A trader on Hyperliquid has quietly turned a $6,800 account into more than $1.5 million in profits—all without making directional bets or chasing volatile price moves.

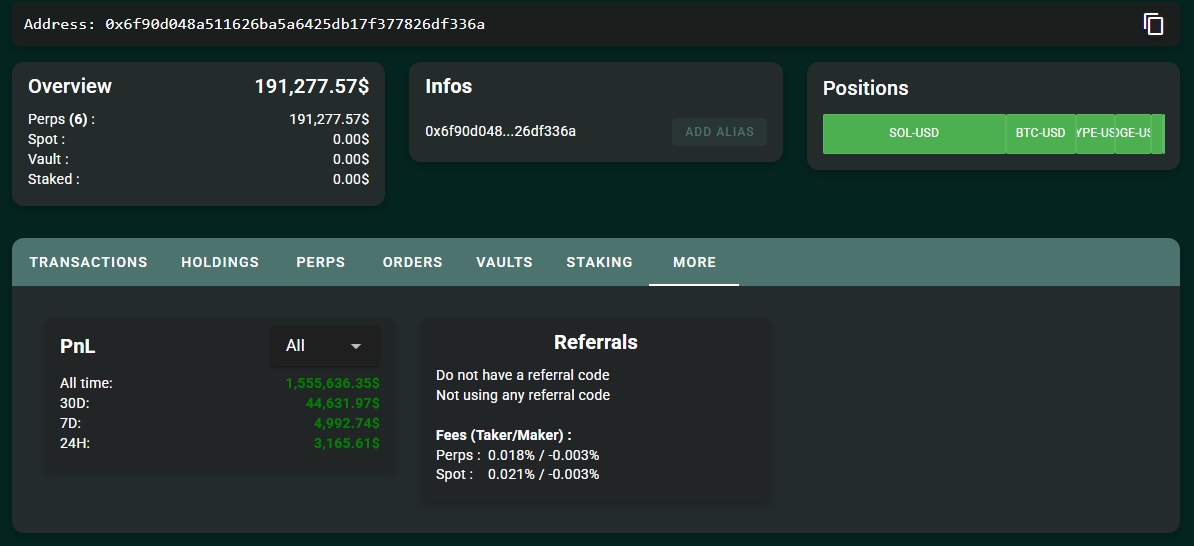

According to wallet data from address 0x6f90…336a, the trader began with just two deposits in early February 2024.

Another Hyperliquid User Makes Legendary Trades

Decentralized perpetuals exchange Hyperliquid has been making headlines in Q2 due to the viral trading of James Wynn. The Bitcoin whale became the most famous degen among the crypto community in a short time.

While the James Wynn saga ended with a $100 million loss, another new trader has quietly emerged into the spotlight.

Over the last few months, the wallet ‘0x6f90…336a’racked up more than $20.6 billion in total trading volume, with the trader withdrawing profits along the way.

The strategy hinges on placing market-making orders that earn small rebates from the exchange rather than trying to guess where prices will go.

A Quiet Giant: 3% of Hyperliquid’s Volume

On decentralized exchanges like Hyperliquid, traders who provide liquidity by placing maker orders get paid a small fee rebate for doing so. This is called a maker rebate.

In contrast, taker orders, which are filled immediately, pay a fee.

On Hyperliquid, the maker rebate is currently –0.0030%, meaning traders are paid 3 cents for every $1,000 in volume they provide. While this may seem small, it adds up rapidly with scale.

Despite managing less than $200,000 in capital, this trader reportedly accounts for more than 3% of all maker volume on the exchange.

The trader has been observed quoting only one side of the market at a time—either bids or asks—minimizing directional risk.

They also maintained a net exposure of less than $100,000 throughout. This suggests a tightly controlled strategy focused entirely on earning rebates, not making bets on price.

Small Capital, High Frequency

Over 14 days, the trader recorded $1.4 billion in volume, turning over their capital hundreds of times per day. The low maximum drawdown of 6.48% reveals just how risk-averse the system is.

What’s most surprising is the scale. Achieving over $1.5 million in realized profits with a sub-$200,000 account, mostly from rebates, is rare in decentralized finance.

The performance suggests the use of a highly automated, latency-sensitive trading system. Orders are likely managed through bots that react instantly to market changes and cancel stale quotes.

This requires infrastructure that is fast, consistent, and carefully tuned to avoid exposure during sudden price shifts.

However, it’s important to note that this strategy isn’t easy to replicate. It demands technical know-how, real-time infrastructure, and a deep understanding of exchange mechanics.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here