Key takeaways:

-

HYPE has surged over 300% since April, driven by growing usage of the Hyperliquid exchange and rising investor interest.

-

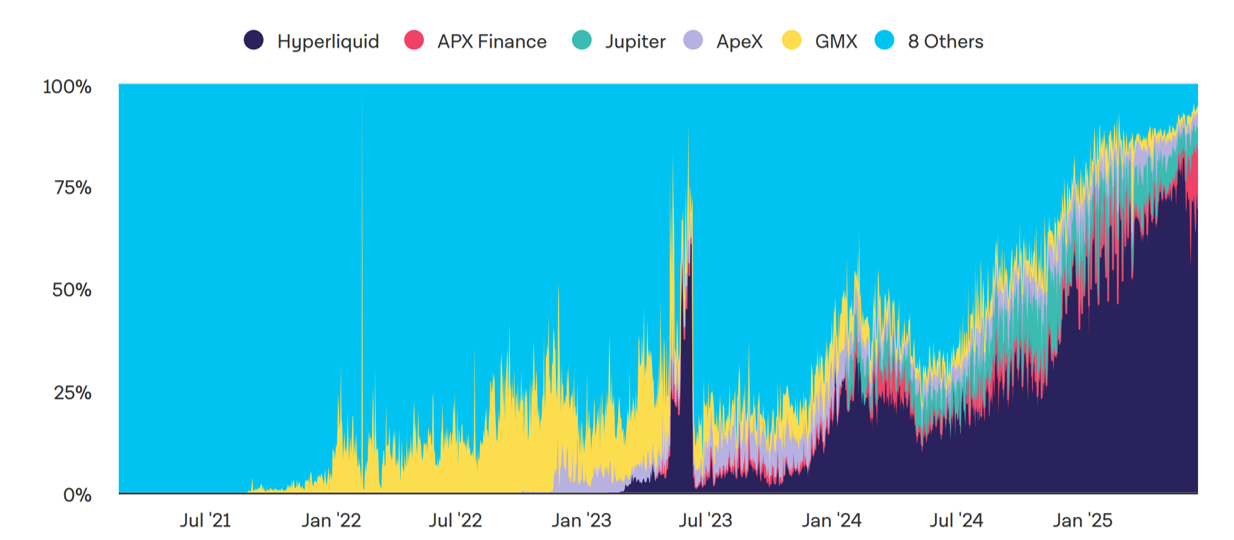

Hyperliquid now leads the decentralized perpetuals market, processing over 70% of DEX perp volume.

-

97% of protocol fee revenue is reinvested into HYPE buybacks, aligning token incentives with platform growth.

Hyperliquid is having a moment. Since its local bottom in April, HYPE (HYPE) has surged over 300% in just two months, reaching an all-time high on June 17, before easing slightly. Meanwhile, the layer-1 blockchain it powers has quietly become one of the biggest players in DeFi.

The numbers speak for themselves. Hyperliquid now ranks 8th among all blockchains by total value locked (TVL), with $1.75 billion locked, according to DefiLlama. Its flagship product—a high-performance DEX—now clears over $420 million in daily volume, placing it 6th among all decentralized exchanges.

And now, Nasdaq-listed Lion Group recently announced it will hold $600 million in reserves with HYPE as its primary treasury asset.

Momentum is building. Yet the question remains: is the token’s meteoric ascent supported by fundamentals, or is this just another hype cycle?

What makes Hyperliquid special?

Launched in 2023 by Harvard classmates Jeff Yan and Iliensinc, Hyperliquid is one of the few major crypto projects to launch without external funding.

Hyperliquid’s goal is ambitious: to offer the self-custody and transparency of a decentralized exchange, while replicating the speed and convenience typically found on centralized platforms. In practice, the DEX does deliver a smooth experience, with features such as one-click trading, direct deposits from over 30 chains, and access to spot, margin, and perpetual markets. Notably, it sidesteps the complexity of bridging assets by offering perpetual contracts tied to token prices rather than the tokens themselves—a design that favors efficiency but limits composability and crosschain interoperability. It also places considerable trust in the accuracy of price oracles and funding rate mechanisms.

This DEX is built on the Hyperliquid blockchain, a custom layer-1 using a variant of Byzantine fault tolerance (BFT) consensus called HyperBFT. The protocol relies on rapid, high-volume communication between nodes and claims to support up to 200,000 transactions per second. Yet, this throughput comes at a cost: decentralization. The network currently operates with just 21 delegated validators, a stark contrast to Ethereum’s 14,200 execution-layer nodes.

The platform reached a critical inflection point in November 2024, when daily trading volume jumped tenfold, from $2 billion to over $20 billion. It now boasts more than 500,000 users.

HYPE tokenomics

Building a great product is one thing. Monetizing it in a way that meaningfully benefits tokenholders is something else entirely.

The HYPE token launched via airdrop in November 2024, distributing 31% of the total supply of 1 billion tokens to the users. So far, the most valuable airdrop in history, its value reached $11 billion just a month after. Currently, 334 million HYPE tokens boast a market cap of $12.4 billion, implying a fully diluted valuation of around $38 billion.

HYPE serves as both the gas token and governance asset of the Hyperliquid chain. It can be staked on-platform, either directly or through validation.

Still, the question persists: Does holding HYPE offer long-term value?

Moonrock Capital CEO Simon Dedic has voiced his doubts on X:

“I love Hyperliquid. I genuinely appreciate everything they’ve built and honestly believe it’s one of the best projects in all of crypto. But seriously – who’s buying HYPE at nearly $50B [of fully diluted valuation]? How is the risk/reward ratio still even remotely reasonable here?”

The users who replied, including crypto analyst Ansem, had their ideas clear on that, arguing that valuation concerns overlook Hyperliquid’s performance and the sector’s potential.

For instance, Hyperliquid currently commands 70% of all decentralized perpetuals trading but only 10% of Binance global volumes. The upside from closing that gap is massive, especially if the regulatory climate in the US improves.

Furthermore, the HYPE supply is carefully managed. Over the past 6 months, Hyperliquid’s Assistance Fund has amassed $910 million in HYPE buybacks, reinvesting roughly 97% of platform fee revenue into HYPE. Currently, only 34% of the total supply is circulating, with most of the team’s tokens (23.8% of the total supply) vested until 2027-2028. Also, almost 39% of the total supply is earmarked for “community rewards” to be distributed gradually. And because the project has never raised from VCs, there’s no external pressure to offload tokens.

In this light, the $38 to $45 billion fully diluted valuation may be high, but not necessarily irrational, particularly for long-term holders who believe in the protocol’s trajectory. According to Ansem, current buyers likely include late-stage VCs shut out of early rounds, TradFi analysts applying P/E logic to crypto, and ETH or SOL whales rotating into what they see as the next dominant trading layer.

Related: South Korea to investigate fees of local crypto exchanges

Hyperliquid appears well-positioned to attract capital. Yet that isn’t always a strength. Time and again, investors and users have favored centralized platforms for their convenience, only to be reminded later that decentralization is more than an ideological preference—it’s a design choice for resilience. Centralization risk rarely matters—until it suddenly does.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here