Reports from market analytics platforms Glassnode and CryptoQuant suggest that Bitcoin still has room for more substantial growth.

The report comes as Bitcoin (BTC) claims a new all-time high of $109,000 on the back of President Donald Trump’s inauguration. In its report, Glassnode stated that Bitcoin’s current trend resembles historical patterns, especially the 2015-2018 cycle.

Bitcoin Trailing 2015-2018 Cycle

The market resource examined data across all Bitcoin cycles to confirm this assertion. Particularly, at the current stage of the market, the Genesis to 2011 cycle had seen an 80.51x price increase from cycle low, while the 2011 to 2015 cycle had achieved a 55.30x growth.

#Bitcoin’s current cycle continues to echo historical trends, particularly aligning with the 2015-2018 cycle.#BTC performance since the cycle low at the current stage of the cycle (no. of days since low):

⚫️2022 Cycle+: +630%

🔵2015-2018 Cycle: +562%https://t.co/9YVv2m2I0p pic.twitter.com/vBSwC8qm5T— glassnode (@glassnode) January 21, 2025

Meanwhile, the 2015 to 2018 and 2018 to 2022 cycles had delivered smaller but still impressive gains of 2.80x and 3.31x from their respective cycle lows. Interestingly, the 2022+ cycle is currently up 2.92x from its low at this stage, resembling the trajectory of the 2015 to 2018 cycle.

Data from Glassnode’s chart confirms that at this stage in the 2015 to 2018 cycle, Bitcoin had risen 562%, while the ongoing cycle has achieved a 630% increase.

Bitcoin Performance from Cycle Low | Glassnode

However, the chart also revealed that after rising 562% from its cycle low in 2015-2018, Bitcoin witnessed further rally, with its growth ultimately rising to 11,374%. This represented the peak of $19,666 in December 2017.

This indicates that, with Bitcoin now up 630% in the current cycle, it could still witness a more substantial growth if it continues to trail the 2015-2018 cycle. However, the extent of its further growth remains uncertain.

To put things into perspective, if the current cycle were to replicate the exact 2015-2018 trajectory, an 11,374% rise from this cycle’s 2022 low of around $15,000 could theoretically push Bitcoin to a peak of $1.7 million, given its 2022 low of $15,000. However, this growth is likely unfeasible.

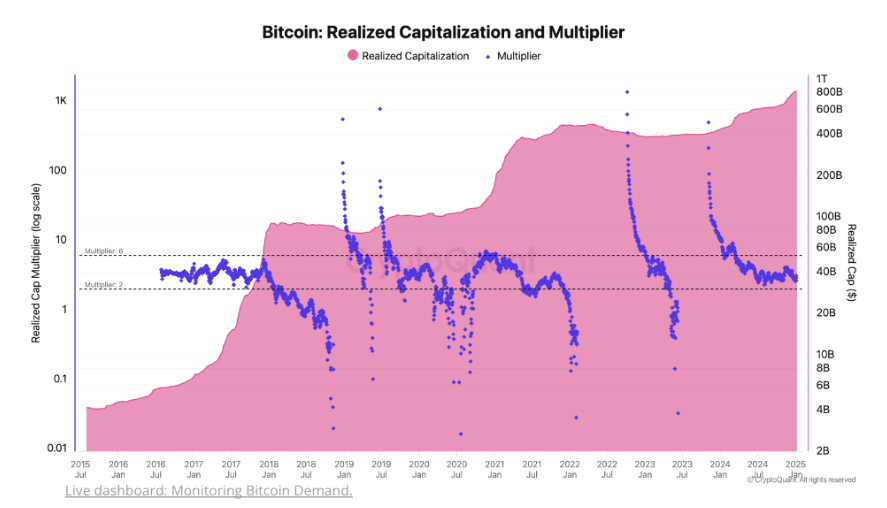

Bitcoin Realized Cap Multiplier

Meanwhile, CryptoQuant’s analysis presented a more realistic target of $145,000 to $249,000 in 2025, as they agreed that Bitcoin still has more room for growth. Their analysis relies on the realized cap multiplier, which measures how Bitcoin’s market value responds to capital inflows.

According to the report, during bull markets, Bitcoin’s multiplier typically ranges between 2 and 6, meaning every $1 of new investment could increase market value by $2 to $6. Based on projected capital inflows of $520 billion by 2025, they calculated these price targets as realistic.

Bitcoin Realized Cap Multiplier | CryptoQuant

Moreover, market analyst Joohyun Ryu recently noted that crypto demand is surging among South Korean investors, a factor that could help propel further growth for Bitcoin. The “Kimchi Premium,” which shows higher local crypto prices, indicates increased domestic interest.

At the same time, Ryu noted that rising unemployment rates in the United States present a potential risk to global economic stability. Notably, such trends have preceded recessions, suggesting the need for caution despite optimistic market conditions. Currently, Bitcoin trades for $104,637, down 2.82% over the past 24 hours.

Read the full article here