As uncertainty continues to affect the crypto market, a new analysis of risk models indicates that top altcoins, including Ethereum (ETH), Cardano (ADA), and XRP, may be entering key accumulation zones. The data suggests that despite recent price volatility and a broader market downturn, current levels have historically represented buying opportunities.

This analysis provides a counterpoint to the prevailing bearish sentiment, highlighting underlying technical setups that could precede a market reversal.

What Are Risk Models Telling Us?

Analyst Dan said that Ethereum’s risk score has dropped to 29, a level historically known for accumulation — periods when investors quietly buy in while the wider market panics.

Source: CryptoCapitalVenture

Related: Ethereum Gears Up for $3,000 Breakout with $1B in ETF Inflows and 1M New Wallets Weekly

Similar setups occurred during past bear markets in 2022 and 2023, eventually leading to powerful rebounds.

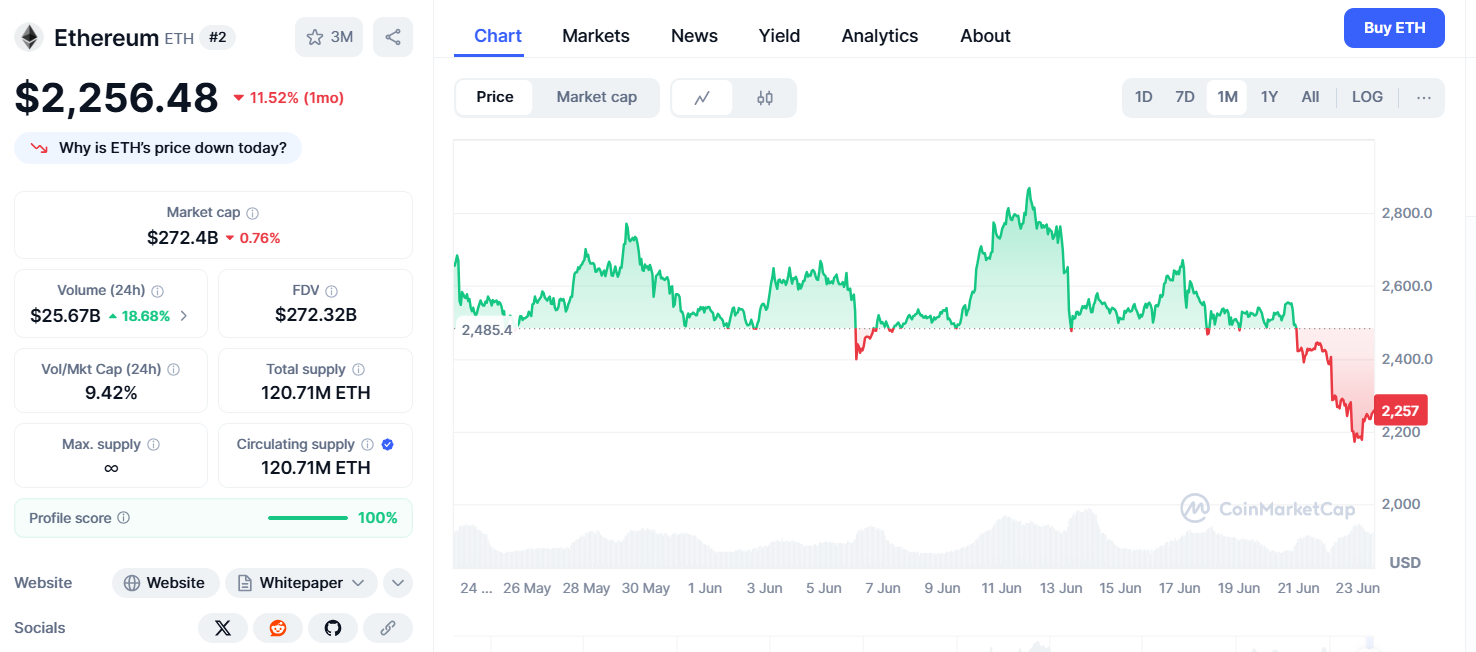

Source: CoinMarketCap

The broader Ethereum chart shows that the asset recently broke down from a consolidation channel. This movement is not out of the ordinary and falls in line with historical patterns. The analyst is now tracking support levels in the range of $1,900 to $1,700 as areas where Ethereum could stabilize and build momentum again.

What’s Happening with ADA and XRP?

The combination of technical breakdowns, fear-driven selling, and wider macro uncertainty has created a perfect storm for altcoins. Cardano has been showing its usual volatility. The token has dipped below a key Fibonacci support zone and is now trading close to $0.50.

Soure: CoinMarketCap

While this may seem like a bearish sign, past data shows that Cardano often falls sharply before making strong comebacks. In one recent example, Cardano dropped to similar levels before surging more than 400% within months.

Related: 5 Altcoins Show Comeback Potential After Market Dip

In contrast, XRP is displaying a stronger setup. The token is holding above its key support zone at $2 and maintaining a higher low compared to previous market swings. This kind of structure offers a more stable outlook in the short term, even as other altcoins struggle to find support.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Read the full article here