For the first time this month, Ethereum (ETH) has recorded a series of spot inflows, signaling renewed investor interest in the leading altcoin.

This comes as the Chicago Board Options Exchange (CBOE) filed an application for a spot-staked Ethereum exchange-traded fund (ETF) on behalf of 21Shares. With a growing bullish bias toward the leading altcoin, it might be poised to commence an uptrend.

CBOE Files for 21Shares Spot-Staked Ethereum ETF

In a February 12 filing, CBOE submitted an application to the US Securities and Exchange Commission (SEC) on behalf of asset manager 21Shares to list a spot-staked Ethereum ETF.

The proposed fund aims to enable the staking of 21Shares’ Ethereum ETF holdings, offering its investors a way to earn passive income while holding the asset.

Staking usually involves locking up ETH coins to help secure the Ethereum network while generating rewards. Compared to standard ETH ETFs, a staked version will provide investors with additional yield opportunities.

In a post on X, Bloomberg ETF analyst James Seyffart noted that the application’s approval is likely. However, he remains cautious, acknowledging the uncertainty surrounding regulatory decisions.

“Assuming this is acknowledged by the SEC (I’d probably make that assumption right now but you never know). The final deadline on this filing will be somewhere around the end of October. Like October 30th-ish.,” the analyst wrote.

ETH Reacts Positively

Following the news, ETH prices gained 12%. On Wednesday, the leading altcoin climbed to an intraday peak of $2,790 from a low of $2,565 as spot inflows soared. According to Coinglass, this totaled $11.87 million and marked the coin’s first spot inflows since the beginning of February.

ETH Spot Inflow/Outflow. Source: Coinglass

When an asset records spot inflows, it means that the amount of the asset being bought and held in its spot market has increased, often indicating growing investor demand. This reflects a shift towards buying the asset directly rather than using derivatives or futures contracts.

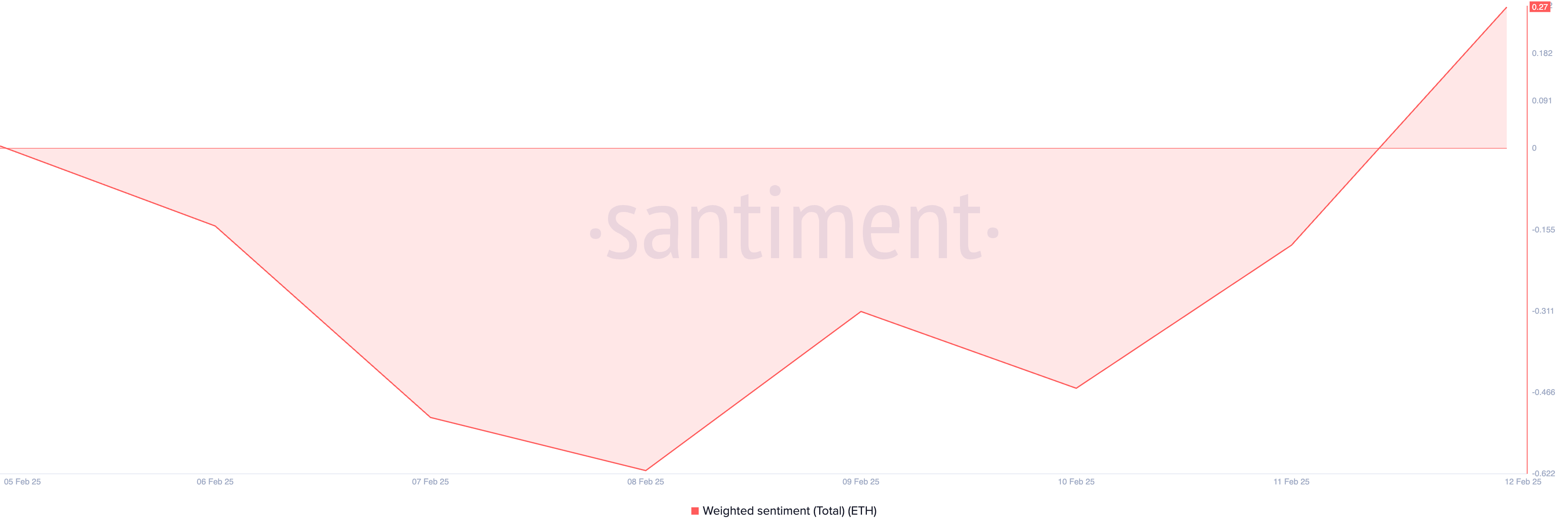

Notably, there has been a turnaround in the bias trailing the altcoin. According to Santiment, ETH’s weighted sentiment metric has returned a positive value for the first time since February 5, reflecting the changing attitude towards the coin. At press time, this is at 0.27.

ETH Weighted Sentiment. Source: Santiment

An asset’s weighted sentiment measures its overall positive or negative bias, considering both the volume of social media mentions and the sentiment expressed in those mentions.

When positive like this, it is a bullish signal as investors become increasingly optimistic about the token’s near-term outlook. This prompts them to trade more, driving up the asset’s value.

ETH Price Prediction: Traders Eye $2,811 and Beyond

A gradual resurgence in ETH’s demand could cause it to extend its current rally. The coin trades at $2,681 at press time, noting a 4% hike in the past 24 hours.

Amid growing spot inflows and sustained positive sentiment among traders, ETH’s price could rise toward $2,811. Should it break this level, a rally toward $3,321 could follow.

ETH Price Analysis. Source: TradingView

On the other hand, if ETH holders resume profit-taking, the coin’s value could slip below $2,500.

Read the full article here