Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee for an update on what is happening in the market today, particularly regarding Bitcoin (BTC). Amid ongoing geopolitical tension, the pioneer crypto continues to endure uncertainty, with recent developments expected to drive volatility.

Crypto News of the Day: Iran Strikes Israel’s $475 Billion Stock Market, But TA-125 Rallies

The previous US Crypto News publication highlighted the S&P 500’s resilience despite escalating geopolitical tension.

In the latest development, Iran has hit Israel’s economic infrastructure, attacking the Stock Exchange building in Tel Aviv, in a retaliatory move against Israel’s $475 billion capital market.

“The Israeli Stock Exchange building in Ramat Gan, east of Tel Aviv, was hit during Iran’s latest missile attack,” reports indicated.

Yesterday, Israeli-linked cyberattacks affected Iran’s banking system and destroyed tens of millions in digital assets.

BeInCrypto reported how the financial market is the new battleground in the Israel-Iran war, with blockchain as one of the fronts.

“And the market’s reaction? It wasn’t organic. It was engineered calm. Liquidity backstopped. AI algos throttled. Panic suppressed. Why? Because this isn’t just war. It’s controlled demolition. A financial power shift wrapped in the theatrics of missiles and speeches. Watch the money, not the headlines. The markets know what’s coming,” one user remarked.

However, in a surprising twist, markets rallied, with the TA‑125 hitting a 52-week high the same day. In the immediate aftermath, the TA-125 surged by over 0.53%, which is not a mean feat in terms of political uncertainty.

TA-125 is a stock market index in Israel tracking the performance of the 35 largest and most actively traded companies listed on the exchange.

Meanwhile, Ray Yossef, CEO of NoOnes and ex-CEO of Paxful, tells BeInCrypto that Bitcoin is still stuck in a narrow range near $105,000 despite geopolitical tension. The crypto executive says daily volatility remains under 2.1%, and there is no panic selling.

“Bitcoin no longer appears to function as a hedge asset; instead, it behaves more like a high-beta tech stock, caught in the macro winds but not really steering its own ship. The link between BTC and the Nasdaq 100 is still strong at 0.68,” Yossef added in a statement shared with BeInCrypto.

Bitcoin’s Current Strength Is Not Just Technical but Structural, Analysts Say

Bitcoin has held above the critical $100,000 level for over 40 days. The pioneer crypto shows impressive resilience amid rising geopolitical tensions and cautious central bank signals.

Against this backdrop, analysts say macroeconomic and institutional forces are now converging to support Bitcoin’s position as a long-term treasury asset.

This aligns with assertions from Robert Kiyosaki, who advocated for Bitcoin among other assets, as indicated in a recent US Crypto News publication.

“Despite the ongoing conflict between Israel and Iran, Bitcoin has remained incredibly resilient over the past week. BTC’s recent strength isn’t only a testament to its resilience or its growing appeal as a safe-haven asset, but also its growing importance as an alternative to the devaluing US dollar,” Elliot Johnson, CEO of the Bitcoin Treasury Corporation (BTCT), told BeInCrypto.

Johnson also pointed to the impact of institutional demand, noting that with both corporations and governments pouring billions into Bitcoin treasuries, led by Michael Saylor himself with his most recent $1.05 billion purchase, it is no wonder BTC remains firmly above $100,000.

Nic Puckrin, founder of The Coin Bureau, echoed that sentiment, saying that the $100,000 level is being cemented in investors’ minds as the base price and not just support.

“Any retail investor panic selling now is becoming exit liquidity for the institutional buyers,” Puckrin noted.

On the macro side, markets were reassured by the Fed’s latest dot plot projecting two rate cuts in 2025. According to Puckrin, liquidity is coming, and when it floods in, Bitcoin will be the biggest beneficiary.

Bitcoin was trading for $104,708 as of this writing, up by a modest 0.5% in the last 24 hours.

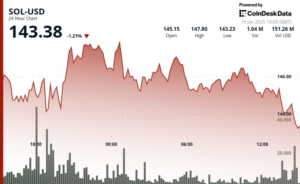

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

Crypto Equities Pre-Market Overview

| Company | At the Close of June 18 | Pre-Market Overview |

| Strategy (MSTR) | $369.03 | $370.50 ($0.40%) |

| Coinbase Global (COIN) | $295.29 | $293.45 (-0.62%) |

| Galaxy Digital Holdings (GLXY) | $26.12 | $27.05 (+3.57%) |

| MARA Holdings (MARA) | $14.49 | $14.61 (+0.83%) |

| Riot Platforms (RIOT) | $9.94 | $9.96 (+0.20%) |

| Core Scientific (CORZ) | $11.90 | $11.97 (+0.59%) |

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here