Bitcoin continues to trade below its recent all-time high as selling pressure and macroeconomic developments keep the asset in consolidation.

At the time of writing, BTC is priced at $104,835, down 2.1% over the past week and around 6.3% off from its peak of $111,814 recorded last month. Despite the broader trend, on-chain data reveals emerging patterns that may signal what could come next in the market.

Following the Federal Reserve’s decision to keep interest rates unchanged in its latest policy meeting, analysts have noted diverging trends in Bitcoin’s price and derivatives market activity.

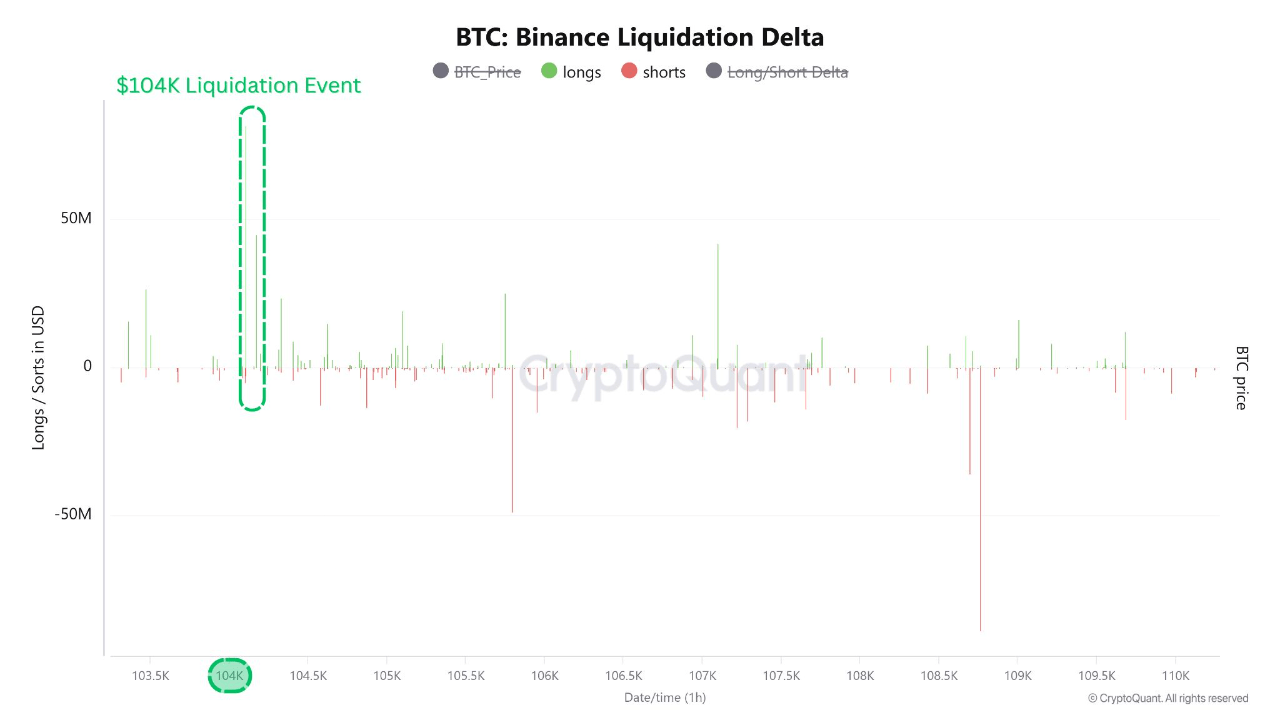

Derivatives Deleveraging and Liquidation Clusters Shape Price Structure

According to Amr Taha, a contributor on CryptoQuant’s QuickTake platform, BTC has been hovering above the $104,000 support zone, where strong demand appears to be absorbing sell pressure.

However, Taha pointed out that open interest on Binance has declined, forming lower lows, a sign that the derivatives market is undergoing progressive deleveraging.

Taha’s analysis emphasized a technical divergence: while price has remained relatively stable around the $104,000 level, open interest has been falling. This divergence suggests that traders are reducing leveraged positions, possibly due to market uncertainty or as a response to the Fed’s cautious stance.

