Technical analysts point out that Hedera (HBAR) price has confirmed textbook breakout patterns that indicate its excellent price recovery could continue.

After months of consolidation and downtrends, Hedera has broken out and will provide a bullish outlook. Analysts are predicting the breakout target to be around $0.504.

If this target is achieved, it will be a massive 75% upside from HBAR’s current trading price of $0.279.

Source: X

It doesn’t end there with excitement. Analysts predict even more upside potential if HBAR breaks through and holds above the resistance level of $0.504.

This next target at 0.962 represents over 90% gains and adds a strong rationale for traders and investors seeking significant gains.

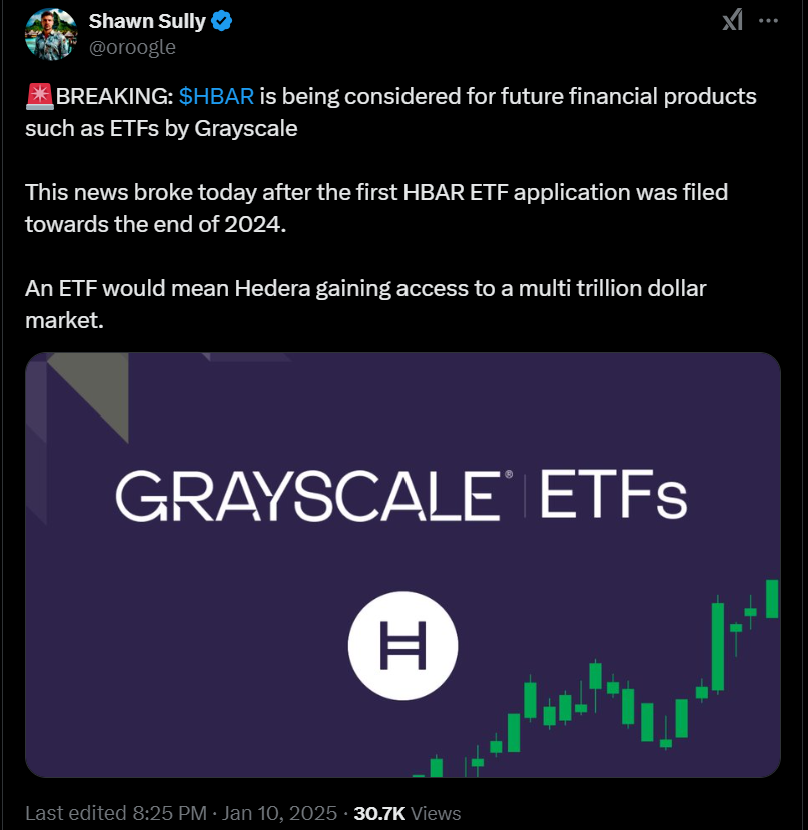

ETF Narrative Fails to Propel Immediate Gains

However, despite these bullish signals, Hedera’s price momentum has been quiet.

– Advertisement –

It has not lifted off for a big reason, such as Grayscale announcing their plans to file an exchange-traded fund (ETF) focused on $HBAR.

Bitcoin and other crypto assets tend to rally when institutional funds start making a play, as ETF-related announcements historically acted as very potent catalysts for price spikes (see Bitcoin ETF).

But HBAR’s response to the Grayscale announcement has fallen flat.

Source: X

HBAR (Hedera Hashgraph) trades at $0.279 per coin after a 1.11% decline in the past 24 hours on the whole market, according to data from CoinMarketCap.

Its market cap is $10.68B, with a fully diluted valuation (FDV) of $13.96B.

An absence of bangs from traders has resulted in the 24-hour trading volume clocking in at $531.32 million, corresponding to a moderate 5% of the market cap.

Technical Analysis Highlights Key Levels For HBAR Price

HBAR’s recent price action constitutes a textbook breakout from a descending trendline that dictated its price behaviour throughout 2022 and early 2023.

After 658 days of declining prices, HBAR broke above key resistance levels, and the move could be the start of a bullish continuation, as per the analysts’ charts.

1-hour charts show that the first significant step on HBAR’s road to recovery lies at the first breakout target of $0.504.

However, beyond this level, analysts are optimistic that the upside potential is even more significant, with the more ambitious $0.962 target being a long-term target for investors.

At the time of writing, $HBAR is in a nice price consolidation, at around $0.265 and $0.285, which can be considered a healthy price stabilization period, allowing the market participants to reposition themselves before the next leg up.

The Money Flow Index (MFI) differs, giving insight into market conditions, as an indicator that sits at 39.45 suggests HBAR could be in for a neutral to oversold condition, which may lead to a renewed influx of buying pressure.

This buying interest could launch the token towards its $0.504 target and beyond.

1-hour HBAR/USD Chart | source: TraadingView

The HBAR price trajectory remains very dependent on its short-term resistance levels. Suppose we can decisively break above $0.285.

In that case, that may lead to impressive bullish momentum again, but if we can’t defend $0.265, look out for a retest of lower levels, perhaps hindering the continued uptrend.

However, traders and investors should watch these levels closely as HHBAR tests a critical period of its market cycle.

Read the full article here