Ethereum’s (ETH) price has struggled to breach the $2,681 resistance level, a barrier that has been in place for weeks. Despite repeated attempts to rise beyond this level, the cryptocurrency has faced stiff rejection, resulting in a drop that has increased short-term losses for investors.

The most recent failed breach led to a sharp uptick in investor losses, signaling the difficulty Ethereum is having in maintaining bullish momentum.

Ethereum Fails to Find Support

The lack of sustained bullish momentum is sparking concerns among Ethereum investors. Over the last 24 hours, relative unrealized losses rose by 14%, reflecting the broader market’s struggle to generate meaningful upward movement. Weak institutional flows are adding to this concern, further dampening investor sentiment and leaving Ethereum in a precarious position.

Ethereum holders are becoming increasingly wary of potential downside risks as the broader market falters. While ETH has shown resilience in holding certain support levels, the continued struggle to break above $2,681 has eroded confidence. This has resulted in a surge of cautiousness as short-term losses continue to climb and market uncertainty persists.

Read more: How to Invest in Ethereum ETFs?

Ethereum Realized Losses. Source: Glassnode

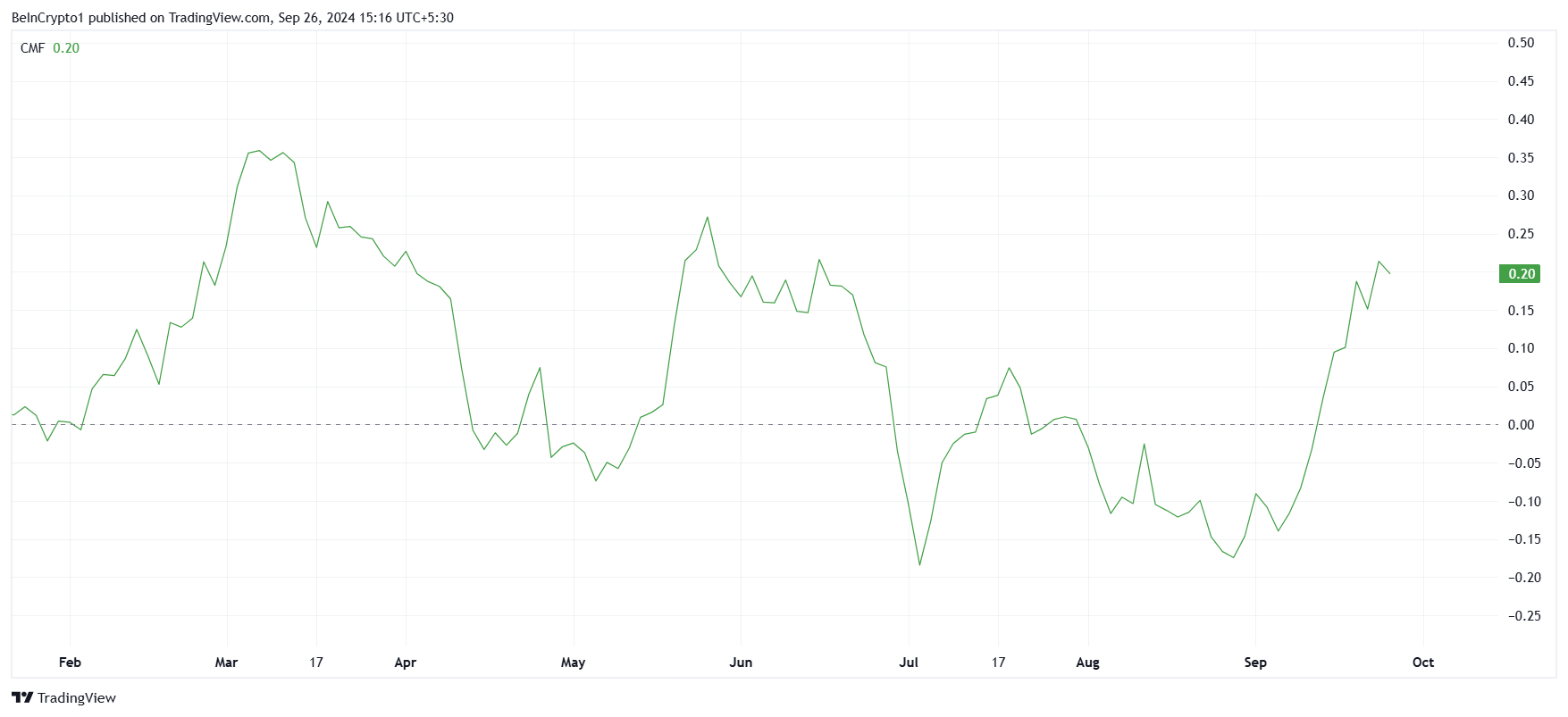

Despite the overall bearishness in the macro market, some Ethereum holders remain optimistic. The Chaikin Money Flow (CMF), a key technical indicator, recently hit a three-and-a-half-month high, bringing it back to levels seen in June. This shows that some accumulation is still occurring, even as the market struggles to break free from bearish trends.

These mixed signals, with the CMF showing strength while broader market sentiment weakening, could keep Ethereum afloat for the near term. While bearish macro conditions persist, the resilience demonstrated by Ethereum holders suggests that a sudden drop is unlikely, although the upside remains limited unless a significant catalyst emerges.

Ethereum CMF. Source: TradingView

ETH Price Prediction: Home Between Rock and a Hard Place

Ethereum’s price is currently trading at $2,614, holding above the $2,546 support. However, the $2,681 resistance has remained a roadblock for the past five weeks. Ethereum’s price action has been constrained by these levels, leaving the cryptocurrency in a state of consolidation.

Given the current market conditions, Ethereum is likely to continue its sideways movement. The uncertainty surrounding the broader crypto market, coupled with weak institutional interest, suggests that ETH will remain stuck between $2,681 and $2,546 for the foreseeable future. A decisive break above or below this range remains uncertain.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Ethereum Price Analysis. Source: TradingView

The bearish-neutral outlook for Ethereum can only be invalidated if the cryptocurrency flips $2,681 into a support floor. If Ethereum bounces from this level, it could generate enough momentum to push toward $2,930. However, failure to do so may result in Ethereum slipping back down, as it has done several times before when facing this resistance.

Read the full article here