Many consider dYdX as one of the most successful Perp DEXs, and surely it is. However, it’s being challenged more and more frequently than before.

DeFi world is seeing technological iterations every day, and no project can rest on its first-mover advantages. Innovative latecomer derivatives trading platforms such as GMX, MYX, Hyperliquid and others, are making every effort to draw closer to dYdX.

The dYdX redemption

dYdX is a charming and reliable project. Founded in 2017, it utilizes the traditional central-limit order book and matching engine to facilitate trades on a decentralized smart contract protocol. As the “elder brother” in Perp DEXs, dYdX is constantly upgrading itself and now has been updated to V4. Nevertheless, compared with new-born derivatives trading platforms, dYdX is lagging behind, especially when it comes to trading facilitation mechanisms.

Unlike other top Perp DEXs, dYdX utilized a central-limit order book instead of the AMM model. This model brought many advantages to early dYdX users: trading on dYdX is very similar to trading in centralized exchanges, and users can learn how to trade very fast; the order book design can provide deeper liquidity and support for advanced order types.

However, the order book model is not without its warts. It brings challenges, such as need for a large amount of liquidity, the low efficiency of capital utilization, vulnerable to sandwich attacks and other typical on-chain attacks, the high cost of data storage and on-chain computation which restricts the number of tradable tokens. Even with continuous upgrading, dYdX has been mired on how to achieve the “self-redemption of order book design”.

The 3r-generation DDEX revolution led by MYX

The 3rd-generation DDEX revolution is led by MYX, a derivative protocol found in 2023. Compared to dYdX, MYX is totally a “freshman”. Though its valuation is relatively low at the moment, MYX has become the fastest growing Perp DEX with its MPM (Matching Pool Mechanism) , hitting the $1B Daily Vol within only 39 days. In comparison, dYdX achieved this number within 208 days.

MYX realizes MPM by introducing the concept of liquidity pool, where Liquidity Providers (LPs) can provide funds, passively assume positions and act as counterparties to facilitate immediate trading. This mechanism ensures good liquidity in the market and allows users to open or close positions at any time. LPs cover potential losses by reserving collateral and have the opportunity to earn trading fees and profit on their positions. At the same time, MYX innovatively introduces funding fees and “Maker rebate” into MPM as a way to balance the interests of both long and short sides and solve the problem of long-term position imbalance.

In a balanced market, MYX’s MPM mechanism can demonstrate higher capital efficiency than traditional P2Pools. Since the MPM only bears the net exposure of long and short positions, LPs bear less risk. In a market where long and short positions grow alternately, MPM can support an open interest that is dozens of times its own position size with limited capital, which not only boosts LPs’ returns and eliminates their over-reliance on “betting returns”, but also allows the platform to reduce trading fees to as low as 1bps.

To cope with market imbalance situation, MYX launched a dual-token design, which enables LPs to clearly manage their own exposure, flexibly choose to hedge their passive positions in other markets, or bear the profit and loss caused by position fluctuations. At the same time, MYX also employs an oracle machine to facilitate order matching. Relying on the off-chain computing capability provided by oracle machines, MYX users can experience comparable or even better trading experience than CEXs.

As crypto market often sees extreme fluctuations, MYX also introduced the Auto-Deleveraging System (ADL) to cope with this scenario. When the trading volume dramatically enlarges and the size of open positions far exceeds that of the liquidity pool, the system will reject new orders. ADL forces liquidation of the most profitable opposite position to alleviate the extent of the market imbalance.

