On-chain activity indicates a notable reaction to regulatory uncertainties surrounding the second-largest digital asset by market capitalization, Ethereum.

A significant spike was registered in the number of tokens sent to centralized crypto exchanges. This is the biggest ever recorded since September 2022, profoundly influencing the price of Ethereum.

Ethereum Sees Largest Exchange Inflow in 2 Years

Ethereum has faced considerable scrutiny recently. Critics within the cryptocurrency community cite its lackluster price performance and the rise of Solana as evidence of Ethereum’s declining influence. Furthermore, regulatory bodies are purportedly targeting the Ethereum Foundation, questioning ETH’s classification as a security.

Indeed, concerns escalated as reports emerged about the US Securities and Exchange Commission (SEC) investigations into entities associated with Ethereum. The resulting negative sentiment led to the transfer of over $720 million in ETH into centralized exchanges during the past week, according to IntoTheBlock.

Notably, SpotOnchain identified three notable long-term ETH traders who deposited 32,527 ETH valued at approximately $109 million onto centralized platforms in the last 24 hours. Specifically, these traders shifted 12,500, 11,600, and 8,427 ETH to Kraken and Binance.

“Three long-term ETH traders/funds deposited 32,527 ETH ($109 million) to CEX in the past 24 hours. Did the whales think that the recent correction was still not enough?,” SpotOnChain wondered.

Ethereum Transfers to Exchanges. Source: SpotOnChain

When funds move to exchanges, it is typically viewed as a bearish signal for the market. This indicates that a holder is prepared to sell their assets. As a result, Ethereum has witnessed a noteworthy dip in its price.

According to BeInCrypto’s data, ETH price dropped by 10% over the past week, settling at $3,371 at the time of reporting.

Lucas Outumouro, Head of Research at IntoTheBlock, highlighted ETH’s underperformance compared to Bitcoin and even the S&P 500. However, he emphasized the enduring strength of Ethereum’s fundamentals, which continue to reassure long-term holders.

“Overall, after undergoing a major upgrade, ETH hodlers continue to be bullish. Despite recent headwinds, the data supports continued growth for Ethereum both on layer 1 and layer 2s,” Outumouro stated.

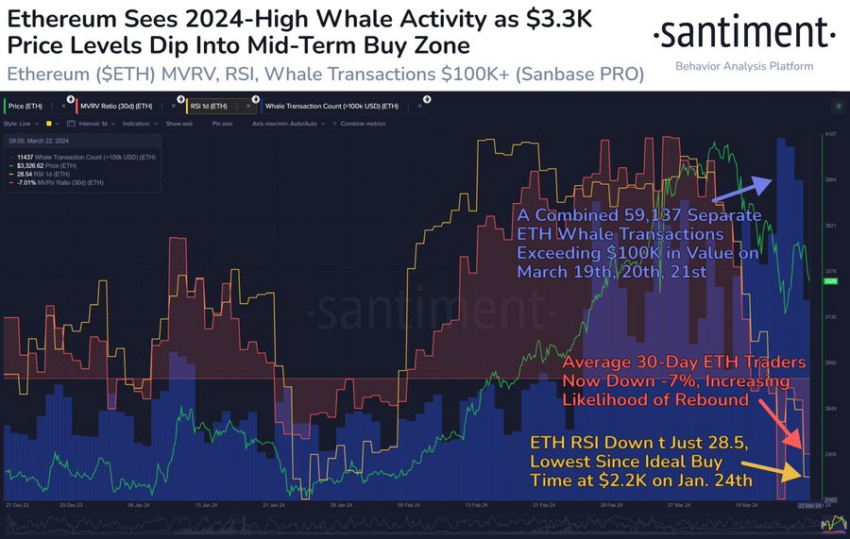

Supporting this stance, analysts at Santiment observed a transaction surge among Ethereum whales. Between March 19 and March 21, this group executed 59,137 transactions exceeding $100,000. The firm also noted a significant 7% reduction in the average 30-day ETH traders, signaling the potential for a market rebound.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Ethereum Whales Activity. Source: Santiment

Additionally, analysts revealed a drop in ETH’s Relative Strength Index (RSI) to 28.5, marking its lowest level since late January. The RSI serves as a momentum indicator to identify overbought or oversold market conditions, with readings below 30 typically indicating oversold territory.

Read the full article here