Ethereum price prodded above $3,040 on May 17, up 6% from the 14-day low of $2,862 recorded on May 14, but spikes in ETH 2.0 staking withdrawals threatens to impede the rebound phase.

Ethereum Price Surge Lagging behind the Crypto Market Average

ETH failed to pull its fair share of capital inflows as bullish momentum returned to the crypto markets this week.

The US Bureau of Labor Statistics latest CPI data release on May 14 and the resurgent GameStop rally have emerged as major catalysts stimulating bullish activity across the crypto markets this week.

Led by mega-cap assets like BTC (+9%), SOL (+22%) and PEPE (+70%), the total crypto market capitalization has increased by $194 billon since the start of the week on May 13.

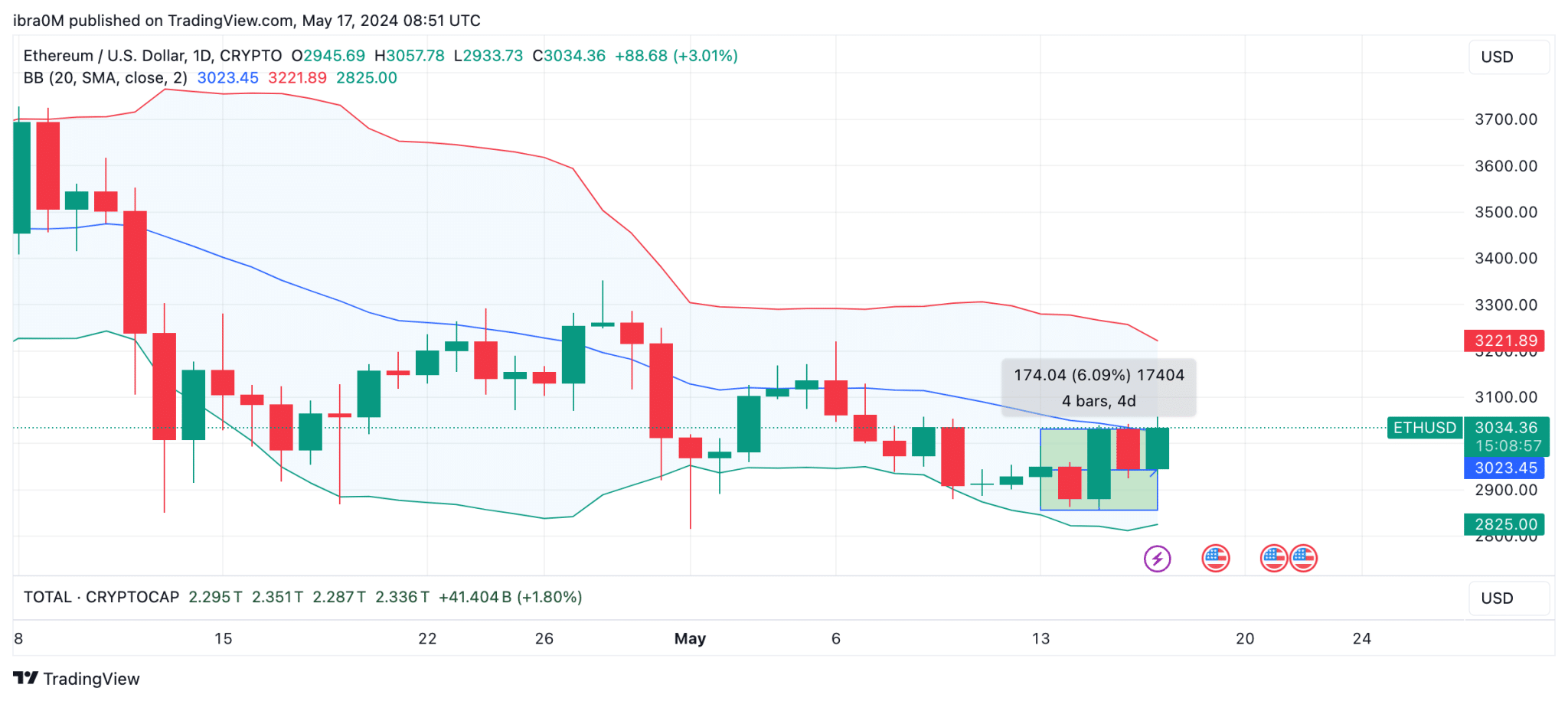

Ethereum ETH Price Action vs Crypto Market TOTAL Cap

At the time of writing on May 17, Ethereum price is currently hovering around the $3,042 territory, up 6% from May 13. In comparison to the trends observed in rival mega-cap Layer-1 assets like Bitcoin and Solana, Ethereum price has underperformed considerably.

