Cardano’s price tumbled below $0.43 on May 1, after closing April with 35% losses; on-chain metrics reveal the major driver behind the ADA downtrend.

Cardano price Closes April 2024 with 35% Losses

In April 2024, Cardano’s price action was significantly volatile. As crypto investors took a cautious stance in the wake of Bitcoin’s halving, demand progressively dried up for mega-cap altcoins, including ADA, SOL, and ETH.

Earlier this week, the Cardano team announced plans for a hardfork that would enhance the proliferation of P2P transactions on the network, sparking rumors of a potential rally.

Cardano ADA Price Action | TradingView

However, the chart above shows that bulls remained on the sidelines despite the community’s optimism surrounding the Ouroboros Genesis rollout. At the time of writing on May 1, ADA’s price dropped to $0.43, its lowest since April 13.

Cardano DeFi Ecosystem Users Withdraw 80M ADA in 60-days

Failure of the Ouroboros Genesis rollout to generate demand for ADA this week, signals the presence of a stronger fundamental bearish catalyst. Looking at the underlying on-chain data, Cardano’s DeFi ecosystems appear to be the key driver behind the recent negative price action.

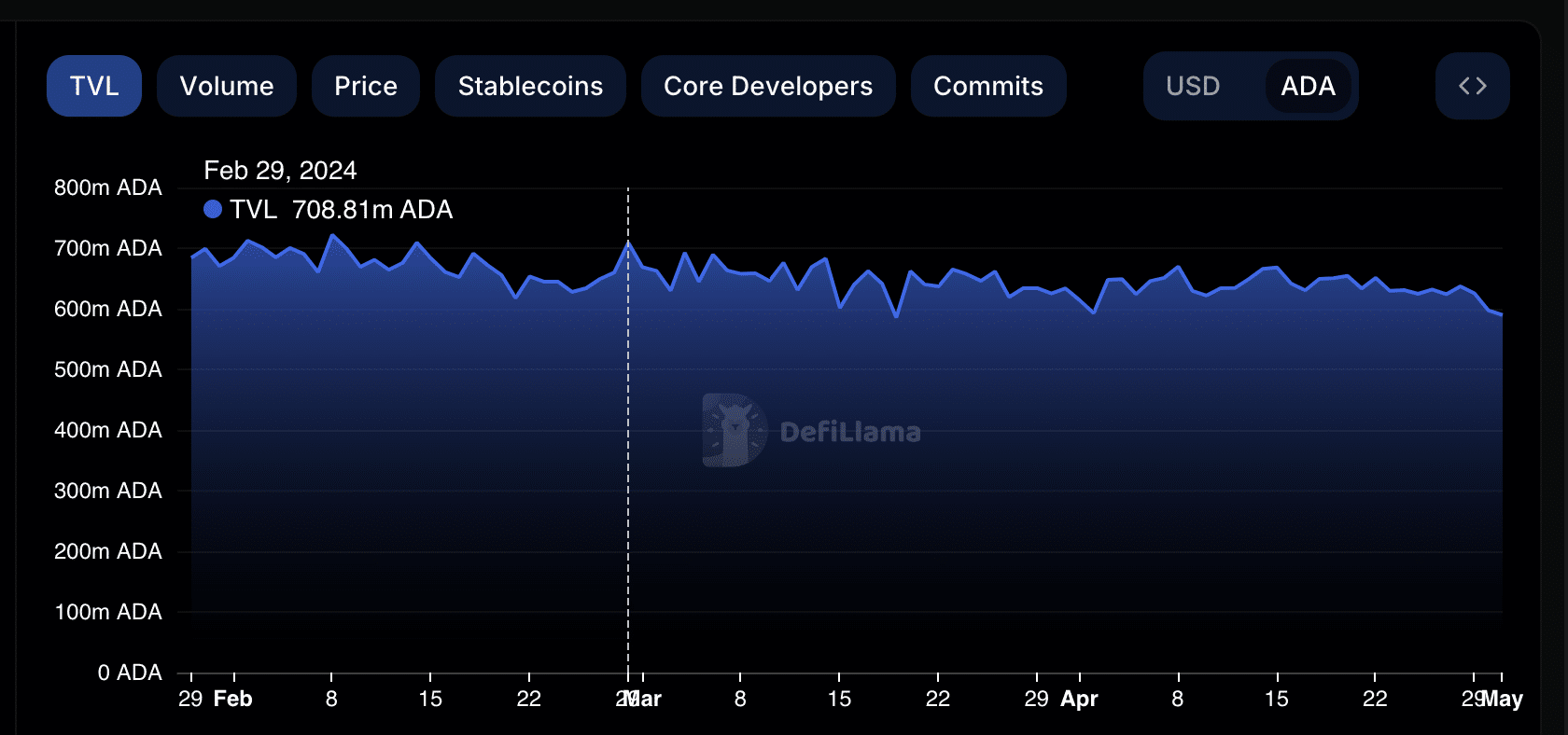

The DeFiLlama TVL chart below monitors real-time swings in the number of ADA coins locked up within Cardano-native DeFi protocols.

