Ethereum (ETH) price surged as high as $3,350 on April 28, marking a 17% bounce in the last 10-day, as on-chain indicators reveal the key catalyst behind the recent uptick.

Ethereum Holders Cut Market Supply by $17 million in 3-Days

When Ethereum price tumbled to a 2024 low of $2,868 on April 19, it sparked fears of an incoming post-Bitcoin Halving crash driving ETH to new lows. However, rather than entering a large scale sell-off, ETH whale holders and Liquidity Staking Derivatives (LSD) users turned to the yield staking contracts to tide over the market downturn with passive income.

As hinted in an earlier report from The Crypto Basic, a $620 million surge in Ethereum 2.0 staking appears to have helped slow down the selling pressure in ETH markets over the past week.

Ethereum Price vs Bitcoin Price Action

Unsurprisingly, Ethereum price has outperformed BTC by a considerable margin in the last 10 days. The chart above illustrates that ETH has recovered 17% between April 19 and April 29. Meanwhile, BTC price has dropped 5% during the same 10-day timeframe.

Looking beyond the price action, on-chain data trends observed in the last 3 days suggests that Ethereum will likely extend its winning streak over BTC in the week ahead.

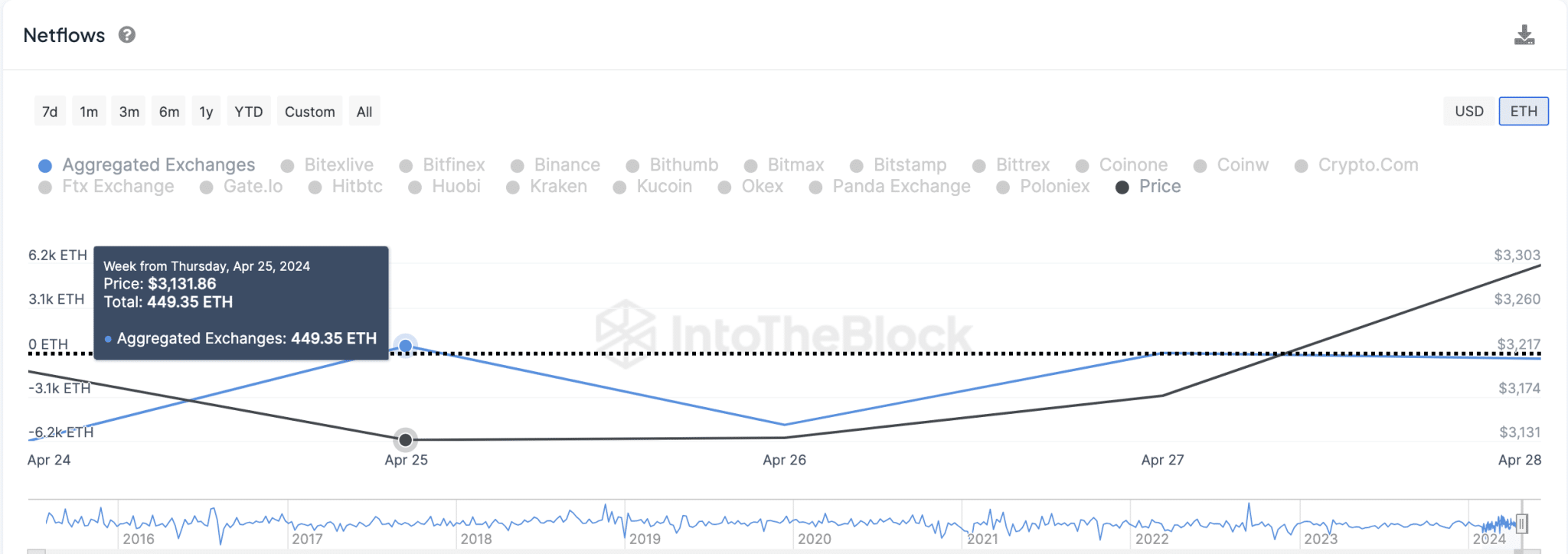

IntoTheBlock Exchange Netflow metric tracks the daily difference between deposits and withdrawals of a specific cryptocurrency across recognized crypto exchanges.

