Ethereum (ETH) appears to be gearing up for a major breakout, with its market structure closely resembling Bitcoin’s (BTC) past cycle.

Notably, an analysis by Titan of Crypto suggests that Ethereum’s current price action closely resembles Bitcoin’s trajectory just before its explosive breakout in the previous bull run.

Ethereum key levels and breakout signals

A comparison of market cycles by the analyst shows that Bitcoin, during its third cycle, consolidated within a symmetrical triangle before experiencing a sharp breakout.

Now, Ethereum, in its fourth cycle, is following a nearly identical pattern, suggesting that a significant rally could be on the horizon.

Ethereum is currently trading around $2,707, with $3,000 emerging as a crucial resistance level that could determine its next move.

If Ethereum successfully flips $3,000 into support, it could clear the way for a surge toward $4,000. A breakout above this zone would confirm bullish momentum, potentially propelling Ethereum toward even higher price targets.

If the fractal pattern holds, Ethereum could be primed for its most explosive breakout yet, similar to Bitcoin’s historic rally from a comparable setup.

However, failure to break above resistance could result in prolonged consolidation, delaying the anticipated move.

Adding to the bullish outlook, a recent analysis by TedPillows suggests that Ethereum has entered a short-term expansion phase following a prolonged period of accumulation and manipulation.

This breakout from consolidation, as noted by the analyst, indicates that ETH could be on the verge of a major price surge, with projections pointing to new highs by March 2025.

Factors driving optimism for Ethereum

Ethereum’s bullish momentum is gaining traction, fueled by a combination of upcoming network upgrades, surging ETF inflows, and fresh speculative interest sparked by Eric Trump’s endorsement.

The Pectra upgrade, scheduled for March 2025, is expected to significantly enhance Ethereum’s scalability, transaction speeds, and cost efficiency.

With test runs already underway on Ethereum’s Sepolia and Holesky networks, the upgrade could attract more developers, further driving demand for ETH.

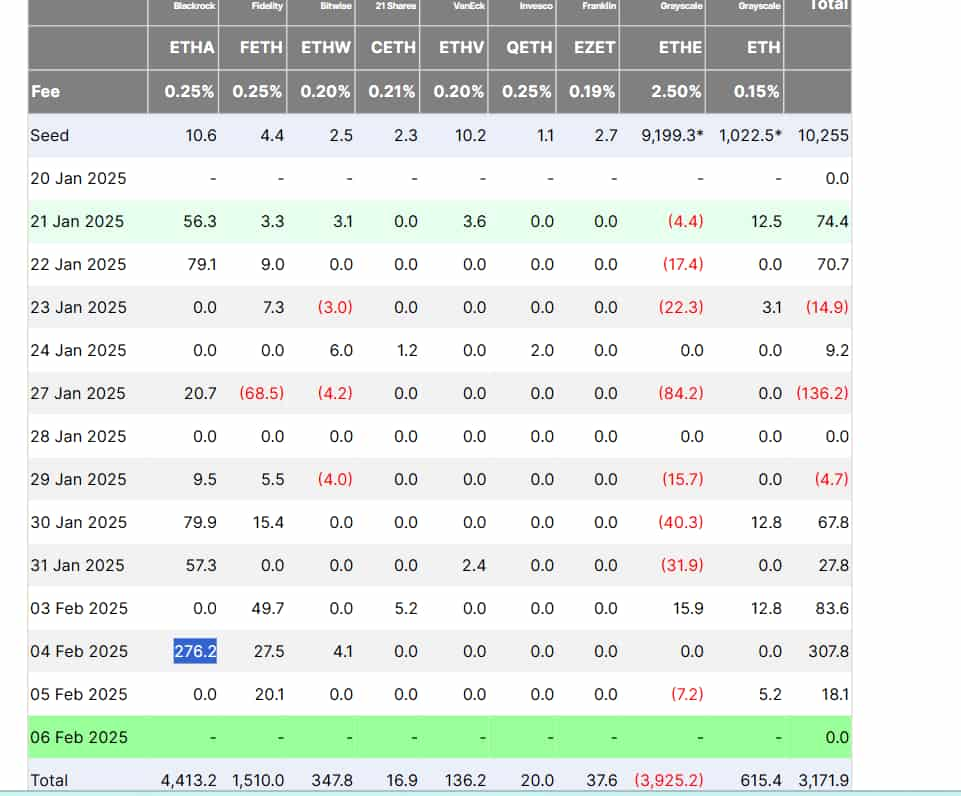

Moreover, institutional interest in Ethereum is on the rise, with US-based spot Ethereum ETFs recording five consecutive days of inflows, totaling $505.1 million from January 30 to February 5, 2025, according to data from Farside.

Leading the surge, BlackRock’s ETHA fund emerged as the top buyer, accumulating $579 million in inflows between January 21 and February 5.

Meanwhile, Eric Trump’s recent endorsement of Ethereum has also triggered renewed speculative interest, particularly among retail investors.

While such endorsements do not directly impact Ethereum’s fundamentals, they often contribute to short-term buying momentum, further supporting ETH’s recovery.

What’s next for Ethereum?

With rising interest from institutional investors and large individual holders, Ethereum appears well-positioned to sustain its upward momentum.

As the cryptocurrency inches closer to the critical $3,000 resistance level, market participants are watching closely to see if it can break through and confirm a bullish trend.

With technical indicators aligning and fundamental factors strengthening, Ethereum’s current phase could set the stage for a surge toward new all-time highs in the coming months.

Featured image via Shutterstock

Read the full article here