Cardano ADA TVL 60 day trend| DeFillama

As of March 1, 708.8 million ADA coins were locked up across the Cardano DeFi Ecosystem. But the latest data on May 1 2024, shows a TVL balance of 589.6 million ADA, reflecting a decline of 119.2 million ADA over the last 60-days.

Typically, a prolonged decline in TVL intensifies bearish pressure on the native coin price for two key reasons.

Firslty, when coins are locked in DeFi protocols, it temporarily reduces the short-term market supply. Hence drop-off in demand for ADA within decentralized finance protocols could lead to increased selling pressure on the native coin as investors seek alternative assets.

More so, the decrease in TVL suggests reduced liquidity and activity within the Cardano DeFi ecosystem, potentially signaling waning investor confidence.

Cardano Price Forecast: Bears Eyeing $0.30 Target

Valued at today’s Cardano prices, the 119.2 million ADA pulled from DeFi smart-contracts has added approximately $50 million to the short-term market supply. If it persists Cardano price could drop as low as $0.30 in the coming weeks.

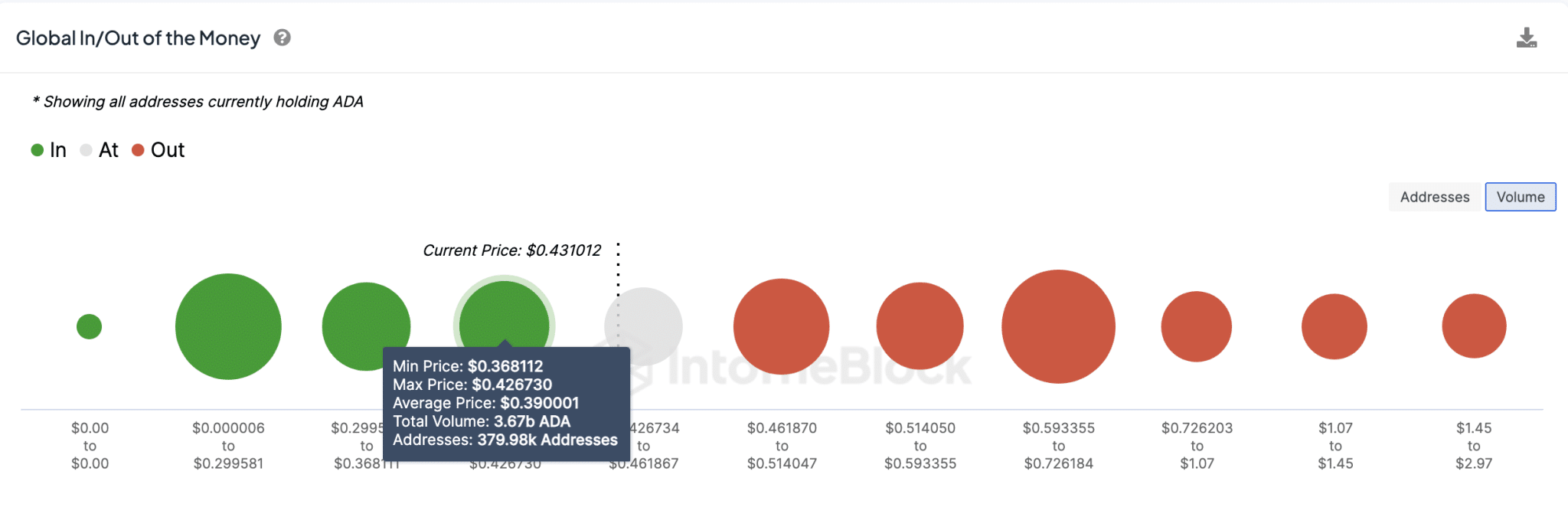

However, IntoTheBlock’s global in/out of the money metric highlights that a looming sell-wall at $0.40 could Cardano bulls a life-line in the near-term.

Cardano ADA Price Forecast | Source IntoTheBlock

As seen above, 379,980 addresses had acquired 3.67 billion ADA at an average price of $0.39. This large cluster of holders could pose formidable short-term support if they make frantic purchases to cover their positions.

However, if the bulls fail to stage a rebound from the $0.40 support, ADA could enter a free fall toward $0.30 as predicted.

On the flip side, Cardano’s price trajectory could flip positive again if the bulls manage to trigger a decisive rebound above $0.50.

Read the full article here