-

Ethereum (ETH) could drop by 11% to reach the $2,850 support level if closes a daily candle below the $3,200 level.

-

Currently, 53.07% of top traders hold short positions, while 46.93% hold long positions.

-

At present, the short positions created by sellers are more than double the long positions held by buyers.

Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, is flashing a sell-off signal, hinting at a notable price decline in the coming days. Over the past three days, sentiment across the cryptocurrency landscape has shifted noticeably toward the bearish side, leading to a substantial price drop.

Ethereum (ETH) Technical Analysis and Upcoming Levels

However, this price decline is expected to continue as ETH has formed a bearish price action on the daily timeframe. According to expert technical analysis, ETH has broken out of a bearish Head-and-Shoulders pattern and breached a crucial support level at $3,250.

Source: Trading View

This breakdown of bearish price action has pushed traders toward short positions, which could influence ETH’s price in the coming days. Historical data indicates that $3,250 has been a strong support level for ETH over the past three months, consistently providing a floor whenever market sentiment turned bearish.

However, this time, the altcoin has failed to hold this level. Based on recent price action, if ETH closes a daily candle below the $3,200 level, there is a strong possibility of an 11% drop, taking it to the $2,850 support level.

Bearish On-Chain Metrics

This bearish outlook has prompted traders to take short positions, as reported by the on-chain analytics firm Coinglass. Currently, the ETH long/short ratio stands at 0.884, indicating strong bearish sentiment among traders. Additionally, data reveals that, as of press time, 53.07% of top traders hold short positions, while 46.93% hold long positions.

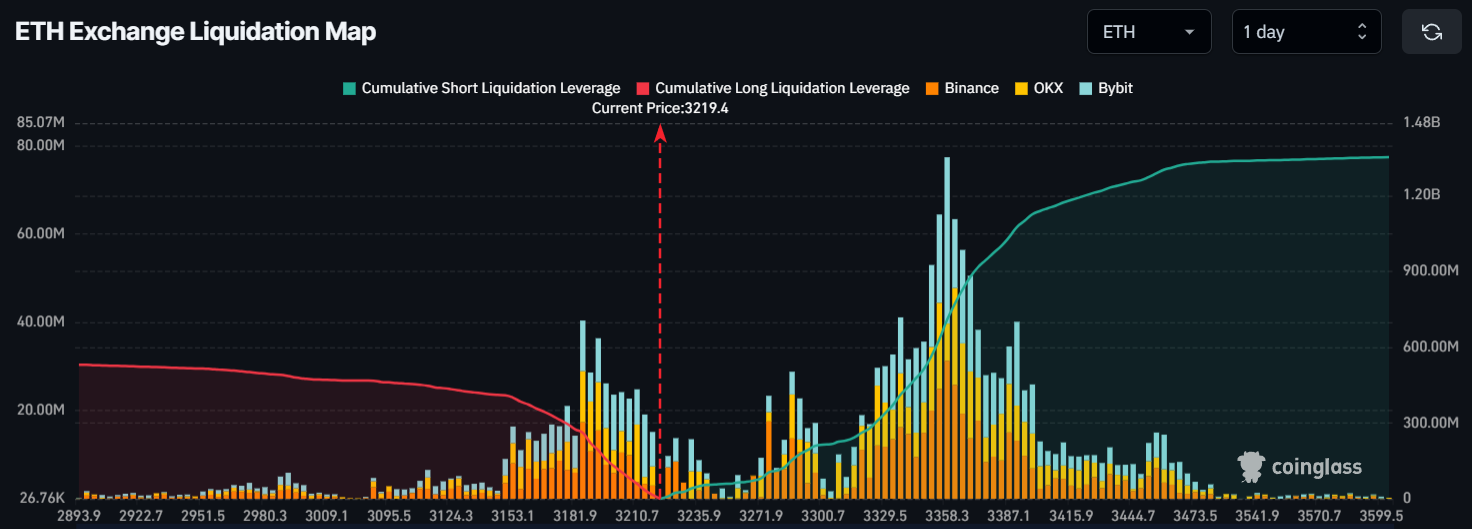

Major Liquidation Levels

In addition, the major liquidation areas are at the $3,185.5 level on the lower side and $3,361.9 on the upper side, with traders heavily over-leveraged at these levels, as revealed by the ETH exchange liquidation map.

Source: Coinglass

If the current sentiment remains unchanged and the price drops to the $3,185.5 level, nearly $261.01 million worth of long positions will be liquidated. Conversely, if the sentiment shifts and the price rises to the $3,361.9 level, approximately $708.16 million worth of short positions will be liquidated.

This data reveals that the short positions created by sellers are more than double the long positions held by buyers, signaling a strong bearish sentiment.

Current Price Momentum

Currently, ETH is trading near $3,225, having experienced a price decline of over 1.65% in the past 24 hours. However, during the same period, its trading volume has dropped by 29%, indicating reduced participation from traders and investors.

Read the full article here