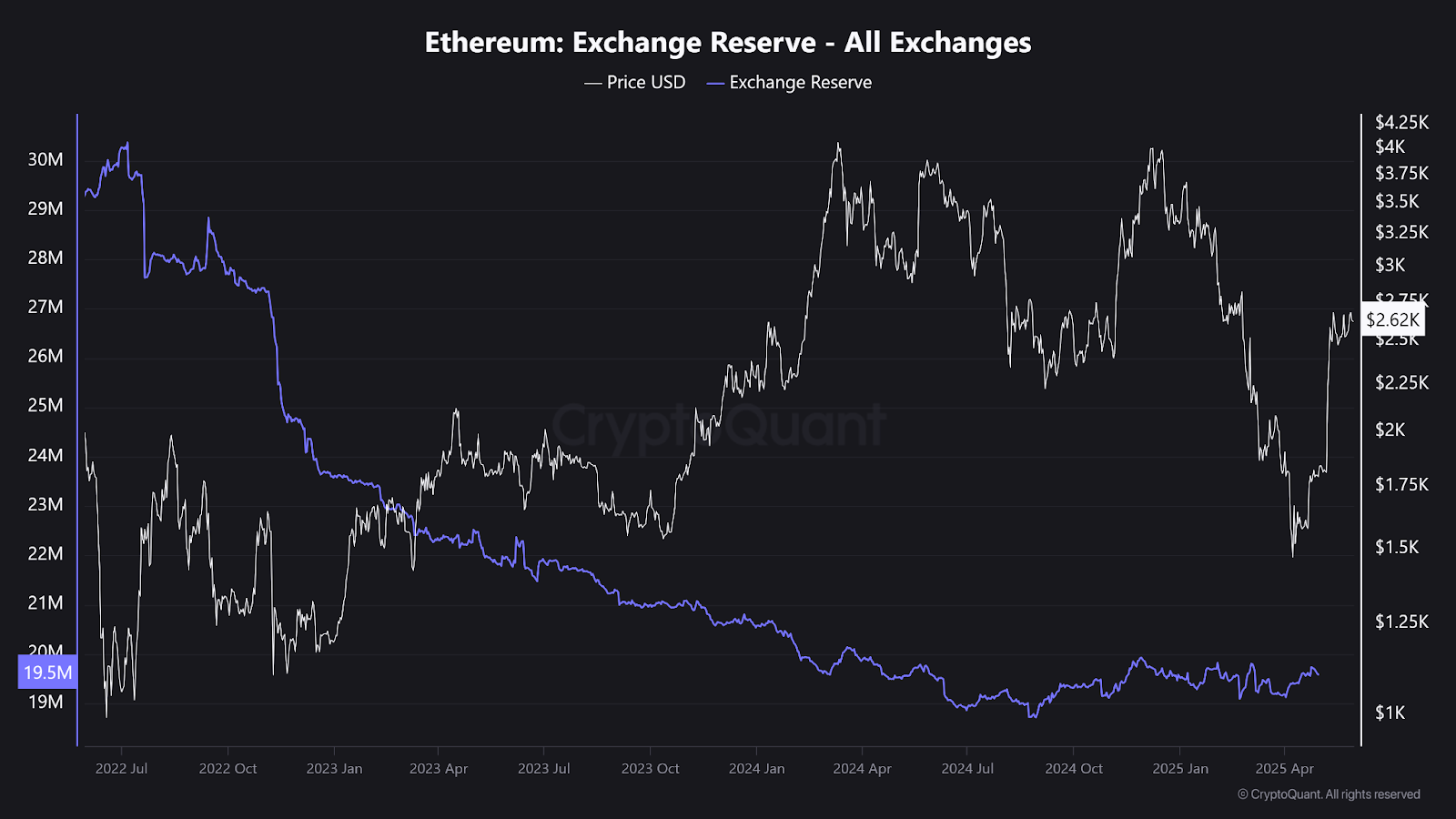

According to CryptoQuant exchange reserve data, Ethereum balances on exchanges are still dropping. As of May 30, the number of ETH held on centralized platforms is at 19.5 million after reaching above 30 million earlier this year. This long-term drawdown indicates less sell-side pressure as most investors grow more confident in self-custody.

