Ethereum’s recent price action has captured market attention, riding an 8-day bullish streak with one brief bearish interlude. After bouncing off a crucial support zone near $2,350 on November 4, the ETH token has soared by over 46% in just a few weeks, with its current price hovering around $3,270. The rally appears to have fueled positive sentiment as investors watch closely to see if Ethereum can break through the resistance levels highlighted in the technical chart below, particularly the “Bulls Target” zone above $3,900.

In a backdrop marked by high volatility, the cryptocurrency’s upward momentum was backed by increased trading volume, which reached $54.57 billion, and a robust market cap of $393.39 billion. With ETH prices testing new highs, one key question lingers: could this rally push the token back toward the coveted $4,000 level?

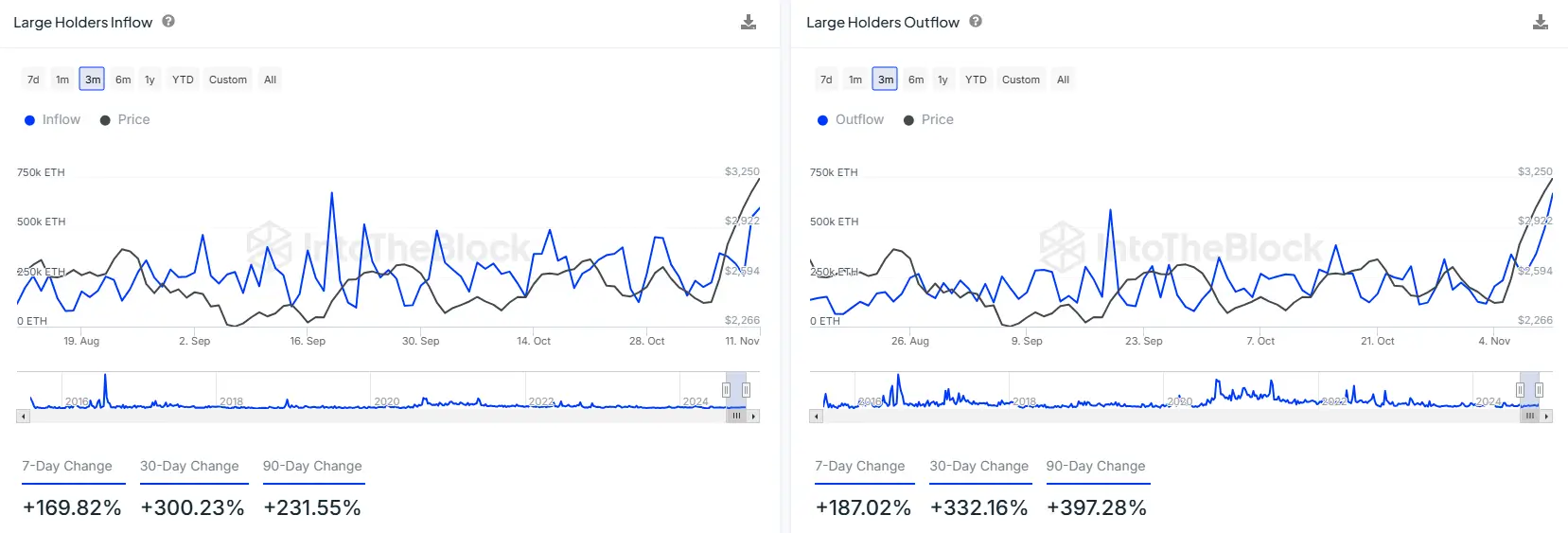

Large ETH Holders Fuel Bullish Sentiment with Increased Inflows and Outflows

Supporting Ethereum’s recent bullish momentum, IntoTheBlock data reveals a heightened 231.55% surge in ETH inflows among major holders over the past 90 days, while outflows saw an even greater increase, soaring by 397.28%. This massive movement suggests increased activity among whales, who may be positioning themselves amid Ethereum’s price rally.

Notably, the past seven days saw inflows jump by 169.82%, and outflows soar by 187.02%, illustrating a dynamic environment where large players actively shift assets. These trends display the strategic decisions among Ethereum’s biggest stakeholders as they perhaps capitalize on price increases or prepare for upcoming resistance levels.

How High Could ETH Go?

As of press time, the ETH cryptocurrency was trading at $3,270, approaching the upper Bollinger Band near $3,389, hinting at possible overbought conditions. This setup suggests a short-term pullback may occur before the ETH token resumes upward momentum.

Yet, there is still room for further gains before this condition is achieved. As a result, traders and investors closely monitor for a potential “change of character” (ChoCH) pattern if the cryptocurrency manages a close above the $3,560 resistance level.

Such a signal could reinforce bullish sentiment, opening the path toward the $3,900 target. On the flip side, if the resistance holds firm, the ETH token may shift toward bearish sentiment, with $3,130 as a key support level. A break below this point could indicate a downtrend reversal, potentially leading the cryptocurrency to retest supports at $3,000 and $2,900.

Read the full article here