Over the last 24 hours, Ethereum (ETH) performed better than Bitcoin (BTC) and Solana (SOL) based on the latest information from CoinMarketCap. The price of Ethereum as of June 3 was $2,612.46, a 4.68% increase in the last 24-hours. However, Bitcoin’s rise was slightly lower with a gain of only 1.02% to $105,348.06. Meanwhile, Solana increased by 4.59% and its price rose to $161.36.

The latest rally in Ethereum began around 4:00 PM on June 2, with momentum building overnight. ETH peaked near $2,655 before finding support at $2,600. The bullish trend was reinforced by a 38% increase in trading volume, signaling renewed investor interest.

Source: Tradingview

Bitcoin Sees Modest Uptick Amid High ETF Flows

While Bitcoin remains the largest cryptocurrency based on market capitalization, its 24-hour fluctuations were not as significant as those of Ethereum. Trade volume increased by 6.13% to $43.39 billion, mainly boosted by strong performance in U.S.-based spot Bitcoin ETFs. The U.S. spot Bitcoin ETFs now account for about 45% of global spot BTC volume, highlighting strong institutional participation.

Source: Tradingview

Bitcoin’s immediate resistance lies near $106,500, with key support at $105,000. A sustained move above resistance could see BTC target the $108,000 to $110,000 range, but failure to hold above $105,000 risks a short-term drop toward $104,000.

Solana Rallies but Remains Behind Ethereum in Market Strength

Solana matched Ethereum’s positive price action with a 4.59% gain in the past 24 hours. SOL traded from an opening near $153.58 to close just above $161. Volume surged 26%, and the market cap reached $84.31 billion, reinforcing Solana’s position among the top digital assets.

Source: Tradingview

Solana held at $153.50 and tried to break past $162 before dropping again. In spite of this, Solana still trails Ethereum in trading and price gains. Analysts believe that project growth and increased trading during Asian hours are why Solana regained ground.

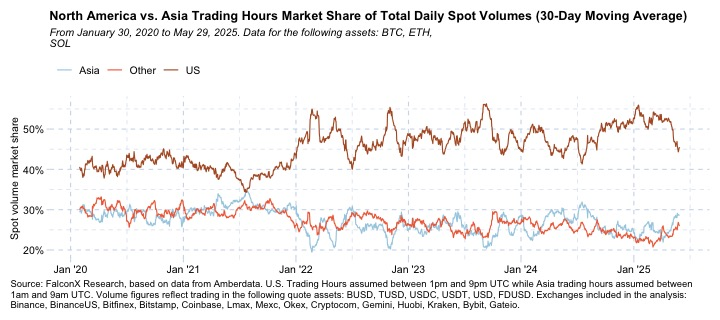

Asian Trading Hours Gain Influence as Ethereum Leads

Trading data shows a growing share of global spot volume shifting to Asian and European hours. As investor activity continues to diversify, Ethereum stands out as the top performer in the latest 24-hour cycle, highlighting a shift in momentum within the crypto market.

Source: FalconX

The latest data shows Asian trading hours now account for nearly 30% of global volume in BTC, ETH, and SOL. As U.S. participation in spot trading declines to approximately 45%, global markets are exerting an increasingly significant influence on price direction. According to FalconX’s research, non-U.S. portfolio flows may be supporting Ethereum’s recent rally, even as Bitcoin’s volumes shift toward ETFs and institutional products.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Read the full article here