Ethereum (ETH) price appears to be moving within a neutral range, as indicated by several market metrics. The current Net Unrealized Profit/Loss (NUPL) value signals that most investors are neither highly profitable nor experiencing heavy losses.

This balanced sentiment suggests a mix of cautious optimism and anxiety but lacks the strong emotions that typically drive dramatic price shifts. Combined with the behavior of larger holders and key technical indicators, ETH might continue its sideways movement in the short term.

ETH NUPL Is Currently Neutral

ETH’s NUPL is currently at 0.34, signaling a neutral market state. This value suggests that most investors are neither deeply in profit nor in significant loss. It reflects a balanced sentiment among holders, with a mix of optimism and anxiety but no extreme emotions that usually drive large market movements.

ETH NUPL. Source: Glassnode

NUPL, or Net Unrealized Profit/Loss, measures investor sentiment by comparing unrealized gains and losses. When NUPL is positive, it indicates holders are in profit, and when negative, it signals losses. A value of 0.34 places ETH in the ‘Optimism — Anxiety’ phase, suggesting investors feel cautiously optimistic but are also wary.

ETH is far from the more extreme stages of ‘Hope — Fear’ or ‘Belief — Denial’, indicating a stable, neutral market condition. This neutrality points to a likely sideways price movement in the short term, as neither strong buying nor selling pressure is currently dominant.

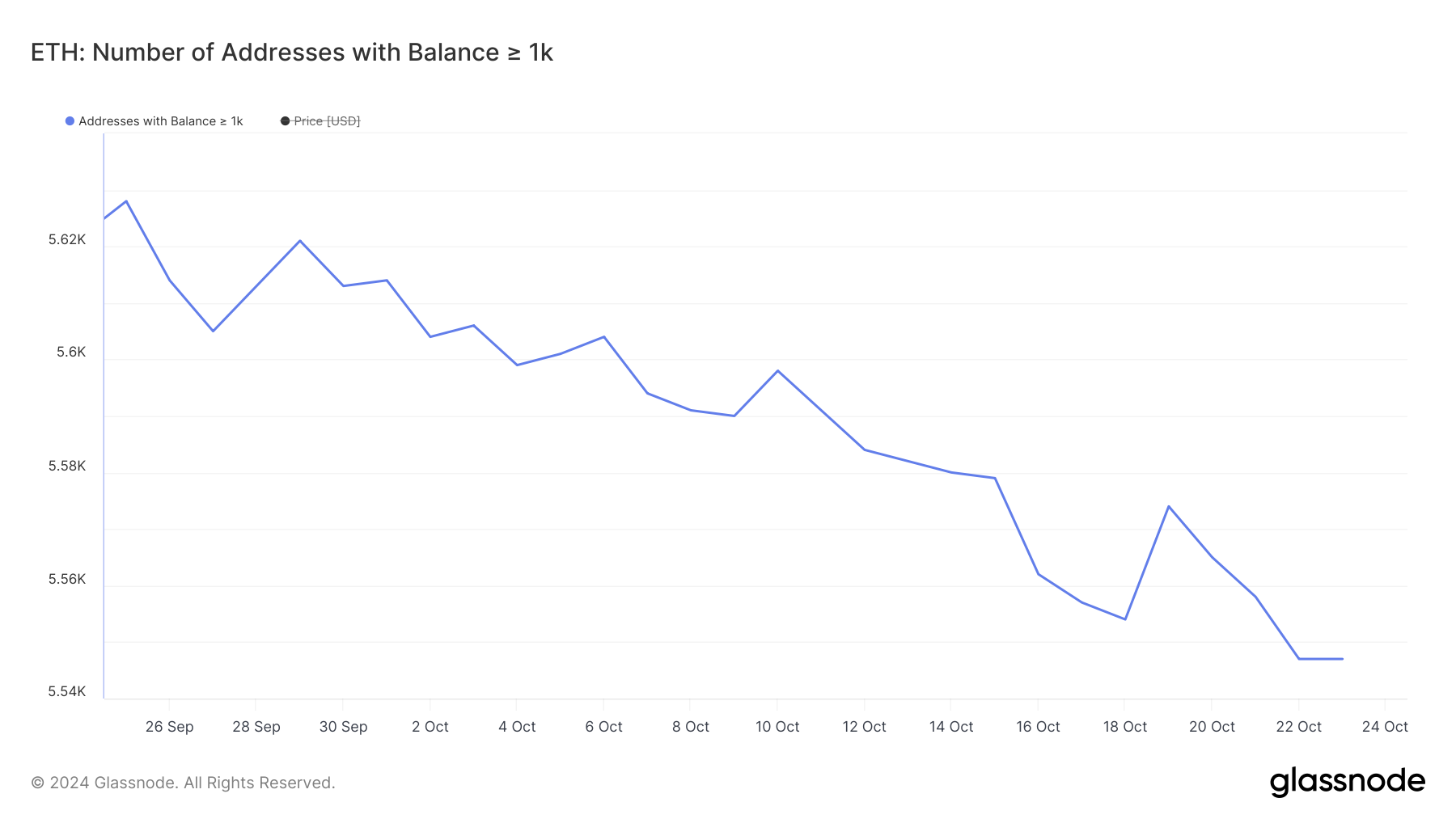

Ethereum Whales Are Not Accumulating

The number of addresses holding at least 1,000 ETH is declining, indicating that whales are not accumulating ETH. On September 25, there were around 5,628 such addresses, and now this number has dropped to 5,547. This steady decrease suggests a lack of confidence among large holders.

Addresses with Balance >= 1,000 ETH. Source: Glassnode

Tracking these whale addresses is crucial because they can significantly influence market trends. When whales accumulate, it often signals optimism and can drive prices higher. Conversely, a decline shows hesitation or risk aversion.

The consistent drop in whale addresses over the past month implies that big investors are not confident enough to accumulate ETH at this time. Instead, they may be reallocated to other assets or waiting for clearer signals before buying more ETH.

ETH Price Prediction: More Sideways Movements Ahead?

This Ethereum (ETH) chart displays several key moving averages (EMAs) and potential support and resistance levels. Currently, ETH is trading around $2,526, slightly below multiple EMA lines, indicating downward pressure.

That’s also reinforced by the fact that its short-term lines are going down. If they cross below the long-term ones, this would create a bearish signal.

ETH EMA Lines and Support and Resistance. Source: TradingView.

The chart also highlights clear resistance levels at $2,728 and $2,820, with previous attempts to break these points being unsuccessful. These levels will need to be breached convincingly to trigger any strong bullish momentum. On the downside, the support levels are marked at $2,308 and $2,150, indicating areas where buyers could step in.

The presence of these support and resistance levels, along with the lack of decisive movement around EMAs, suggests that ETH may continue consolidating, with price fluctuations within the range before a clear trend develops.

Read the full article here