Ethereum (ETH) has experienced its largest daily loss in four years, plummeting by nearly 27% in a single 24-hour period.

This decline brought the price of ETH down to just above $2,100 before a slight recovery to around $2,544 at press time.

One of the largest liquidation events in recent history

The drop in Ethereum’s value was not isolated; it was accompanied by substantial declines across other major cryptocurrencies.

Bitcoin (BTC) fell by 6%, XRP by 22%, Solana (SOL) by 8%, and Dogecoin (DOGE) by 23%.

This widespread sell-off contributed to over $2.24 billion in liquidations, affecting more than 730,000 traders.

The largest single liquidation order was observed on the crypto exchange Binance, where an ETH/BTC trading pair was liquidated for $25.64 million.

Crypto liquidation heatmap by Coinglass

Ethereum (ETH) traders have been the biggest casualties of today’s crypto market liquidations, with ETH’s long positions losing approximately $613.72 million, highlighting the scale of leveraged bets that went sour as the market turned bearish.

The total crypto liquidations for the day have already surpassed those seen during significant past events like the Covid-19 market crash and the collapse of FTX, showcasing the severity of the current market downturn.

Why has the Ethereum price fallen that much?

The catalyst for this market shake-up appears to be rooted in geopolitical tensions, specifically the announcement of new US tariffs by President Trump targeting imports from China, Canada, and Mexico.

These tariffs have introduced fears of escalating global trade wars, prompting investors to pull back from riskier assets like cryptocurrencies.

The ripple effect of these policies was immediate, with markets registering significant losses shortly after the announcement.

Investor sentiment

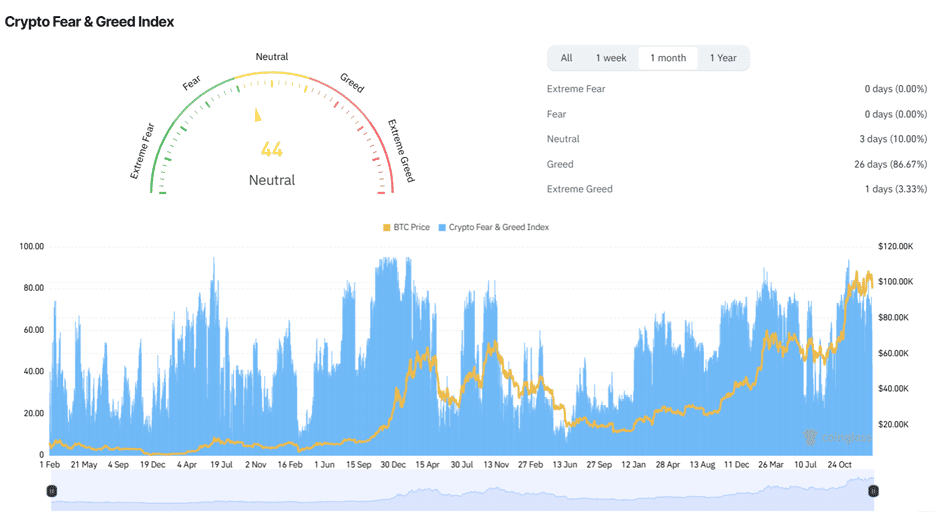

Following the crypto market crash, the investor sentiment in the crypto market swiftly moved to “fear,” before pulling back to “Neutral” as indicated by the Crypto Fear & Greed Index from Coinglass.

Crypto fear and greed index by Coinglass

This fear is not unfounded, given the rapid devaluation and the scale of losses.

However, historical patterns suggest that such fear can often lead to buying opportunities for those who believe in the underlying value of cryptocurrencies.

For instance, the “7 Siblings” group, known for their substantial holdings, made a strategic purchase of 5,382 ETH, amounting to $14.5 million, increasing their total to 50,429 ETH valued at about $126 million.

Another wallet of “7 Siblings” bought 5,382 $ETH($14.5M). 7 Siblings bought a total of 50,429 $ETH($126M) today. The last time 7 Siblings bought a large amount of $ETH at the bottom was on Aug 6, 2024, when the market crashed. x.com/lookonchain/st…

10:49 AM · Feb 3, 2025

Another whale has used $1M DAI to buy 398 ETH at a price of $2,515, after holding the DAI for almost 2.5 years.

Insane hold of $DAI. A whale has used $1M $DAI to buy 398 $ETH at a price of $2,515, after holding $DAI for almost 2.5 years. The whale received these $DAI from FixedFloat 2.5 years ago. Addresses: – 0xf094e2d70385f4f3af3cc4ba7e6da0dcfac522dc -…

9:38 AM · Feb 3, 2025

This accumulation of ETH as it plummets could be interpreted as a vote of confidence in Ethereum’s future, especially considering such significant acquisitions often coincide with a market recovery.

Can Ethereum (ETH) recover?

Analysts are divided on Ethereum’s immediate future.

Some, like IncomeSharks, see this dip as a potential buying opportunity, setting optimistic price targets above $3,000.

$ETH – Can’t pass up buying one of the largest liquidation events we’ve seen. A bigger sell off than expected but that’s a rare opportunity to bid.

6:01 AM · Feb 3, 2025

Others, like Benjamin Cowen, point out that ETH has reached a key long-term support level, suggesting a potential rebound.

On the technical side, Ethereum has moved below both the 50-day and 200-day moving averages, signalling a strong short-term bearish trend, though the oversold RSI might hint at easing selling pressure.

Ethereum (ETH) price chart by TradingView

Notably, Ethereum (ETH) has a history of recovery; after a similar crash in 2021, it surged to $5,000, indicating its capacity for resilience.

However, recovery is not guaranteed.

The market’s reaction will depend heavily on global economic developments, particularly how the tariff situation unfolds.

If tensions escalate, Ethereum might face further downward pressure.

The post Ethereum (ETH) logs worst single-day drop in four years, shaking crypto markets appeared first on Invezz

Read the full article here