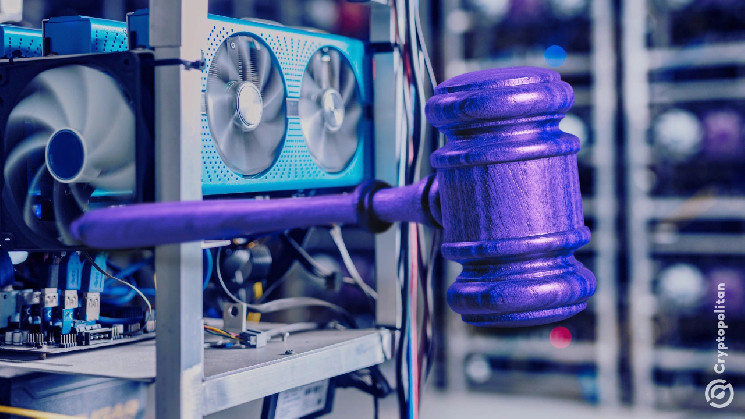

A Texas federal judge has put the brakes on the US Securities and Exchange Commission’s (SEC) case against Geosyn Mining LLC, a Bitcoin mining and hosting company, after federal prosecutors filed criminal charges against three of its executives.

CEO Caleb Ward, COO Jeremy McNutt, and former sales manager Jared McNutt are accused of misusing customer funds and spending investor money on personal luxuries instead of mining equipment.

The ruling came after Ward and Jeremy McNutt turned themselves in on Thursday and appeared in court over the impending indictments. Prosecutors allege that Geosyn executives engaged in wire fraud, running what appeared to be a Ponzi-like operation disguised as a crypto mining business.

The SEC, which had initially opposed a pause in its lawsuit, agreed to the stay after reviewing new legal arguments from Ward’s team.

Prosecutors: Geosyn executives used investor funds for luxury spending

Court documents unsealed this week reveal that Geosyn executives made big promises to customers—investors were told their money would be used to purchase and operate Bitcoin miners, with profits from those machines flowing back to them. Instead, according to the criminal complaint, the funds were diverted for personal use.

Prosecutors say that instead of buying mining equipment, Ward, Jeremy McNutt, and Jared McNutt used the money to fund extravagant lifestyles. According to DOJ filings, the trio spent customer funds on a Las Vegas wedding, a Disney World trip, luxury watches, and a Miami “business trip” that racked up thousands of dollars in restaurant and nightclub expenses.

The complaint also alleges that Geosyn’s executives falsified financial reports to keep investors in the dark. When customers expected mining profits, the company used money from new clients to pay old ones, creating the illusion that the business was profitable. Both Jeremy and Jared McNutt left the company in October 2022.

The SEC’s lawsuit, which sought to classify Geosyn’s mining agreements as securities, has now been put on hold. Federal Judge Mark Pittman requested that both parties brief him on how recent statements from President Donald Trump and acting SEC Chair Mark Uyeda—who have advocated for easing SEC enforcement on crypto firms—could affect the case.

In their February 11 response, Ward and McNutt’s legal team argued that pausing the lawsuit would allow time to assess how the Trump administration’s crypto policies could impact the SEC’s regulatory power. The SEC initially fought against the stay, but after reading the motion, reversed course and agreed to pause the case.

“The SEC initially resisted, but after reviewing our arguments, they agreed,” said Jeff Daniel Clark, Ward’s attorney.

Read the full article here