Source: CryptoQuant

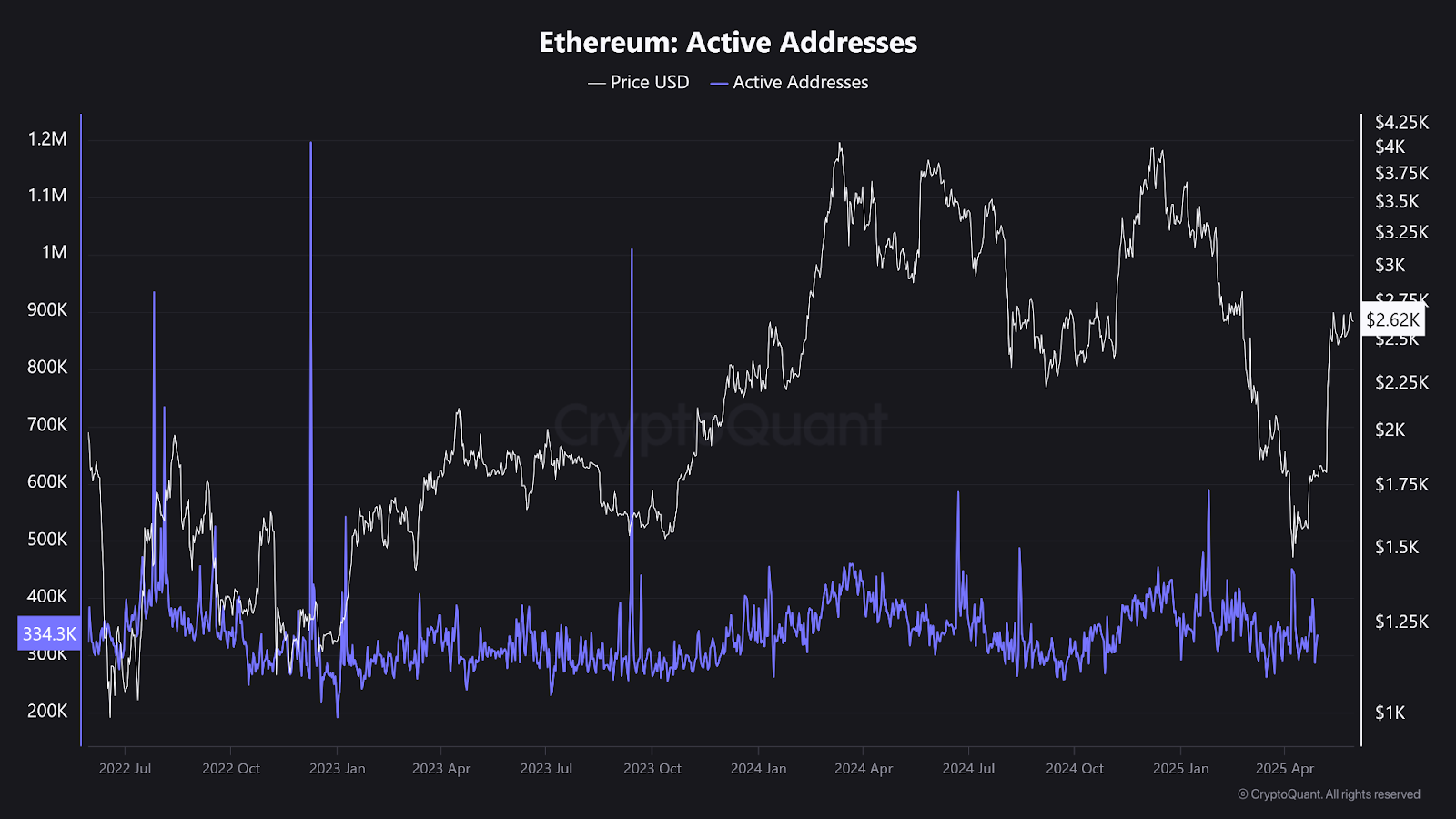

Active address counts, meanwhile, have dropped to 334,000, a level not seen since early 2023. This dip may indicate a lull in retail activity, but it falls in line with the current market structure dominated by ETFs when institutions purchase in large quantities and with fewer addresses.

Source: CryptoQuant

Ethereum derivatives open interest has risen to $35 billion, an increase of 8.8% in the last week. CoinGlass said that positive funding rates indicate most traders were taking long positions. According to options data, retail traders are hoping to push the price to $3,000 this month, while institutional players want to take it to $3,500 by June.

Read the full article here