Blockchain sleuth ZachXBT has accused Garden Finance, which brands itself as “the fastest Bitcoin bridge,” of facilitating the laundering of funds linked to major crypto thefts, including the Bybit hack.

In a June 21 post on X, ZachXBT claimed that over 80% of Garden’s recent fee revenue stemmed from illicit transactions allegedly tied to the North Korean Lazarus Group.

The allegation came in response to an earlier post by Jaz Gulati, a co-founder of Garden Finance, who had recently touted the platform’s success, citing 38.86 Bitcoin (BTC) in collected fees — $300,000 of which was earned over the 12 days ending June 2.

“You conveniently left out >80% of your fees came from Chinese launderers moving Lazarus Group funds from the Bybit hack,” ZachXBT said.

Related: Hong Kong to develop crypto tracking tool for money laundering

Laundering via centralized liquidity

ZachXBT further alleged that that a single actor continuously topped up cbBTC liquidity from Coinbase, effectively fueling illicit flows while Garden claimed to operate a trustless and decentralized model.

“Explain how it is ‘decentralized’ when I watched in real time for multiple days as a single entity kept topping up cbBTC liquidity from Coinbase,” ZachXBT wrote, questioning the project’s claims of decentralization.

In response, Garden Finance founder Jaz Gulati denied the allegations, pointing out that 30 BTC in fees were collected prior to the Bybit incident. He dismissed the criticism as misinformation, calling the “fake decentralized” label baseless.

Garden Finance claims to enable crosschain swaps within 30 seconds while offering zero-custody risk.

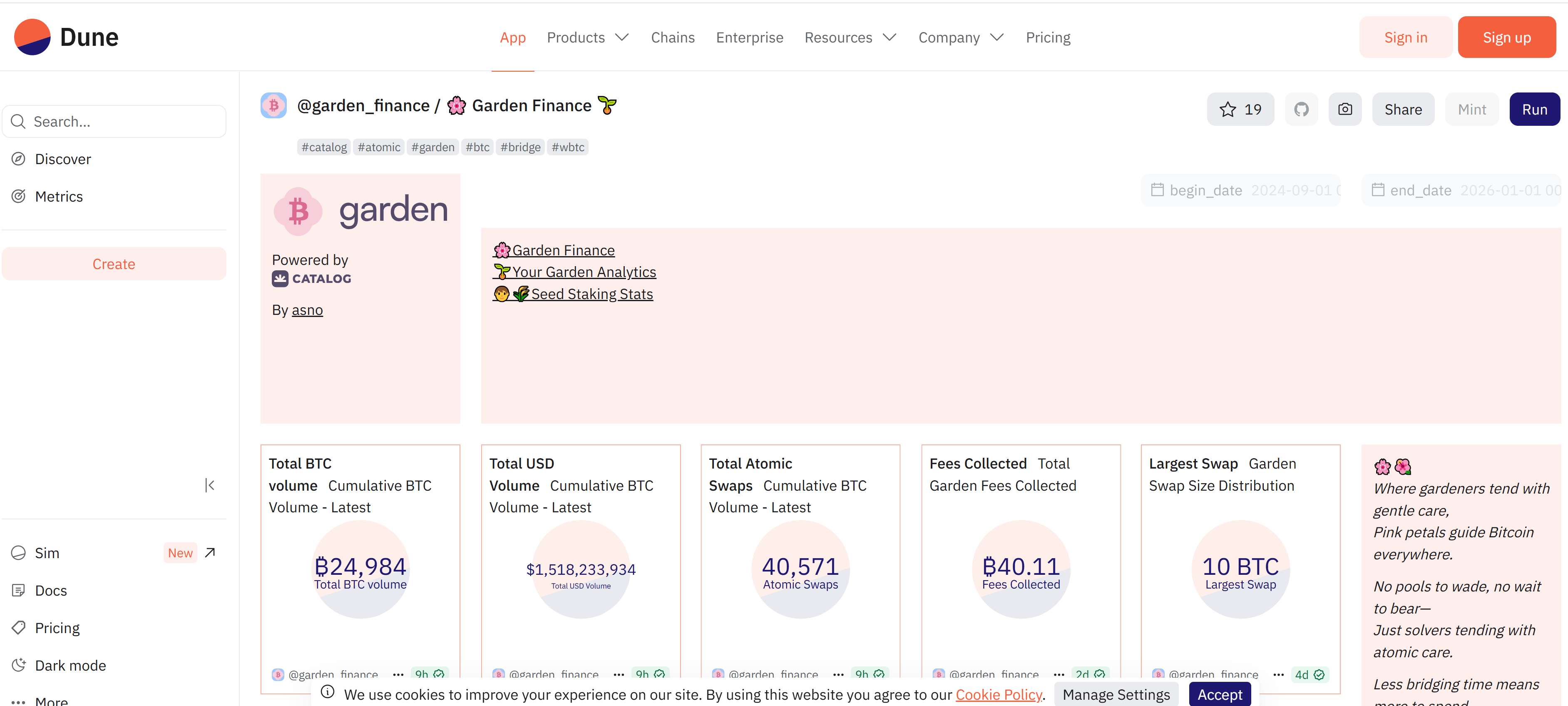

According to its Dune Analytics dashboard, the project has facilitated over 24,984 BTC in total volume, equivalent to more than $1.5 billion, across 40,571 atomic swaps. The platform has collected 40.11 BTC in fees to date, with its largest single swap reaching 10 BTC.

Cointelegraph reached out to Jaz for comment via X but had not received a response by publication.

Related: Crypto scammers plead guilty to $37M scheme targeting Americans

Crypto founder accused of laundering $530M

Last week, Iurii Gugnin, the founder of crypto payments firm Evita Pay, was arrested in New York. He faces 22 federal charges tied to a sprawling money laundering scheme allegedly involving over $530 million.

According to the US Department of Justice, Gugnin facilitated stablecoin transactions that enabled clients connected to sanctioned Russian banks, such as Sberbank and VTB, to bypass restrictions and gain access to sensitive US technologies.

Prosecutors say the operation ran from June 2023 through January 2025. Gugnin is charged with wire fraud, money laundering, and running an unlicensed money transmission business. If found guilty, he could face a life sentence.

Magazine: New York’s PubKey Bitcoin bar will orange-pill Washington DC next

Read the full article here