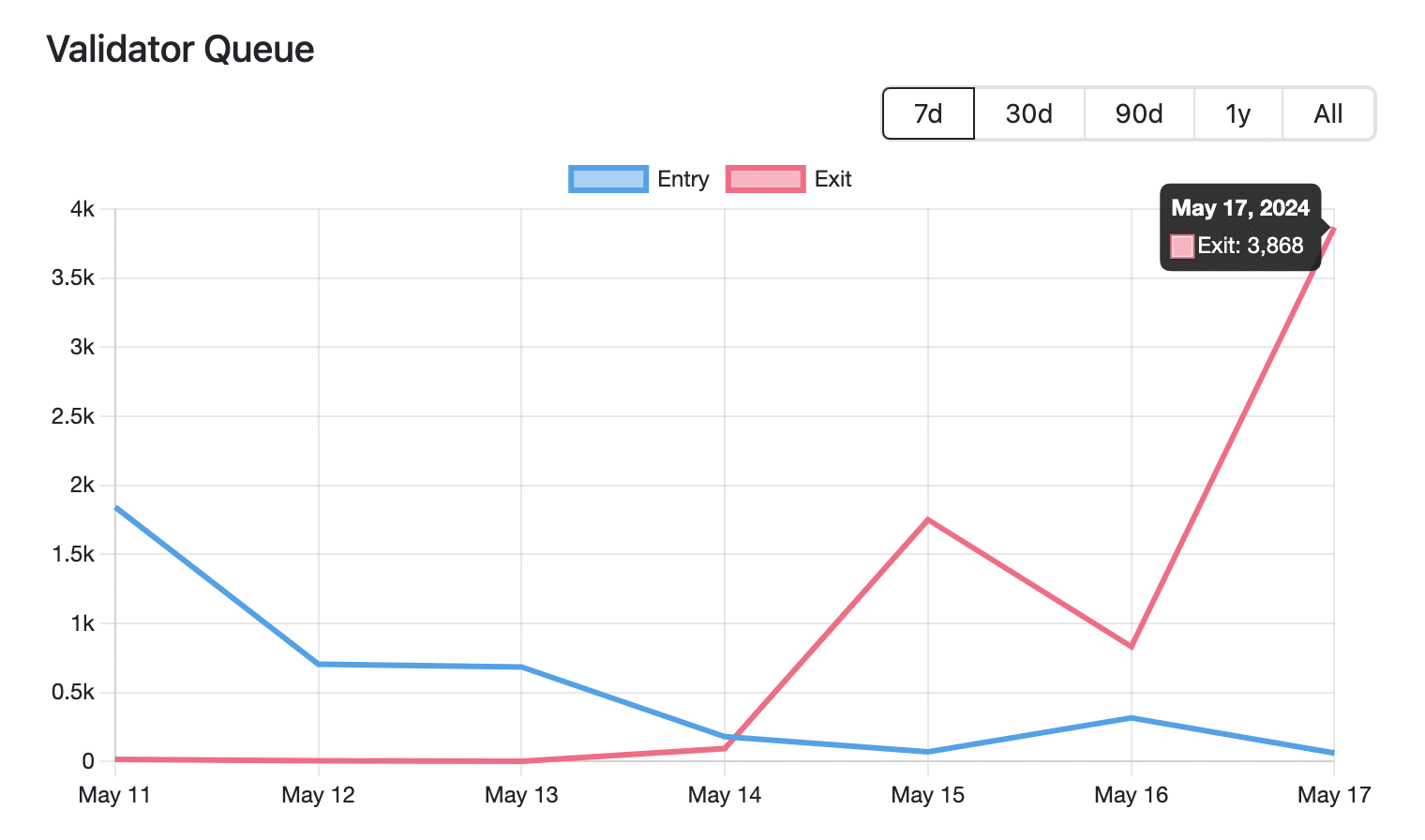

ETH 2.0 Withdrawal Queue Spikes 4,000% in 5-days

Ethereum’s laggard performance is well illustrated in the TradingView chart above. However, on-chain staking data from the ETH 2.0 beacon chain reveals even more worrying signals that could spark intense volatility in Ethereum price action the days ahead.

The Validator Queue chart below provides real-time insights into the number of investors seeking to join the ETH 2.0 staking pool versus those seeking to withdraw their funds.

Ethereum records 4000 Spike in ETH 2 Withdrawal Queue

At the start of the week, only 93 stakers moved to withdraw their staked ETH from the beacon chain May 14. But that figure has now skyrocketed to 3,868 addresses at the time of writing on May 17.

This implies that the number of ETH node validators queueing up to make withdrawals has spiked 4,000% within the last 3 days, raising concerns of imminent bearish pressure. Meanwhile, over the past week, the ETH 2.0 deposit queue has nosedived 97% from 1,842 to 61 entry addresses.

The combination of increased withdrawals and decreased deposits creates a dual catalyst of downward pressure on the Ethereum price, partly explaining why ETH price has failed to catch up to the broader market uptrend this week.

On one hand, the rapid rise in withdrawals adds to the circulating supply of ETH, potentially flooding the market. On the other hand, the sharp drop in new deposits signals a decrease in long-term confidence among investors.

These critical factors could combine to exacerbate bearish trends, leading to heightened market volatility and sustained downward pressure on Ethereum prices.

ETH Price Forecast: Another Reversal below $2,900?

Ethereum price is currently around $3,040 mark at the time of publication on May 17. However, as traders begin to react to the 4,000% spike in ETH 2.0 staking withdrawals, Ethereum price will likely slump below $2,900 in the near-term.

The Bollinger band technical indicator also support this pessimistic ETH price forecast.

Ethereum ETH Price Forecast

As seen below, the upper-limit Bollinger Band indicator shows ETH price is still some distance away from reclaiming critical resistance level at $3,200, which would put bulls in control of the market momentum.

However, if ETH price tumbles below the short-term support at the 20-day SMA price level at $3,023, it could open the doors to rapid bearish reversal towards $2,825.

Read the full article here