Hedera’s (HBAR) price action has remained stagnant over the past few weeks, with limited upward momentum. Despite this, traders are maintaining a bullish outlook, anticipating a significant price surge.

Unlike typical periods of consolidation that trigger sell-offs, the HBAR community appears optimistic about a breakout that could push the altcoin higher.

HBAR Traders Are Bullish

HBAR’s Open Interest (OI) has surged by $144 million over the last week, bringing the total OI to $344 million. This sharp increase indicates that traders are actively returning to HBAR, eyeing potential gains from the expected uptrend. The rise in OI is further supported by a positive funding rate, showing that most Futures positions are long, reflecting confidence in a price increase.

The surge in market participation aligns with traders’ expectations for HBAR to breach key resistance levels. The inflow of capital into the asset highlights optimism as investors anticipate a shift in momentum. The alignment of funding rates and rising OI provides a strong foundation for potential bullish activity in the near term.

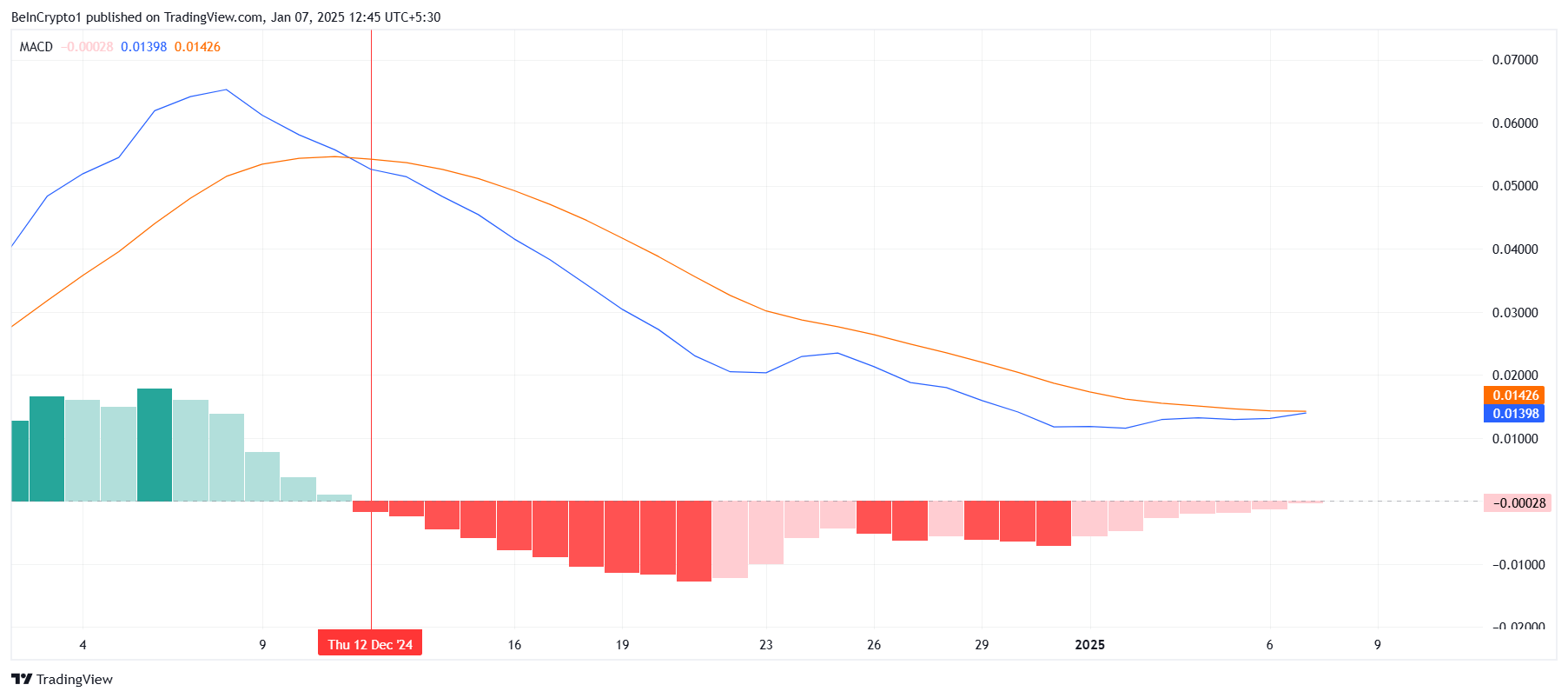

HBAR’s macro momentum is showing signs of improvement, as the Moving Average Convergence Divergence (MACD) indicator suggests the end of bearish pressure. The MACD line is approaching a crossover with the signal line, signaling a potential bullish breakout. Such a shift would mark the beginning of upward momentum, supported by improving broader market cues.

The nearing bullish crossover on the MACD reflects growing market optimism, setting the stage for price recovery. The alignment of technical indicators with rising Open Interest and positive funding rates further strengthens the likelihood of HBAR achieving a breakout. These factors collectively suggest a shift in investor sentiment toward bullishness.

HBAR Price Prediction: Looking For A Breakout

HBAR has been stuck in a consolidation phase for the past month, trading between $0.33 and $0.25. This price stagnation has limited profits for investors.

However, the aforementioned market cues suggest a breakout is imminent. If successful, HBAR could rise to $0.39, matching its 2024 high and possibly reaching $0.40.

The breakout scenario hinges on HBAR breaching and flipping $0.33 into support, which would confirm a sustained upward trend. Such a move would reinvigorate market confidence, attracting more capital into the asset. On the other hand, failing to breach $0.33 could prolong the consolidation phase, potentially leading to selling pressure.

A sell-off triggered by prolonged consolidation could push HBAR below its support of $0.25. This scenario would invalidate the bullish outlook, leading to further price declines and dampening investor optimism.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here