Cryptocurrency is booming in South Korea, but beneath the surface, the surge is driven less by optimism than by the economic desperation of its younger generation, according to a local expert.

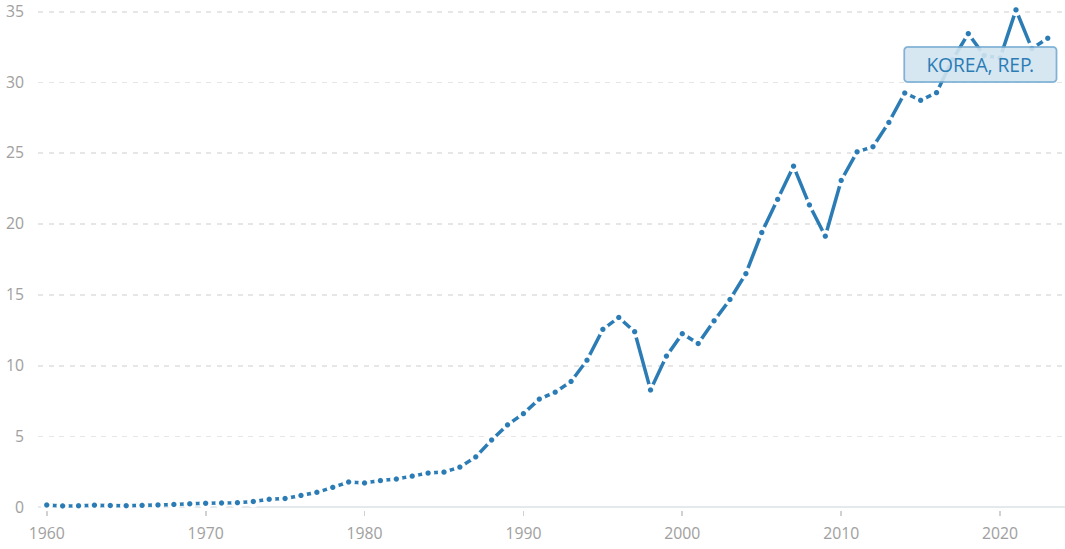

Crypto exchange users in South Korea have surpassed 16 million, according to data from late March, after receiving a boost from US President Donald Trump’s election win last November. The figure represents over 30% of the country’s population.

Still, recent comments at German Blockchain Week from Eli Ilha Yune, chief product officer at quantum machine learning startup Anzaetek, suggest that this is not a consequence of the local population’s enthusiasm for blockchain technology. He explained during an “Asia Insights” panel that there are a lot of “crypto traders in Korea.”

Yune noted that the “motive comes not from […] a belief in Web3 […] like in the West.” Instead, he attributes it to the financial desperation of the young generation, which pushes them to seek “quick money.”

Yune’s remarks come as newly elected President Lee Jae-myung moves to fast-track campaign pledges for integrating digital assets into South Korea’s financial system, with bold plans for institutional crypto integration.

That includes support for issuing domestic stablecoins, with the head of South Korea’s central bank reportedly stating that he is not opposed to the country issuing a Korean won-based stablecoin.

Related: South Korea to investigate fees of local crypto exchanges

The dire situation of South Korea’s youth

Crypto’s popularity among the younger generations is not new, and the 2025 Korea Wealth Report shows that the “young rich” hold three times more crypto than the over-45 wealthy. Also, 34% of local high-net-worth individuals already own crypto, according to local reports.

Still, according to Yune, this is not motivated by a widespread belief in crypto’s potential among South Korea’s youth. He said South Korea is used to having a high-growth economy that found itself unable to keep the pace, leaving the younger generations jobless.

Youth unemployment for individuals aged 15 to 29 in South Korea stood at 6.6% in May, more than double the overall 2.7% unemployment rate.

Related: Kaia pledges won-pegged stablecoin as South Korean payment stocks rally

Real estate out of reach

Yune admitted that stocks would be the first option for South Korean youth to consider. Still, he pointed out that “they don’t see a lot of returns.” Housing is also out of reach both for personal needs and as an investment, Yune said:

“They cannot buy houses anymore, or even the rent is too high for them. So their only option is to do crypto.“

The median Seoul apartment price has doubled in five years, topping 1 billion won ($689,000), and the price-to-income ratio for the city is reportedly 15.2. “So that’s why a lot of […] crypto traders and why I’m saying this is they’re not actually interested in [crypto,]” Yune said.

Yune added that “there are exceptions, of course,” but said “many of them are not even aware of the infrastructure or the technology” involved in crypto.

Magazine: Korea to lift corporate crypto ban, beware crypto mining HDs: Asia Express

Read the full article here