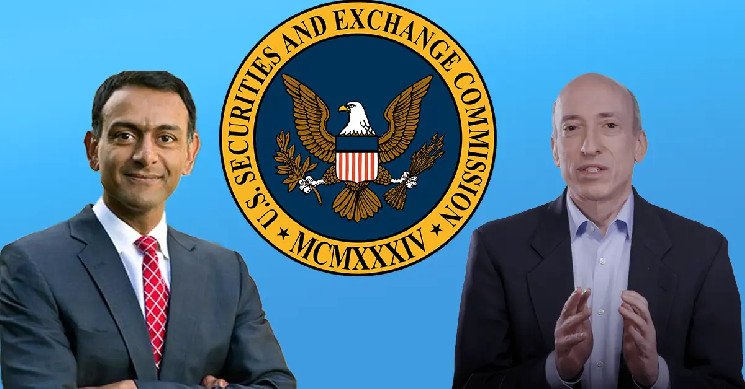

Gary Gensler is stepping down as SEC Chair on January 20, 2025. But before leaving, he has made a final strike against the crypto world. The SEC, under his watch, filed an 81-page document targeting Binance. It opposes Binance’s motion to dismiss its lawsuit, calling Binance Coin (BNB) and ten other tokens securities. Let’s unpack what this means for Binance and the broader crypto market.

SEC’s Target: Eleven Cryptocurrencies

The SEC is not happy targeting just Binance Coin. Along with BNB, it labeled ten more tokens as securities: Solana (SOL), Cardano (ADA), Polygon (MATIC), Filecoin (FIL), Cosmos (ATOM), The Sandbox (SAND), Decentraland (MANA), Algorand (ALGO), Axie Infinity (AXS), and COTI.

Source : courtlistener

But the filing goes beyond naming tokens. The SEC accuses Binance of more than just selling them. It claims Binance promoted secondary markets for these tokens. Why does that matter? Because it allegedly encouraged investors to see these tokens as profit-making opportunities.

Ripple’s partial victory earlier this year shaped the SEC’s arguments too. That case ruled XRP’s secondary sales weren’t securities. So now, the SEC is being extra careful to cover those gaps.

How Binance is Being Called Out

The SEC’s case rests on something called the Howey Test. In simple terms, this test asks three things to decide if something is a security:

- Was money invested?

- Was there a common goal?

- Did people expect profits from someone else’s work?

The SEC says Binance ticks all three boxes. It claims Binance tied token value to its ecosystem’s growth, making users think they were investing.

What’s more, the SEC argues secondary market trades are also securities. Binance has said otherwise, but this filing directly challenges that.

Ethereum and Bitcoin: Why Are They Spared?

Not everyone agrees with the SEC’s methods. Paul Grewal, Coinbase’s legal chief, called out what he sees as selective enforcement. In a tweet, he asked why Ethereum (ETH) and Bitcoin (BTC)—the two biggest cryptocurrencies—are always left out.

Yesterday @SECGov filed eight-one pages of arguments that secondary trading of BNB and ten other tokens triggers liability under Howey. But do they offer ONE WORD explaining how this same bogus logic somehow avoids ETH? Or BTC? Nope. Because they can’t. 1/3

— paulgrewal.eth (@iampaulgrewal) December 5, 2024

It’s a fair question. ETH and BTC dominate the market. Yet, they’re nowhere in this filing. Ripple’s case may have influenced the SEC’s tactics here, but critics are still scratching their heads.

What This Means for Crypto

If the SEC wins, the fallout could be huge. Tokens labeled as securities might vanish from platforms like Binance. Developers and investors would face stricter rules, which could slow innovation and growth.

The SEC’s goal is clear: take control of the crypto market. By targeting both token sales and secondary trades, it’s trying to set a firm legal standard.

What’s Next?

This filing isn’t a new lawsuit. It’s the SEC doubling down on its claims against Binance. But the exclusion of Ethereum and Bitcoin? That raises serious questions about fairness.

As Gensler prepares to leave, this feels like his last big move. For crypto, the stakes are massive. The court’s decision could either bring clarity—or turn the market upside down.

Read the full article here