Ethereum (ETH) price has lagged behind other major assets this year, with a 30% year-to-date increase compared to Bitcoin’s 102% and Solana’s 118% gains. However, recent metrics suggest that ETH may be gearing up for a stronger performance.

Whale accumulation is picking up again, and key indicators like the 7-day MVRV ratio and EMA alignments are signaling a potential bullish phase.

ETH 7D MVRV Is at An Important Threshold

Ethereum’s 7-day MVRV ratio currently sits at -3%, suggesting that short-term holders are at a slight unrealized loss on average. This metric often indicates whether an asset is undervalued or overvalued relative to recent market activity.

A negative MVRV ratio like this can signal a potential accumulation zone, as it reflects that holders may be less inclined to sell, creating room for upward price movement if demand increases.

ETH 7D MVRV. Source: Santiment

The MVRV 7-day ratio measures the average profit or loss of addresses that have acquired Ethereum over the past seven days.

Interestingly, on November 5, MVRV 7D ratio hovered around similar levels before a sharp price rally took ETH from $2,400 to $3,400 in just a week, highlighting how this could happen again soon.

Ethereum Whales Are Accumulating Again

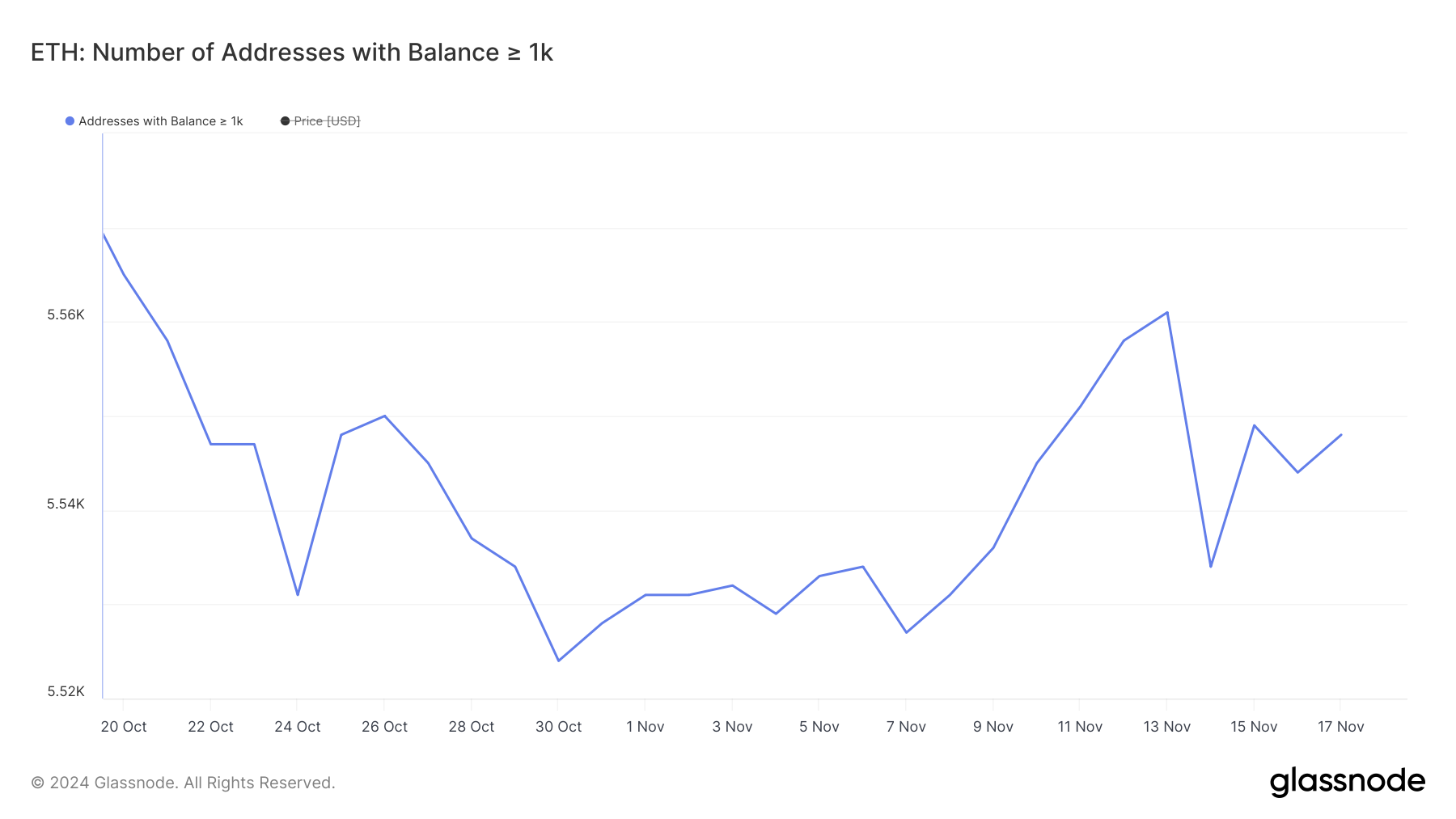

From November 7 to November 13, the number of whales holding at least 1,000 ETH increased significantly from 5,527 to 5,561. This marked one of the largest growth spurts in this metric for 2024, signaling strong accumulation by large holders.

Such activity often reflects increased confidence in ETH’s, as whale accumulation tends to precede periods of upward price movement due to reduced selling pressure and concentrated ownership.

Addresses with Balance >= 1,000 ETH. Source: Glassnode

Following this surge, the metric saw a sharp drop to 5,534 in just one day, reflecting profit-taking. However, it has started climbing again, reaching 5,548 in recent days.

This renewed growth suggests that whales are once again positioning themselves, which could bolster ETH price stability or even fuel a potential rally.

ETH Price Prediction: Potential 15% Upside

With the MVRV 7D ratio at -3% and whales resuming accumulation, ETH price appears to be positioning itself for a bullish phase. This outlook is further supported by its EMA alignment, where the price is above all lines, and the short-term lines are crossing above the long-term ones, forming a golden cross.

This technical setup often signals the start of a strong uptrend, reflecting growing momentum in the market.

ETH Price Analysis. Source: TradingView

If the bullish momentum holds, ETH could challenge its resistance at $3,560, which represents a potential 15% upside from current levels.

However, if the uptrend weakens, ETH may test support around $2,822, and failure to hold that zone could lead to a deeper correction toward $2,360. These levels will be crucial in determining whether ETH can sustain its recovery or face further consolidation.

Read the full article here