Ethereum (ETH) funding rate has hit the highest level since March following a price increase above $3,400 earlier today. However, while ETH’s price has since dropped, the bullish sentiment around the altcoins has remained elevated.

This renewed optimism also indicates that traders believed that a new all-time high could be underway. But historically, this kind of hike in the funding rate spells trouble.

Ethereum Overheated as $200 Million Coins Enter Exchanges

Like other cryptos in the market, ETH’s price has recently registered a double-digit increase. Today, the altcoin rose as high as $3,445 before it dropped to $3,256. Following the hike, Ethereum’s funding rate soared to an eight-month high.

Funding rates are a key metric for gauging market sentiment in cryptocurrency trading. When funding rates are high, it often suggests a bullish market, as more traders are betting on price increases by taking long positions. Conversely, low or negative funding rates can indicate a bearish outlook, with traders increasingly favoring short positions.

While positive funding rates usually reflect strong demand in a bullish market, excessively high readings can signal an overheated environment. This imbalance puts Ethereum traders with long positions at heightened risk of liquidation, potentially triggering a chain reaction that could further drive down ETH’s price.

Ethereum Funding Rate. Source: CryptoQuant

One analyst echoing this cautionary outlook is ShayanBTC, a contributor on CryptoQuant. According to ShayanBTC, Ethereum funding rate is a warning sign that the cryptocurrency could face a pullback.

“In the current market climate, with funding rates at heightened levels, the risk of increased volatility and potential corrections rises. An overheated market could lead to rapid sell-offs, especially if liquidations are triggered by profit-taking or minor corrections,” the analyst explained.

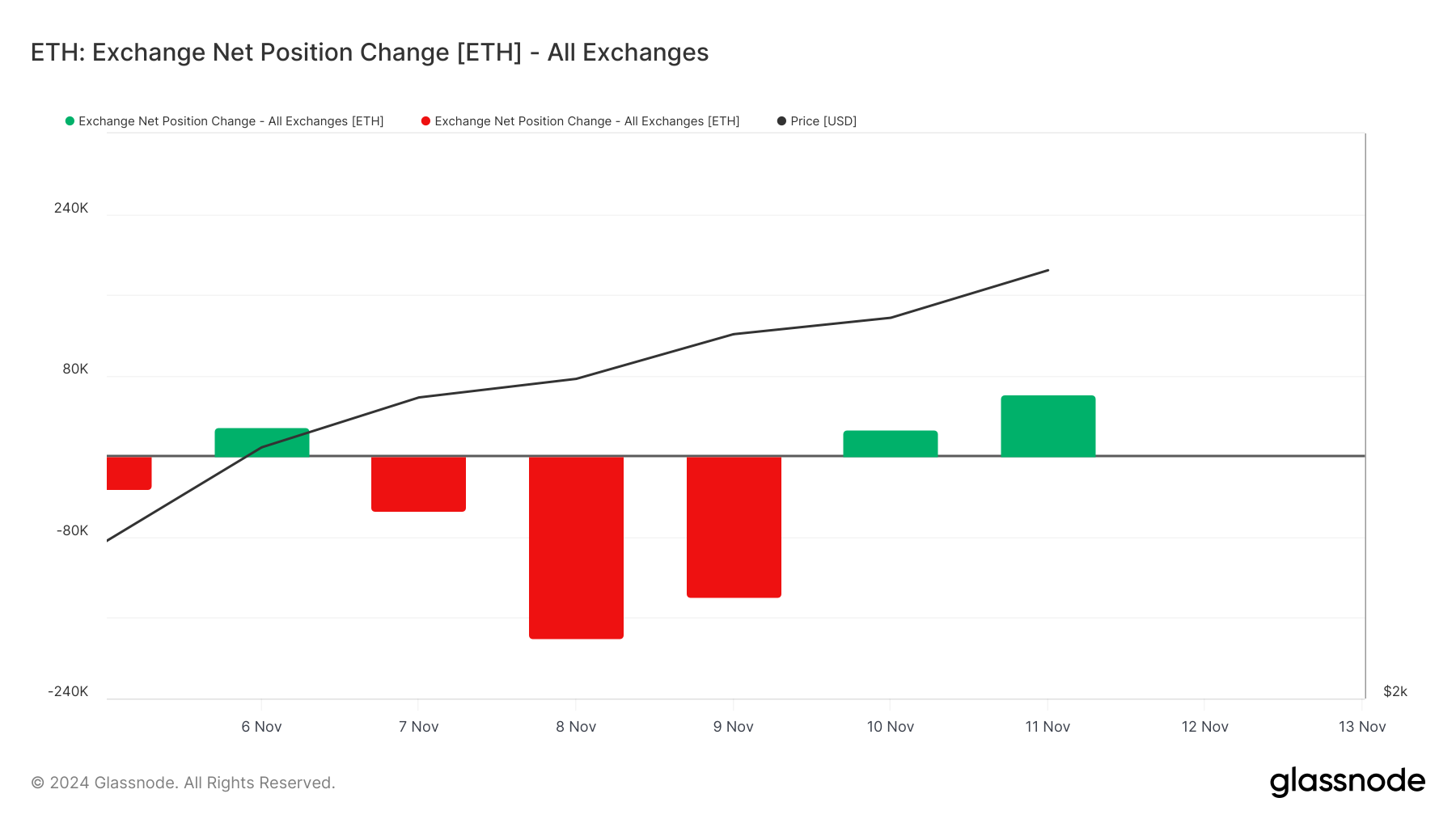

Adding to the signs of a further decline for Ethereum is the Exchange Net Position Change metric, which tracks the 30-day change in ETH supply held in exchange wallets. A rise in this metric often signifies that investors are moving assets onto exchanges, potentially positioning for a sell-off.

On the other hand, a decline in the metric indicates that holders are refraining from selling. According to Glassnode, about 61,603 ETH, valued at about $200 million, had flowed into the exchange at the time of writing. Should this number increase, ETH’s price could face another drawdown.

Ethereum Exchange Flow. Source: Glassnode

ETH Price Prediction: Another Brief Decline Ahead

Since November 5, Ethereum’s price has increased by 40%. This price increase came as a result of the breakout of the descending channel, as seen below. However, as the cryptocurrency attempted to hit $3,500 today, bears pushed it back, and it now trades at $3,256.

A further look at the chart shows that the Balance of Power (BoP), which measures the strength of buyers and sellers, shows that sellers now have the upper hand. If this remains the same, ETH could drop to $3,009.

Ethereum Daily Analysis. Source: TradingView

However, if bulls prevent the cryptocurrency from dropping below $3,221, this might not happen. Instead, ETH’s price could climb toward $3,563 in the short term, possibly hitting $4,000 afterward.

Read the full article here