Jupiter’s native token JUP has emerged as the market’s top gainer, climbing 6% in the past 24 hours, despite a broader market downturn during that period. The surge follows an announcement that the Solana-based decentralized exchange will burn some of its JUP tokens and allocate half of its fees to buy back tokens from the market.

With a strengthening bullish bias, JUP is poised to maintain its uptrend in the short term.

Jupiter to Burn $3.6 Billion Worth of JUP Tokens, Launches Buyback Program

Jupiter wrapped up its first-ever ‘Catstanbul 2025’ event with a keynote address delivered by its pseudonymous founder ‘Meow,’ who outlined two major plans to enhance JUP’s value and utility.

One plan is to burn 3 billion JUP tokens, currently valued at approximately $3.6 billion. According to Meow, this will “reduce emissions, increase certainty, and lower the fully diluted valuation (FDV).”

Meow also announced a buyback program, stating that 50% of Jupiter’s protocol fee revenue will be allocated to repurchasing JUP tokens. These tokens will be held in a “long-term litterbox,” signaling a commitment to stabilizing the token’s value over time. The remaining 50% of fee revenue will be directed toward growth initiatives and ensuring the platform’s operational stability.

JUP Token Reacts

These announcements have positively impacted JUP, whose value immediately soared to a 30-day high of $1.28 on Sunday.

As of this writing, buying activity is still underway, evidenced by the token’s rising open interest. At press time, this stands at a multi-month of $364 million, climbing 25% over the past 24 hours.

Open interest measures the total number of outstanding derivative contracts, such as futures or options, that have not been settled. When it climbs during a price rally, it indicates growing market participation and increased bullish sentiment. This suggests that new money is flowing into the JUP market, reinforcing the upward price movement.

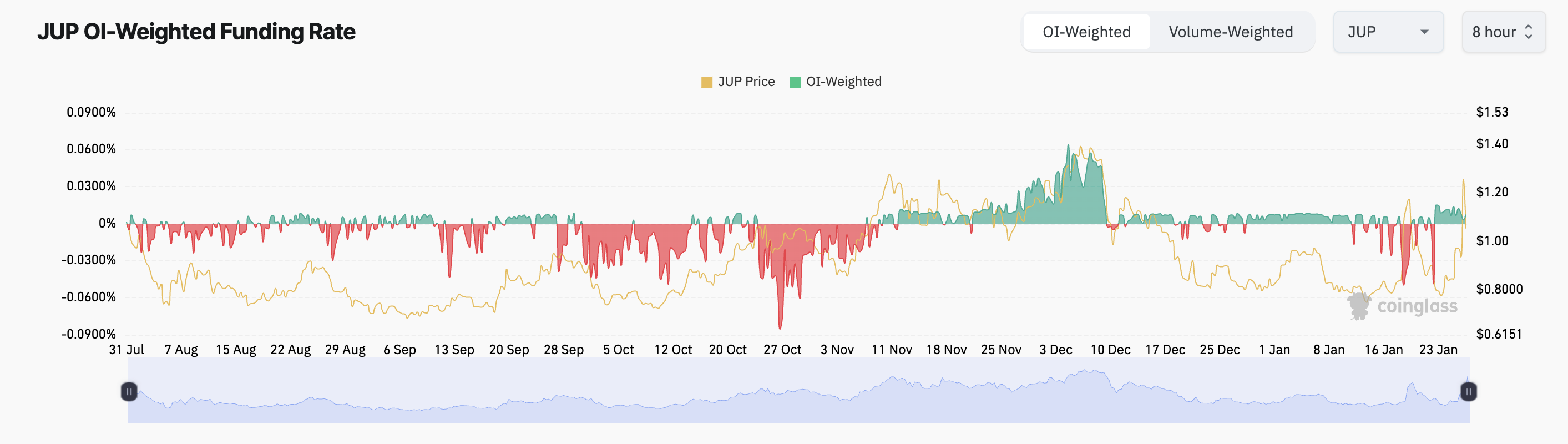

Further, JUP’s positive funding rate confirms this bullish outlook. At press time, this is 0.0074%, reflecting the growing demand for long positions.

The funding rate is a periodic payment designed to keep the contract price close to the underlying asset’s spot price. As with JUP, a positive funding rate means long-position holders are paying short-position holders, indicating strong bullish sentiment and higher demand for long positions in the market.

JUP Price Prediction: Key Levels to Watch

At press time, JUP trades at $0.95. If buying pressure is maintained, the token’s price could extend its current gains toward $1.08. If the bullish bias strengthens, JUP could exchange hands at $1.22.

On the other hand, a shift in the market trend toward profit-taking would invalidate this bullish projection. In that scenario, JUP’s price could plunge below the support formed at $0.95 and fall to $0.81.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here