Essentially, a Negative Exchange Netflow trend means investors are increasingly withdrawing coins into long-term storage or staking contracts, while cutting down available spot market supply, and vice versa.

Ethereum ETH Price vs Exchange Netflows | IntoTheBlock

As seen in the snapshot, above Ethereum has recorded negative flows in 3 consecutive trading days dating back to April 26. And during that period, investors have shifted a total of 5,410 ETH from exchange-hosted into long-term storage and staking contracts.

At the time of publication on April 29, ETH price is trading around $3,180, implying that the Ethereum holders have cut down on the current market supply by approximately $17 million.

ETH Price Forecast: $3,250 Resistance Looming Large

Drawing inferences from the $17 million decline in ETH market supply, Ethereum price looks set to outperform Bitcoin for a second consecutive week, as the bulls seek to reclaim the $3,500 milestone.

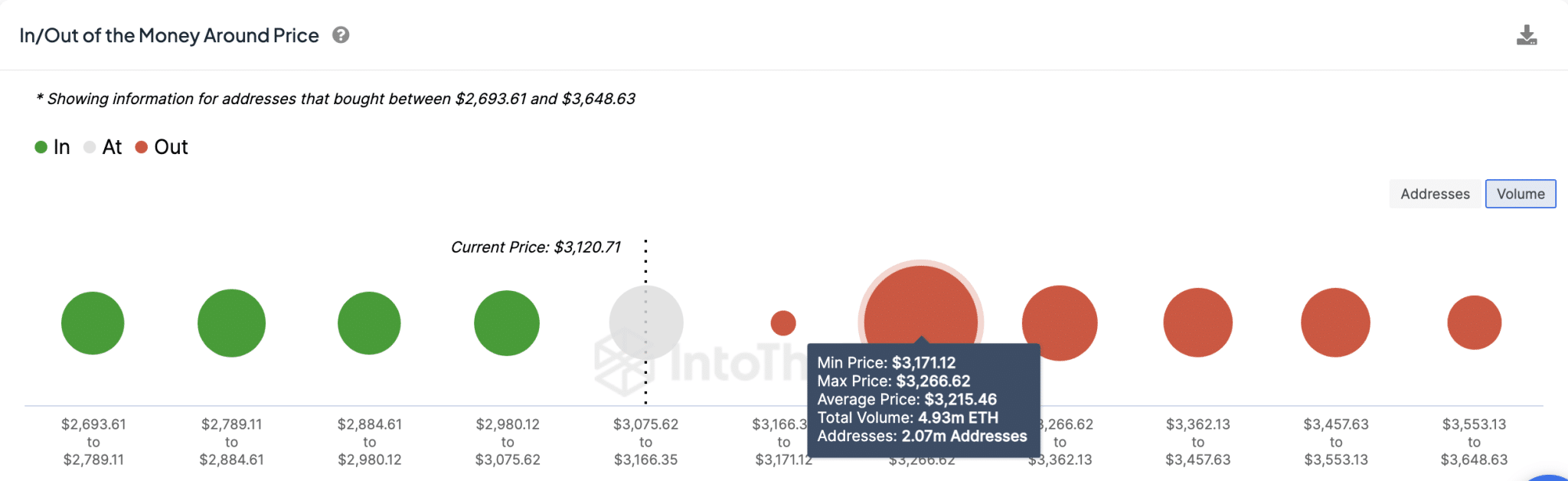

But based on historical accumulation trends, Ethereum price must post a green candle above the $3,266 territory to where 2.07 million addresses had acquired 4.93 million ETH validate this bullish price forecast.

Ethereum ETH Price Forecast

If Ethereum bulls can stage a decisive breakout above $3,270, further uptrend towards $3,500 could follow. But conversely, if ETH price suffers another major downswing, it could slide as low as $2,980 before finding a significant support cluster.

Read the full article here