Galaxy Digital withdrew large amounts of Ethereum through OTC transactions, transferring it to an address reportedly linked to a whale or institution.

This comes as the price of Ethereum (ETH) consolidates at $2,626.51, reflecting a slight 0.64% increase in the past 24 hours.

According to Lookonchain, Galaxy Digital’s over-the-counter (OTC) wallet withdrew 89,000 ETH from an exchange. This withdrawal, worth about $234 million, quickly grabbed the market’s attention. However, the transfers didn’t stop there.

It seems that a whale/institution bought 108,278 $ETH($283M) through OTC.

Galaxy Digital OTC wallet withdrew 89,000 $ETH($233.5M) from exchanges in the past 12 hours, and then transferred 108,278 $ETH($283M) to the whale/institution wallet 0x0b26.

Wallet 0x0b26 currently holds… pic.twitter.com/BgqiLH2xlH

— Lookonchain (@lookonchain) June 4, 2025

Afterwards, Galaxy Digital facilitated an additional OTC transaction of 108,278 ETH, worth around $283 million. This transaction occurred in multiple batches: 44,000 ETH, 50,000 ETH, and 14,278 ETH, which were subsequently moved to a different address.

Transfer to Whale Address

Following the OTC transactions, these Ethereum holdings were transferred to a new address: 0x0b26. This address now holds a total of 139,476 ETH, valued at approximately $365 million. According to Lookonchain, this address could be owned by a whale or an institution.

This transfer marks a substantial accumulation of Ethereum, especially given the significant value of the assets involved. Typically, when whales or institutions add large amounts of Ethereum, it usually signals a potential long-term holding strategy. This creates increased scarcity, possibly taking asset prices higher due to a drop in selling pressure.

In recent weeks, the Galaxy Digital OTC address has been transferring large amounts of Ethereum (ETH) through multiple transactions to exchanges like Coinbase and Binance. Notably, these transfers occurred in several stages throughout April, including transactions such as 4.4K ETH ($7.86M), 5K ETH ($8.93M), and 5.5K ETH ($9.83M) to the Coinbase exchange. These happened around the 28th of April.

ETH’s price had been declining in early April, followed by a stagnation around $1,800 when these transactions were taking place. However, as the transactions started shifting into individual addresses, the price of ETH began to pick up momentum, eventually surging past $2,500 by mid-May. Nonetheless, this might just be coincidental.

Significant Outflows from Exchanges

IntoTheBlock data further confirms that exchanges are experiencing considerable outflows of Ethereum.

Ethereum Exchange Outflows

The flow of funds off exchanges has notably increased, with a 24-hour change of 20.66%, a 7-day change of 29.00%, and a 30-day change of 267.58%. This rise in outflows suggests a significant shift, as investors seem to be moving their assets off centralized platforms.

Changes in Ethereum Ownership Across Wallets

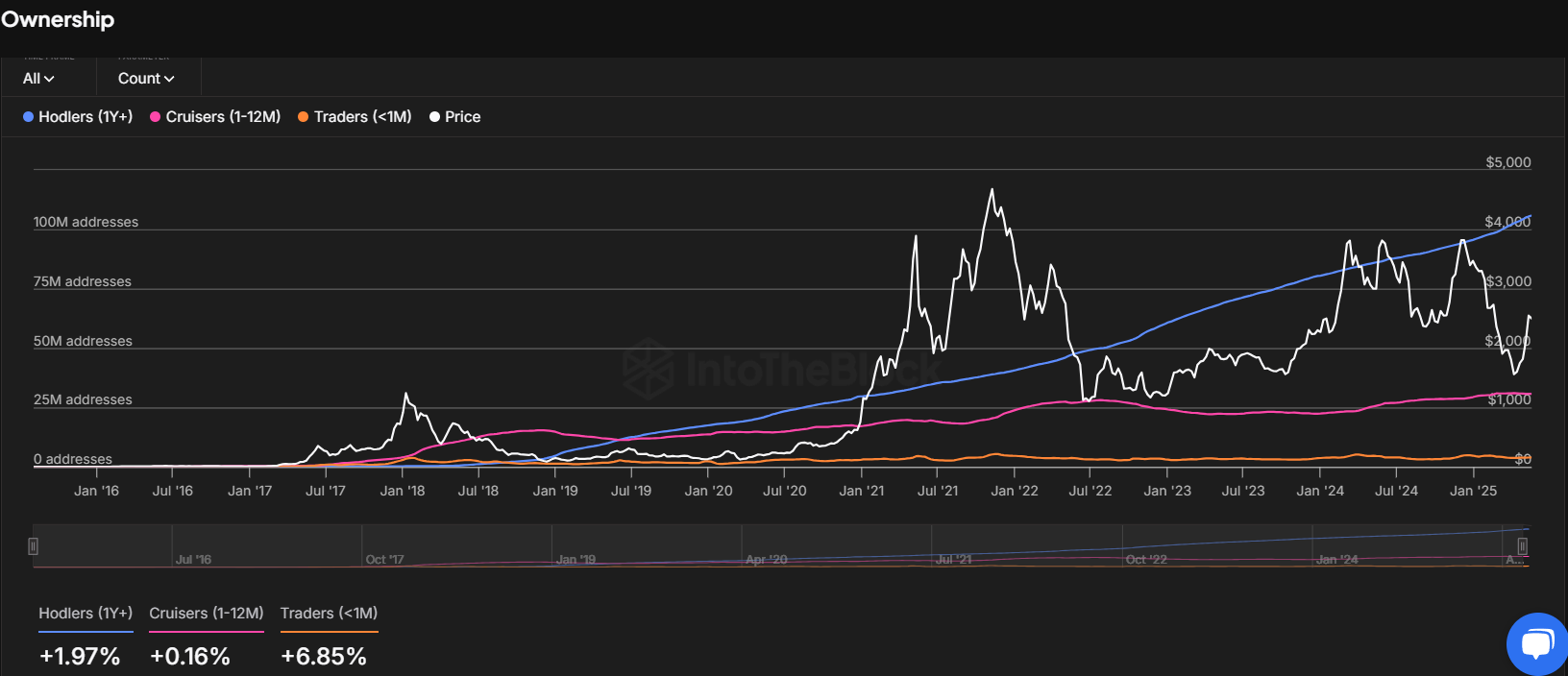

Data also shows notable shifts in Ethereum ownership among different types of investors. The percentage of Ethereum addresses that have held their ETH for over one year has increased by 1.97%.

Ethereum Addresses by Time Held

Meanwhile, medium-term investors who have held ETH between 1 month and 1 year saw a slight increase of 0.16%. In contrast, short-term speculators who have held ETH for less than a month experienced a more significant increase of 6.85%. These movements reflect broader changes in investor behavior, especially with the growing focus on long-term holdings.

Large Institutions Also Accumulating ETH

In addition to these wallet trends, prominent institutions have been shifting their focus from Bitcoin to Ethereum. BlackRock, for example, has been gradually liquidating its Bitcoin holdings in favor of Ethereum.

This shift has been observed over the past few days, with BlackRock moving 5,362 BTC, worth $561 million, and simultaneously acquiring 27,241 ETH, valued at $69.25 million.

Read the full article here