XRP price could witness a massive boost if the XRP Ledger handles 100% of the transaction volume processed by Hidden Road.

Notably, Ripple’s expansion ambitions led to the acquisition of Hidden Road, a well-known prime brokerage firm, for $1.25 billion last month. This move confirmed Ripple’s growing focus on serving institutional clients and expanding its presence in traditional finance.

Ripple Confirms Use of RLUSD for Post-Trade Settlement

Interestingly, following the acquisition, Ripple confirmed that Ripple USD (RLUSD), its proprietary stablecoin, will handle Hidden Road’s post-trade transactions, placing the stablecoin at the center of this new strategy.

Since RLUSD also runs on the XRP Ledger (XRPL), most transactions will pass through the XRPL network. While XRP won’t settle these trades directly, the asset is necessary as a transaction fee. The network burns these fees, which slowly reduces the total amount of XRP in circulation.

Notably, Hidden Road processes around $3 trillion worth of transactions each year. If all of that activity moves to the XRPL, the network could see a sharp increase in traffic. To better understand what this might mean for XRP’s price, we asked Grok, the AI chatbot from xAI, for an assessment.

Grok Presents Factors That Could Impact XRP Price Growth

Grok explained that predicting the exact price is difficult because several factors play a role. These include how much of Hidden Road’s volume actually lands on the XRPL, how many transactions it involves, how much XRP gets burned, and how investors react to the development. Ultimately, it predicted a possible rise in price to a range of $3.5 to $28.

However, according to Grok, the burn rate on its own won’t have a huge effect. If $3 trillion worth of transactions result in about one billion operations on XRPL, that would burn around 100,000 XRP each year.

At the current price of $2.16, that’s about $230,000, barely a dent in the total supply of around 58 billion XRP. Even if activity increases tenfold, the burned amount still remains small compared to the overall supply.

Grok Analysis

However, Grok stressed that real value growth could come from rising demand and greater adoption. If RLUSD helps bring more institutional transactions to XRPL, XRP’s role as the fuel that powers the network becomes more important. This utility could raise demand for XRP, especially if financial institutions start building more use cases around the XRPL.

Further, Grok also pointed out that market sentiment could push the price higher. Ripple’s acquisition of Hidden Road has already triggered excitement in crypto circles. If more investors and analysts start viewing this move as a sign of Ripple’s strength in institutional finance, XRP could benefit from that optimism.

XRP Price if XRPL Handles All of Hidden Road’s Transactions

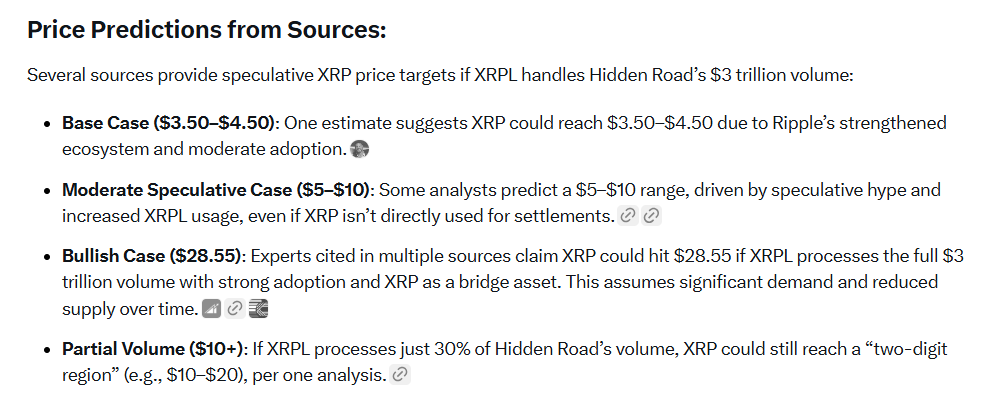

Specifically, regarding price predictions, Grok presented a few possibilities. In a realistic scenario, where XRPL sees steady growth and RLUSD gains traction, XRP could climb to between $3.50 and $4.50 within the next six to twelve months.

XRP Price if XRPL Handles All of Hidden Road Volume | Grok

If adoption picks up faster and market enthusiasm grows, XRP might reach between $5 and $10 over the next year or two. Some highly optimistic predictions go as high as $28.55, but Grok noted that reaching that level would require massive adoption and an overall crypto market surge.

Read the full article here