Bullish sentiment has intensified in Ethereum futures, with positive funding rates pointing to optimism in ETH’s price potential.

The funding rate metric in futures markets reflects buyer aggression, where positive values indicate bullish sentiment and negative values suggest bearishness.

Recently, ETH funding rates turned positive, showing a shift toward optimism. Although the rates have yet to reach levels seen during previous strong rallies, the trend suggests increasing confidence in Ethereum’s potential for a rally.

Source: CryptoQuant

For Ethereum to overcome significant resistance levels, funding rates need to climb higher. Rising rates would indicate stronger buying interest from futures traders, adding upward pressure to ETH’s price.

If this trend continues, higher funding rates could signal confidence, raising the likelihood of a sustained price breakout.

Such positive sentiment could drive ETH’s price higher if it aligns with broader bullish trends in the cryptocurrency market.

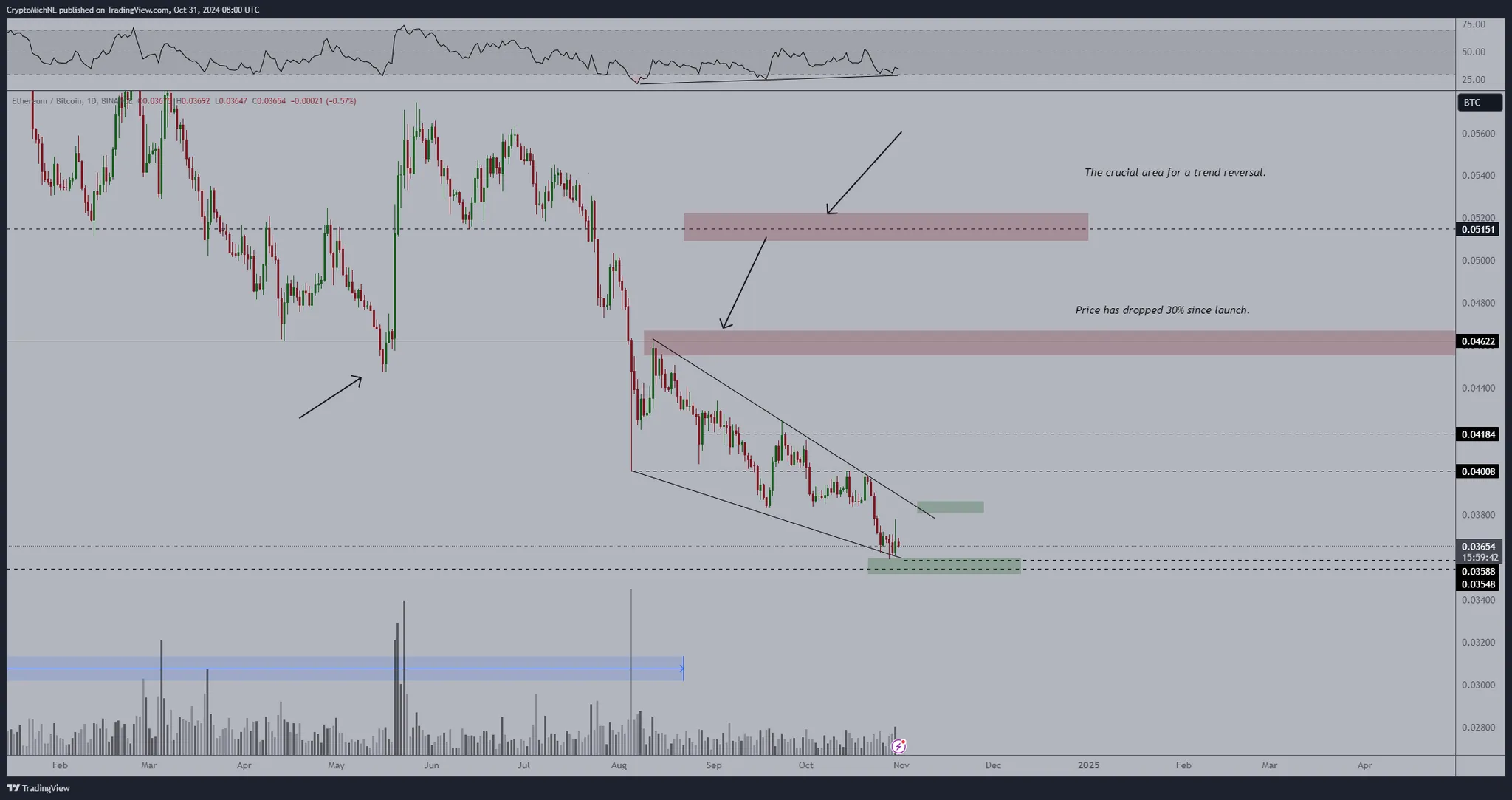

ETH’s Gains Remain Vulnerable Despite Bullish Divergence

While bullish sentiment grows, Ethereum’s price remains vulnerable to reversals. Historical data shows ETH often struggles to hold gains, indicating volatility.

If ETH continues to make lower lows, this bullish divergence might lose credibility, weakening its momentum against Bitcoin (BTC). Further economic data could impact ETH’s price movement, making caution necessary.

Lower lows might indicate market instability, suggesting investors should look for signs of reversal before assuming any sustained uptrend.

Source: Trading View

At current levels, ETH shows weakness against BTC, with each bounce quickly reversing. The price action reflects a pattern where ETH struggles to maintain support, leading to lower price points.

If ETH reaches a new low around the 0.031 BTC level, it could open new buying opportunities. Investors should watch for changes in momentum as ETH’s price might find support in this area.

Patience could reveal a good buying window, especially as ETH could regain strength closer to early 2025.

Bond Yields and Economic Factors Shape Ethereum’s Path

U.S. 2-year government bond yields recently showed a bearish divergence, trending downward after reaching a peak. Lower yields generally point to slowing economic growth and a potential shift in interest rate policies.

As yields drop, fixed-income investments become less appealing, which may drive investors toward higher-risk assets like Ethereum. This environment could create favorable conditions for ETH, as investors seek better returns in riskier markets.

If bond yields continue their downward trend, Ethereum could see higher demand. Falling yields could also hint at a dovish stance from the Federal Reserve, possibly slowing down or pausing rate hikes.

Source: Trading View

Such a shift would likely increase liquidity, benefiting risk-on assets like ETH. However, this trend comes with the risk of short-term volatility, as shifting economic conditions might lead investors to seek safe-haven assets.

ETH’s price would remain sensitive to macroeconomic indicators and broader liquidity trends.

What’s Next?

Ethereum’s path to sustained price growth relies on a few key factors. Positive funding rates signal growing confidence, but ETH needs stronger momentum to break past resistance.

However, ETH’s vulnerability against BTC indicates caution, as any economic uncertainties could disrupt this positive outlook.

For now, Ethereum’s price trajectory depends on both investor sentiment and economic data. The potential decline in bond yields could boost ETH demand, but volatility risks persist.

Investors should keep an eye on funding rates and key economic trends, as these factors would guide ETH’s price movement in the coming months.

Read the full article here