Leading altcoin Ethereum (ETH) has seen a remarkable spike in the past week. Its value has climbed nearly double digits and currently trades at $3,672.

However, hopes of a sustained rally towards the $4,000 mark may face headwinds as a significant increase in sell orders has been observed in the coin’s futures market.

Ethereum Sellers Dictate Price Trends

CryptoQuant’s data shows a surge in sell orders in the ETH futures market, with its taker buy-sell ratio remaining below one since January 4. Currently, the ratio stands at 0.84.

This metric tracks the proportion of buy orders to sell orders in the futures market. A ratio below one signals more sell orders being executed, reflecting a shift in market sentiment from bullish to bearish. The growing selling pressure could weigh on ETH’s price, potentially erasing some of its recent gains.

Ethereum Taker Buy Sell Ratio. Source: CryptoQuant

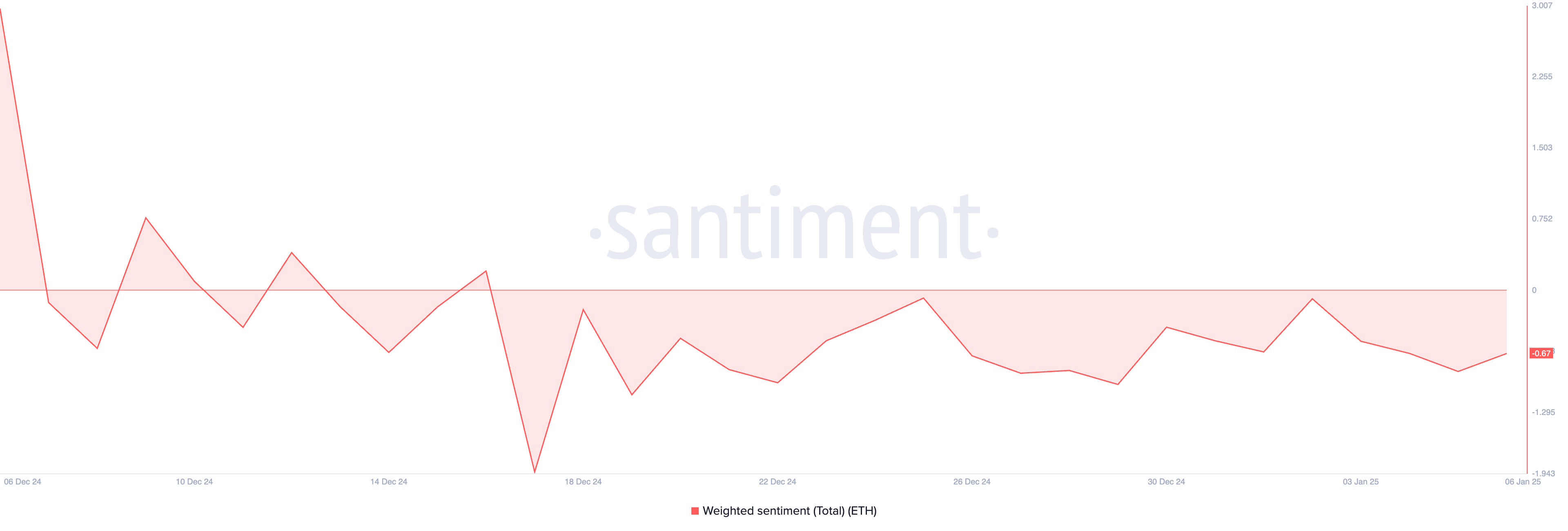

Moreover, the coin’s negative weighted sentiment confirms the likelihood of a price correction. For context, ETH’s weighted sentiment has returned predominantly negative values since December 17. At press time, this stands at -0.67.

This metric measures the overall sentiment expressed towards a particular asset, considering both the sentiment polarity (positive or negative) and the volume of social media mentions. As with ETH, a negative weighted sentiment indicates that the prevailing sentiment towards the asset is predominantly negative, suggesting potential bearish market conditions.

Ethereum Weighted Sentiment. Source: Santiment

ETH Price Prediction: $4,000 Target Feels Distant

ETH currently trades at $3,654, slightly above support formed at $3,332. If futures market selloffs intensify, this support level will be tested. A breach of this zone could occasion an ETH price drop to $2,509, further from the highly coveted $4,000 mark.

Ethereum Price Analysis. Source: TradingView

On the other hand, if selling activity stalls and buying pressure resurges, it could propel ETH’s price above the $4,000 mark and toward the four-year high of $4,783.

Read the full article here