Main Takeaways

-

This blog previews the recent Binance Research report discussing key developments in crypto markets over the past month.

-

April was a tough month for crypto, with total market capitalization decreasing 11.3% as the momentum from previous months slowed.

-

DeFi and NFT markets also declined, registering a 0.7% decrease in TVL and a 21% fall in monthly trading volume, respectively.

Thanks to Binance Research, you can take advantage of industry-grade analyses of the processes shaping Web3. By sharing these insights, we hope to empower our community with the latest knowledge from the field of crypto research.

Today’s blog explores key Web3 developments in April 2024 to provide an overview of the ecosystem’s current state. We analyze the performance of crypto, DeFi, and NFT markets before previewing major events to look out for in May 2024.

Crypto Market Performance in April 2024

April was a difficult month for crypto, with total market capitalization decreasing 11.3% as the momentum accumulated over the previous months shifted downward. Some of the main contributors to this reversal included changes in rate-cut expectations, geopolitical risks, and a slowdown in spot bitcoin ETF flows.

Nevertheless, there were positive developments throughout the month as well. Six different spot crypto-based ETFs began trading in Hong Kong on April 30 after approval from regulators. Additionally, the total supply of USD-pegged stablecoins reached its highest point in two years. Stablecoin supplies of USDT and USDC have been steadily increasing, indicating sustained capital flows into the crypto market.

Monthly change in crypto market capitalization (%)

Source: CoinMarketCap (April 30, 2024)

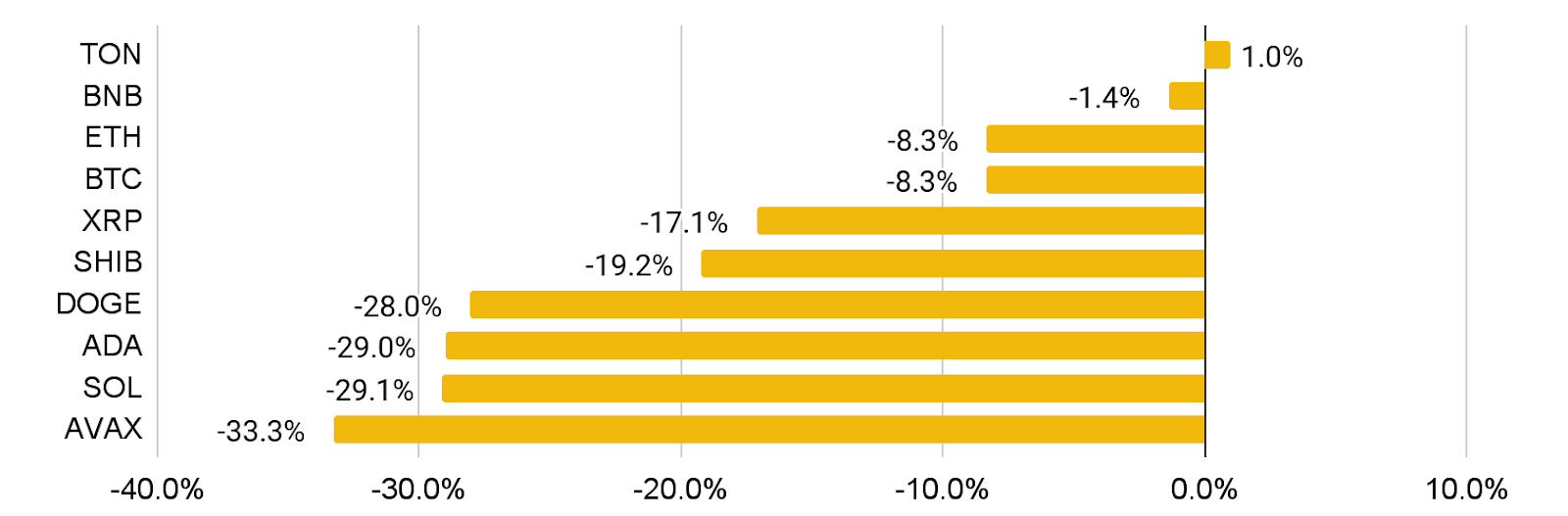

Monthly price performance of the top 10 coins by market capitalization

Source: CoinMarketCap (April 30, 2024)

Most of the top ten coins by market capitalization closed off the month in negative territory. TON and BNB managed to show relative resistance with a gain of 1.0% and a slight decrease of 1.4%, respectively. TON’s top performance can be attributed to the traction its ecosystem has been gaining recently, hitting all-time highs in April in terms of monthly active addresses and the total value locked (TVL) in the network. BNB has continued to be one of the top performers over the past few months.