Notably, the $104K region has emerged as a critical liquidity pocket, with data showing long positions being liquidated massively in this area. The dominance of long-side liquidations, with few short liquidations, reflects a flush-out of recent entrants attempting to ride the previous rally.

The analyst argued that this deleveraging phase could pave the way for a price rebound if macro conditions remain favorable. Historically, Bitcoin has responded positively to rate pauses, often resuming upward movement when signs of seller exhaustion appear.

The stabilization of open interest, combined with reduced liquidations, might act as a foundation for a new upward push in the near term.

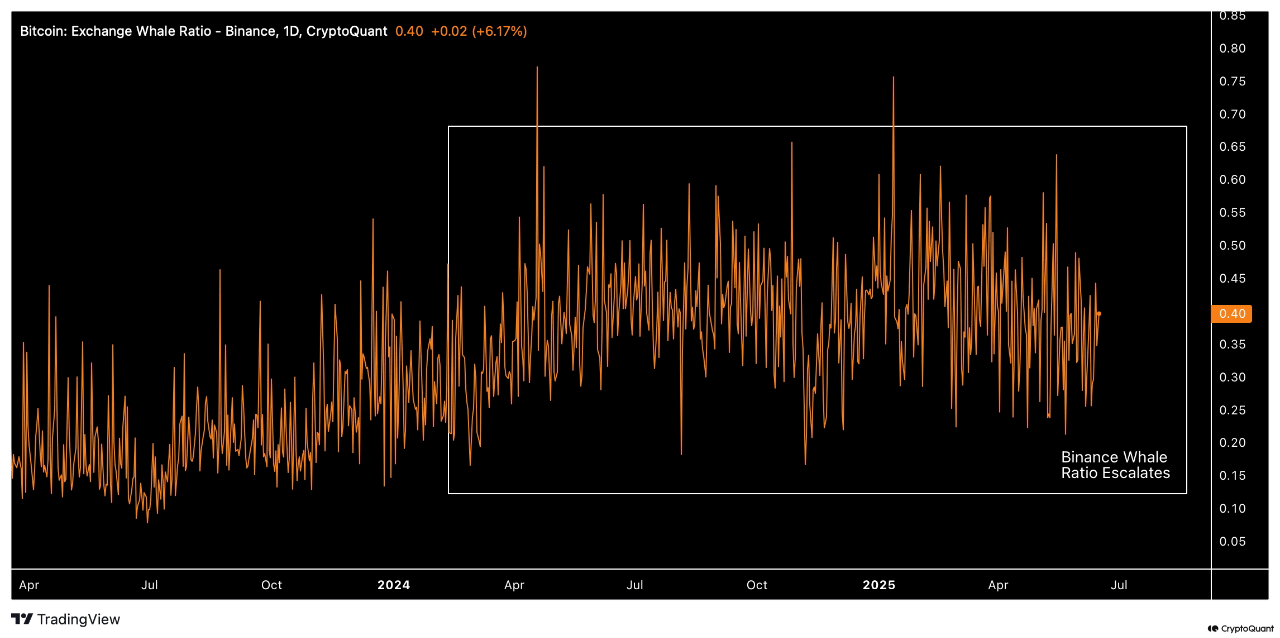

Bitcoin Whale Activity on Binance and Shifts in Market Behavior

In a separate analysis, another CryptoQuant analyst, Oinonen, highlighted growing whale activity on Binance. Since 2023, the whale ratio metric on the exchange has surged dramatically, climbing from 0.08 in mid-2023 to as high as 0.77 in 2025.

This shift marks a 400% increase and indicates significant accumulation behavior among large holders. Whale inflows and retention on Binance have generally coincided with longer-term confidence during periods of market volatility.

Moreover, the data shows that during recent episodes of elevated volatility, Binance users have leaned toward holding rather than exiting positions. Inflows to the platform have remained low, particularly from both whales and retail participants, suggesting that market participants are refraining from panic selling and instead are anticipating future price appreciation.

Featured image created with DALLE, Chart from TradingView

Read the full article here