The price of Dogecoin (DOGE) has seen a significant 21% decrease over the last few days, dropping to $0.18.

This decline, while seemingly bearish, sets the stage for a potentially bullish phase, indicating an opportune moment for accumulation.

Time to Accumulate Dogecoin

Despite the recent drop in its market value, Dogecoin is now positioned favorably for accumulation. The Market Value to Realized Value (MVRV) ratio, which assesses investors’ profit or loss status, suggests that DOGE is ripe for buying.

Currently, Dogecoin’s 7-day MVRV ratio stands at -7.55%, indicating that many holders are at a loss—a condition that historically precedes a recovery phase. Typically, a recovery for DOGE is observed when the MVRV ratio falls within the -5% to -15% range, marking it as an opportunity zone for investors.

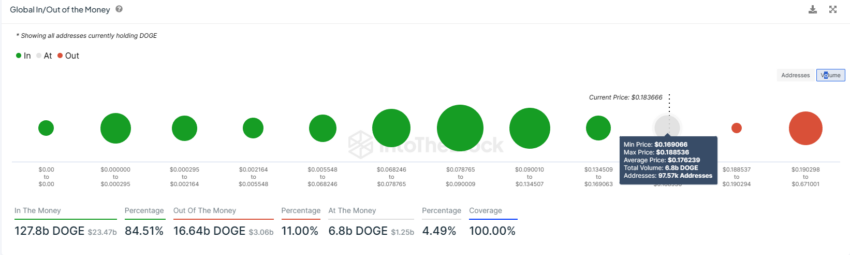

Furthermore, nearly 6.8 billion DOGE, worth over $1.2 billion, is on the brink of profitability, having been purchased in the price range of $0.169 to $0.188.

With the price of DOGE currently nearing the higher end of this range, investors have growing optimism. This could discourage selling and encourage holding, potentially sustaining the uptrend.

DOGE Price Prediction: Bullish

Dogecoin’s current trading price of $0.182 is tantalizingly close to surpassing the crucial $0.182 support level. Successfully turning this level into a support point could catalyze a DOGE rally toward $0.200.

Should DOGE manage to establish $0.200 as a new support level, it could then aim for $0.220, setting a new high for the year.

Read more: Dogecoin (DOGE) Price Prediction 2024/2025/2030

However, it is important to note that the $0.20 and $0.18 levels have been significant resistance points in the past. Failure to overcome these levels could counter the bullish outlook for Dogecoin.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here