Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

Happy Fri-yay!

It’s been a weird week as we not only clean the skeletons out of our closets but also prepare for the last few months of the year.

But no one’s had a worse week than ETH, which is down 10% so far this week (though things are starting to look up today). So much for a bullish start to Q4.

All that aside, there are some bullish trends on the horizon. For example, Permissionless is just a few sleeps away and there’ll be plenty of folks weighing in on where we go from there with a healthy sprinkle of what’s making people bullish…or bearish.

Now I’m off to pack my bags. See y’all next week!

— Katherine Ross

The clock’s ticking

By now, most loyal Empire readers know about Binance executive Tigran Gambaryan and his ongoing imprisonment by the Nigerian government.

But, ICYMI, Gambaryan was detained in Nigeria at the beginning of this year after taking a meeting with government officials on behalf of Binance. The country and Gambaryan’s employer are — to put it lightly — not on great terms. And, unfortunately, Gambaryan became a pawn in the ongoing dispute between the two.

Fast forward to now, and Gambaryan’s suffering from health issues yet is still imprisoned at the Kuje Prison. And I wish I could report that there was, well, more to report. But unfortunately, at this point, there’s not.

Gambaryan will appear in court next Wednesday, Oct. 9 for a hearing where the judge will decide whether to release him on bail

However, I wanted to bring him up not only because of the ongoing situation, but also because the more I’ve looked into Gambaryan, the more I’ve realized just how extensive his crypto ties are.

When I first started reporting on the situation back in February, I referred to Tigran as an ex-IRS official. But, dear reader, did you know he became a specialist (according to a 2015 affidavit, which we’ll get to) in digital currency back when he was with the IRS?

Wired’s Andy Greenberg — who wrote the book Tracers in the Dark: The Global Hunt for the Crime Lords of Cryptocurrency with Gambaryan as the protagonist — called the former IRS agent “kind of a legendary figure in the crypto crime investigation world.”

Gambaryan served as a special agent involved in taking down former Drug Enforcement Administration agent Mark Force and former Secret Service agent Shaun Bridges, who were both involved in the Silk Road.

He wrote that the two “abused their positions” as federal agents in a 2015 affidavit. When detailing his experience, he said that he “developed a specialty in cyber and digital currency crimes.”

Following his government career, Gambaryan went on to join Binance just over three years ago, in 2021.

“Tigran led several multi-billion dollar cyber investigations, including the Silk Road corruption investigations, BTC-e bitcoin exchange, and the Mt. Gox hack,” Binance said in its press release announcing the hire.

Earlier this week, Tigran’s wife, Yuki Gambaryan, did an interview with Illicit Edge’s new podcast “Designated” about his imprisonment.

“Tigran is innocent, he didn’t do anything wrong,” she told host Yaya Jata Fanusie. She also pushed for more “decisive actions” from the US government.

“I am having this constant fear of losing Tigran,” Yuki went on to say.

— Katherine Ross

IYKYK

Could BitGo’s stablecoin offering dump the entire stablecoin market on its head?

Empire’s Jason Yanowitz seems to think so. In today’s Empire episode, he mused that the launch of USDS could spur more companies to launch their own stablecoins.

“We’re going to see the custodians launch stablecoins. We’re going to see the exchanges launch stablecoins. We’re going to see FinTechs like Robinhood launch stablecoins…Visa is helping BBVA launch a stablecoin. We’re going to see the banks launch stablecoins. Everybody and their mother is going to launch a stablecoin,” Yanowitz said.

We have to note, though, that Robinhood’s Johann Kerbrat told us earlier this week that they’re not currently looking into a stablecoin.

Yanowitz also thinks that the stablecoin issuers’ “hands are going to be forced and they’re going to need to figure out how to give yield back to the users. And the way that they’re going to do that is not by giving yield directly to the users, but by giving it to the people, probably the exchanges who are sitting on the yield.”

Perhaps this could be enough to dethrone Tether. Perhaps not.

