Since January 17, Hedera (HBAR) has been on a downward trajectory, shedding 20% of its value as selling pressure intensifies. The altcoin has since traded below a descending trendline, indicating persistent bearish sentiment in the market.

As demand for the altcoin continues to plummet, HBAR risks extending its price drop. This analysis has the details.

Hedera Bears Overrun Market

BeInCrypto’s assessment of HBAR’s price performance on a daily chart reveals that the altcoin has traded below a descending trendline since January 17. The token trades at $0.31 at press time, noting a 20% price decline since then.

A descending trendline is a bearish pattern that connects a series of lower highs in an asset’s price movement, indicating a consistent downtrend. When an asset trades below this trendline, it suggests that the price is under bearish pressure and the prevailing market sentiment is bearish.

HBAR Descending Trendline. Source: TradingView

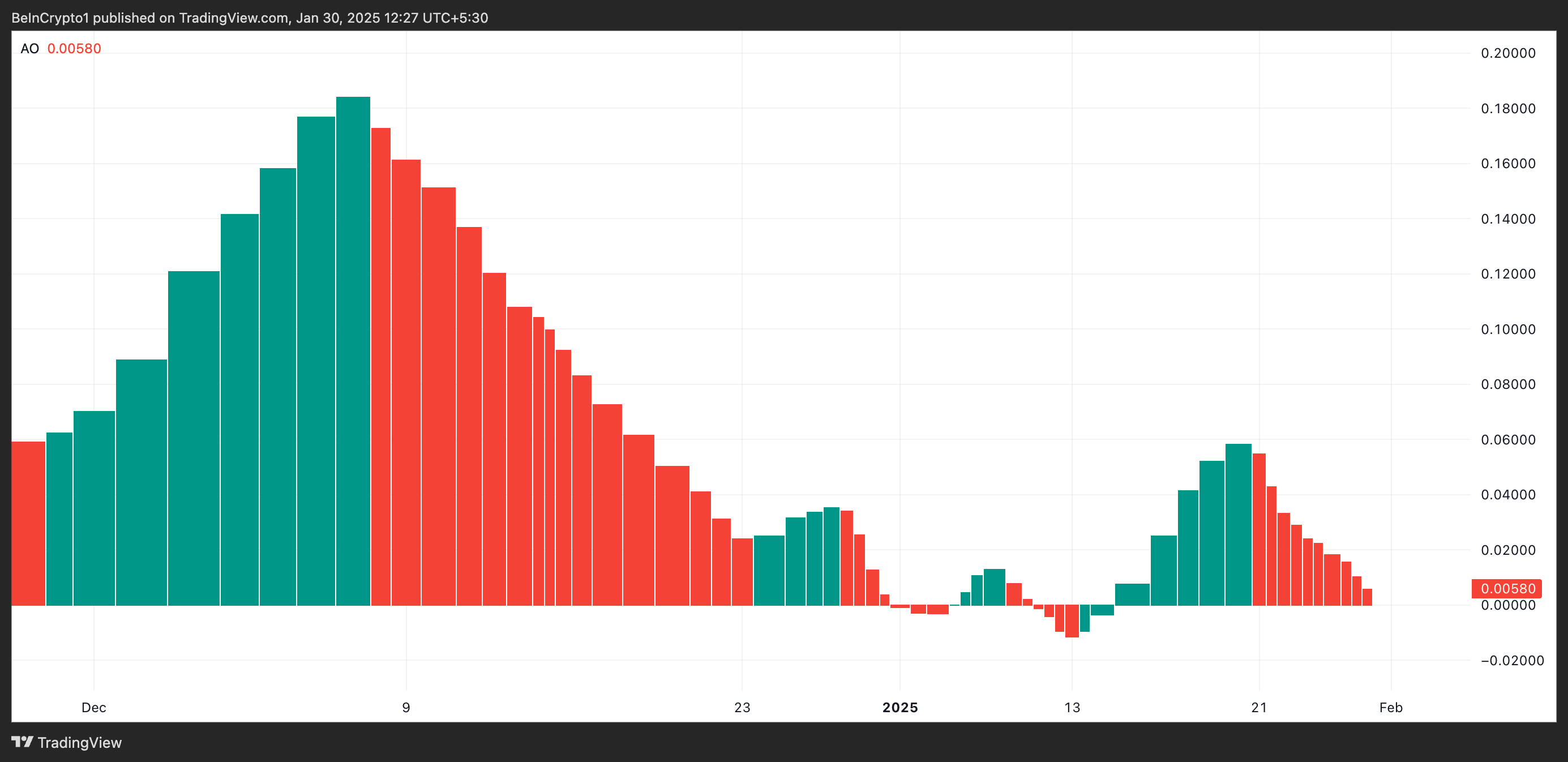

Readings from HBAR’s Awesome Oscillator (AO) confirm this prevailing bearish sentiment. For context, this momentum indicator has posted only red histogram bars since January 21, indicating that HBAR has been trailed by negative bias for a while.

An asset’s AO measures market momentum by comparing the difference between two simple moving averages (SMA) of an asset’s price. When its bars are red, it indicates a shift towards bearish momentum, suggesting that sellers are gaining strength and the market may be poised for further downside.

HBAR Awesome Oscillator. Source: TradingView

HBAR Price Prediction: Token Under Threat of 18% Decline to $0.26

If sellers retain market control, HBAR risks falling 18% to trade at $0.26. According to its Fibonacci Retracement tool, if selloffs increase at this point, that support level may not hold, and the token’s price could drop further to $0.22.

HBAR Price Analysis. Source: TradingView

However, a positive shift in market sentiment could prevent this from happening. If HBAR witnesses a spike in buying pressure, its price could rebound and climb toward its multi-year high of $0.40.

Read the full article here