Ethereum (ETH) price has remained below expectations in December, disappointing many who anticipated it would hold above $4,000. Despite this, ETH has managed to gain nearly 6% over the last seven days, showing some signs of resilience.

The RSI has been neutral for a week, reflecting a lack of strong momentum, while whale activity has stabilized near its highest levels since September. With the price consolidating between $3,523 and $3,220, ETH’s next move hinges on breaking key resistance or holding critical support levels.

ETH RSI Has Been Neutral For a Week

Ethereum Relative Strength Index (RSI) is currently at 50.21, remaining in the neutral zone where it has fluctuated between 35 and 55 since December 20.

This indicates that ETH price movement has lacked significant momentum in either direction over the past week, reflecting a period of consolidation.

ETH RSI. Source: TradingView

The RSI is a momentum indicator used to measure the strength of price changes, with values ranging from 0 to 100. Readings above 70 typically indicate overbought conditions, signaling potential price corrections, while readings below 30 suggest oversold conditions, which could lead to price recoveries.

Ethereum RSI at 50.21 suggests a balanced market, with neither buyers nor sellers exerting strong control.

Ethereum Whales Dropped a Little, But Are Still at High Levels

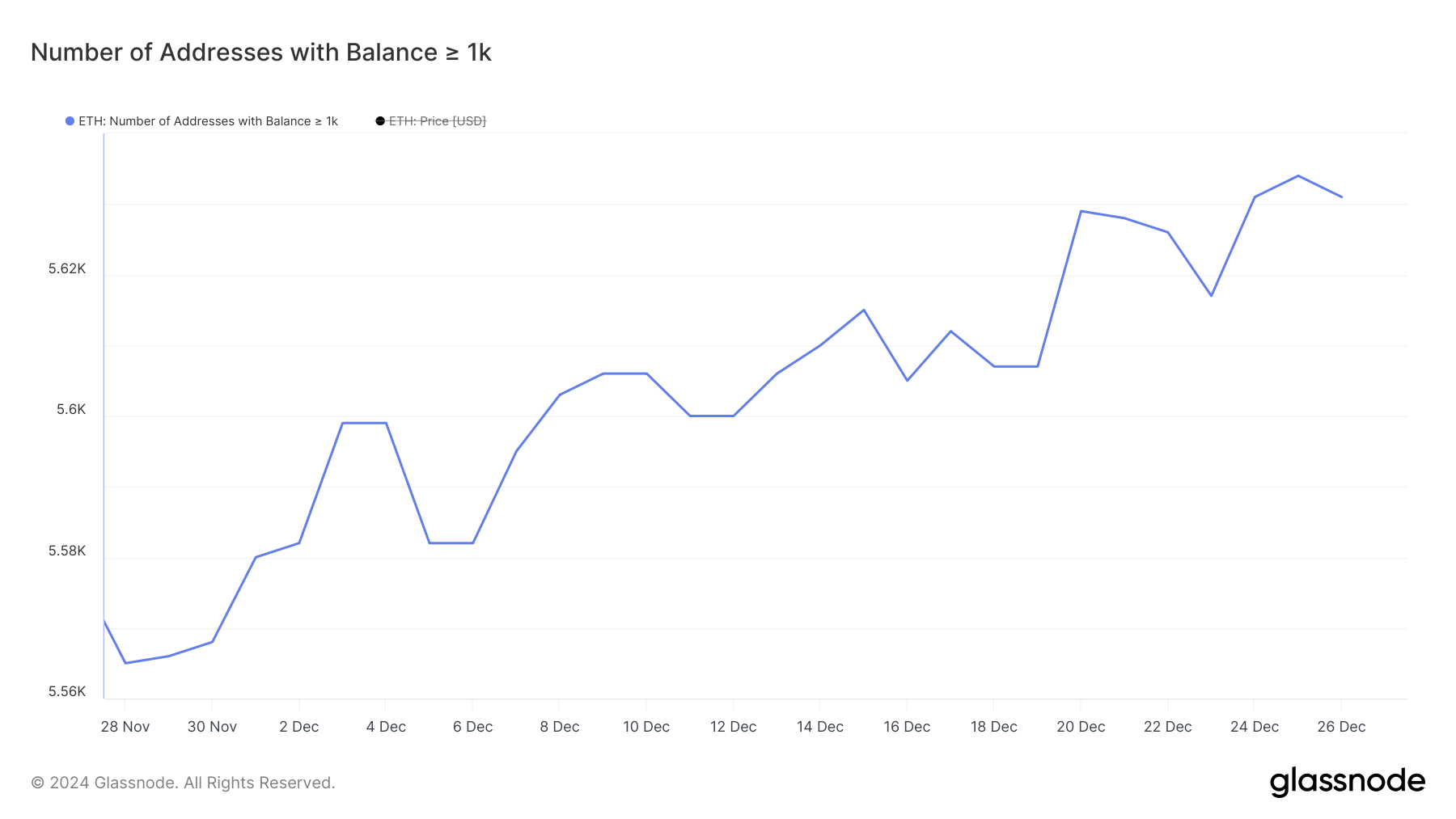

On December 25, the number of addresses holding at least 1,000 ETH reached 5,634, the highest level since September. This was followed by a slight decline to 5,631 on December 26.

The increase comes after a month-low of 5,565 on November 28, highlighting a gradual recovery in large holders’ activity.

Addresses with Balance >= 1,000 ETH. Source: Glassnode

Tracking the behavior of ETH whales is important because their holdings and movements often influence the market due to the significant amounts of liquidity they control.

The current stabilization at higher levels suggests that large holders are maintaining confidence in ETH, potentially supporting its price in the short term. However, the slight decline also indicates caution, meaning ETH price could remain range-bound unless there’s a decisive shift in whale behavior.

ETH Price Prediction: Consolidation Before a New Breakout?

Ethereum price is currently trading within a range, with resistance at $3,523 and support at $3,220. Its EMA lines indicate a downtrend, with short-term averages positioned below the long-term ones.

However, the weakening strength of this trend suggests that ETH might be entering a phase of consolidation rather than continuing its decline.

ETH Price Analysis. Source: TradingView

If ETH price breaks above the resistance at $3,523, it could aim for higher levels at $3,827 and potentially $3,987.

Conversely, if the support at $3,220 is tested and fails to hold, the price could drop further to $3,096, marking a critical level for potential stabilization.

Read the full article here