And now you know.

It’s officially Q4 (where did the time go?) which might just be the perfect time to take a look back at last quarter and see if we can parse the tea leaves here.

Admittedly, unrest in the Middle East makes those leaves a bit murkier than we perhaps would have hoped. But, without counting unknown events or catalysts, the general expectation for Q4 is a positive one.

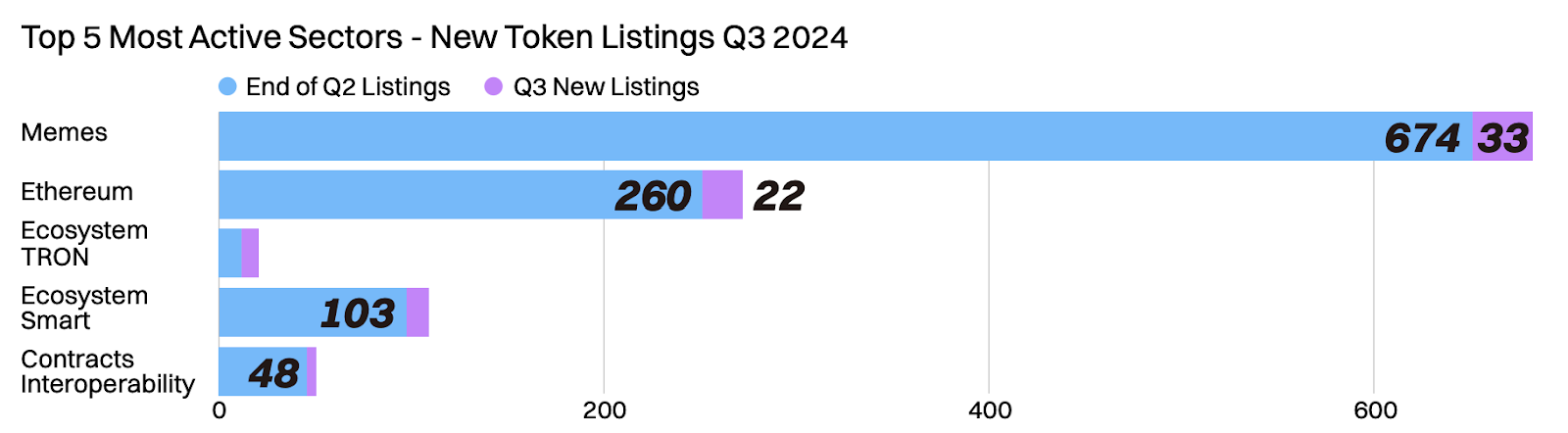

I know we’ve been light on the charts this week, so I’ve dug up a few to end the week, starting with this one courtesy of a CoinMarketCap report that recapped last quarter.

Source: CoinMarketCap

We already covered why this might not be an Uptober earlier this week, but perhaps there’s still a chance for either/both November and December to take on a more positive tone.

A rising tide floats all boats, right? Well, some sectors of crypto might not even need bitcoin to go on a green spree to notch gains.

Source: CoinMarketCap

To no one’s surprise, memes were on fire last quarter. But, perhaps slightly surprising, the data from CMC shows a “shift from DeFi and infrastructure projects towards more speculative and consumer-focused sectors like AI, media, and memes in the past quarter.”

Source: CoinMarketCap

Analysts at CMC are in general consensus with other folks I’ve talked to: Q4 could be more positive because it gets a lot of unknowns out of the way, such as the US presidential election.

“Historically, Q4 has often been a strong period for Bitcoin, and on average BTC has yielded 90.33% price increase in Q4 for the past 10 years. Especially, this year we’re entering Q4 from a relatively low price level. With these factors in mind, there’s a significant chance that we could see a price pump during the remainder of the year, potentially even pushing Bitcoin towards another all-time high,” analysts wrote.

But more unknowns will probably lead to drawdowns. If only we had a crystal ball to steer the course.

— Katherine Ross

Read the full article here