ETH and BTC both saw declines of around 8% in April. Nevertheless, the approval of three spot BTC ETFs and three spot ETH ETFs in Hong Kong marked a positive milestone for the two leading cryptocurrencies. XRP and SHIB experienced larger price declines, decreasing 17.1% and 19.2% over the month, respectively. DOGE, ADA, SOL, and AVAX demonstrated the weakest performances among the leading pack, falling around 30% by the end of the month.

Decentralized finance (DeFi)

Aligned with broader market trends, April was a quiet month for the DeFi sector, which saw a 0.7% decrease in TVL. Among the top ten chains, Merlin Chain, a native Bitcoin layer-2 solution, grew the most with a monthly gain of 1000% and a TVL raching over $1 billion. Regarding protocols, notable performers included Pendle and Hyperliquid. Pendle’s TVL reached $5 billion, and its cumulative trading volume exceeded $15 billion. Hyperliquid’s TVL breached $435 million, surpassing Aptos, Near, and Cardano.

TVL share of top blockchains

Source: DeFiLlama (April 30, 2024)

Non-fungible tokens (NFTs)

Monthly NFT trading volume

The NFT market also declined in April, registering a 21% monthly decrease in total sales volume to $1.11 billion. Bitcoin collections continued to steal the spotlight, with four of the top five collections by sales volume for the month being Bitcoin-based. These collections, namely Ordinals, PUPS, WZRD, and NodeMonkes, collectively recorded a sales volume of $423 million. Sentiment toward Ethereum collections remained relatively poor.

In terms of NFT sales volumes across the top chains, Bitcoin led with $567 million, followed by Ethereum with $241 million and Solana with $153 million. On a percentage basis, Bitcoin saw a 5% decrease in total volume, while Ethereum and Solana saw significant declines close to or more than 50%. These numbers suggest that collectors have recently shifted their focus toward Bitcoin-based offerings.

Upcoming Events

To help users stay updated on the latest Web3 news, the Binance Research team has summarized notable events and token unlocks for the month to come. Keep an eye on these upcoming developments in the blockchain space.

Notable events in April 2024

Source: Binance Research

Largest token unlocks in US$ terms

Source: Token Unlocks, Binance Research

Binance Research

The Binance Research team is committed to delivering objective, independent, and comprehensive analyses of the crypto space. We publish insightful takes on Web3 topics, including but not limited to the crypto ecosystem, blockchain applications, and the latest market developments.

This article is only a snapshot of the full report, which contains further analyses of the most important market charts from the past month. It also dives deeper into recent developments surrounding the Runes protocol, liquid restaking, stablecoin supply, and the TON ecosystem.

Read the full version of this Binance Research report here

Further Reading

-

Binance Research: Key Trends in Crypto – April 2024

-

Binance Research: Top Crypto Trends to Follow in 2024

-

Binance Research: Key Trends in Crypto – March 2024

Disclaimer: This material is prepared by Binance Research and is not intended to be relied upon as a forecast or investment advice and is not a recommendation, offer, or solicitation to buy or sell any securities or cryptocurrencies or to adopt any investment strategy. The use of terminology and the views expressed are intended to promote understanding and the responsible development of the sector and should not be interpreted as definitive legal views or those of Binance. The opinions expressed are as of the date shown above and are the opinions of the writer; they may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Binance Research to be reliable, are not necessarily all-inclusive, and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given, and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Binance. This material may contain ‘forward-looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. This material is intended for information purposes only and does not constitute investment advice or an offer or solicitation to purchase or sell in any securities, cryptocurrencies, or any investment strategy, nor shall any securities or cryptocurrency be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase, or sale would be unlawful under the laws of such jurisdiction. Investment involves risks.

Read the full article here