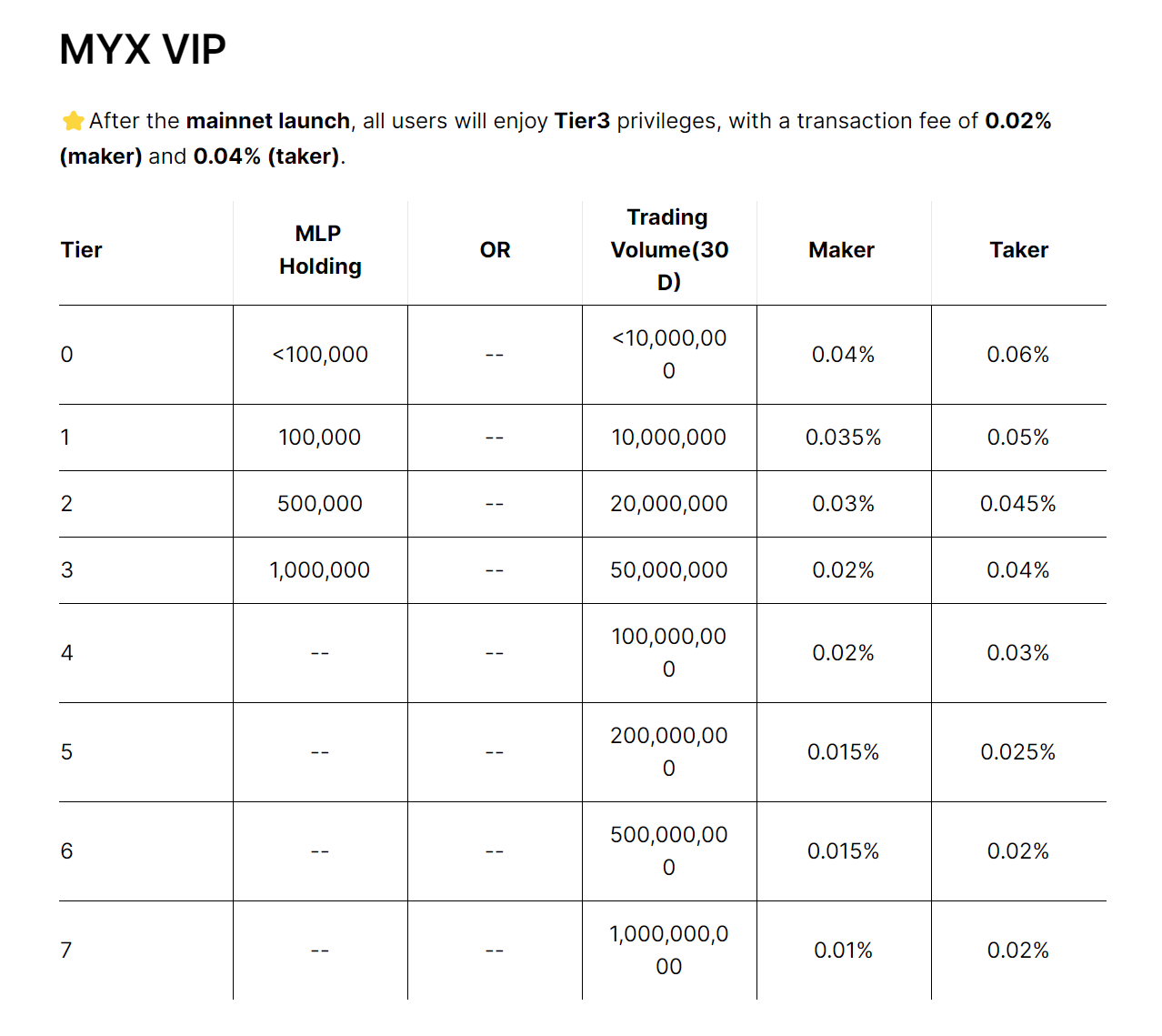

While providing a high-level trading experience with a very low trading cost(0.02% for maker and 0.04% for taker, MYX also pays great attention to the interests of the community users and supporters. In March this year, MYX launched “Project Origin”, which is still underway, airdropping 200,000,000 tokens (20% of its total token supply) to community members and supporters. It’s estimated that the third phase of “Project Origin” will be live very soon.

With the stable, smooth and efficient trading experience, MYX has attracted over 33,000 users with a daily trading volume of more than $200 million shortly after its launch on Arbitrum in February this year. Such a growth rate of user numbers and trading volume is stunning even in the current crypto market. MYX will be reportedly launched on Scroll in the near future. We have no doubt MYX will not only bring a brand-new trading experience to all Scroll ecosystem users, but also continue its rapid growth momentum.

The blue-eyed boy of international capitals and top VCs

MYX’s innovative product and fast user growth rate attracted the attention of top international capitals from the very beginning of its existence. In November 2023, MYX completed a $5 million seed round of financing with a valuation of $50 million, led by HongShan (Sequoia China), Consensys, Hack VC, and other top-tier VCs. Backed by top VCs, MYX reached various forms of strategic cooperation with crypto players such as OKX, Izumi, zkPASS, Pyth, etc. to empower its ecosystem.

With the stable and smooth trading experience supported by MPM, MYX is undoubtedly becoming a member of the “Top Perp DEXs Club”. It is just like a compressed spring. If you invest more and bet more on it, it will gain more kinetic energy, silently store up its strength, and at the moment of release, it will leap upward and multiply the investment you made in it, soaring into the sky.

Read the full article here