John Bollinger, legendary trader and creator of the Bollinger Bands, has warned of a looming correction for Bitcoin and Ethereum following the latest price upswing.

Bollinger conveyed these warnings in two different posts on X in response to ongoing inquiries from traders regarding his position on the recent price resurgence. Notably, Bitcoin (BTC) and Ethereum (ETH) have spearheaded the market’s shift from bearish to bullish momentum this week.

BTC and ETH Record Resurgence

Bitcoin surged 7.8% in intraday gains on Monday, breaking a four-day period of consolidation below the $68,000 psychological threshold. This rebound allowed the leading cryptocurrency to reclaim the $70,000 level for the first time in over a month, reaching a high of $71,500 before encountering resistance.

Ethereum experienced a remarkable 19.25% surge on the same day, marking its most significant intraday gain in over six years. This historic performance pushed ETH beyond the $3,600 threshold, continuing its upward trajectory until May 21 and culminating in a two-month peak of $3,839.

Amid the recovery efforts, market participants who missed the dip are looking to augment their holdings, while those who currently hold positions remain uncertain of the direction from here. This growing uncertainty has triggered questions directed at market veterans such as John Bollinger.

Ethereum Rides on Spot ETF News

In response to numerous questions about the sustainability of Ethereum’s recent uptrend, Bollinger noted that the optimism surrounding the potential approval of Ethereum spot ETFs by the U.S. Securities and Exchange Commission (SEC) had already been largely factored into the market.

Several inquiries about $ETHE today. The news is mostly in, the discount mostly gone, and the move is over-extended, so I trimmed my position today. $ETHUSD $ETHBTC

— John Bollinger (@bbands) May 21, 2024

Reports from this week suggested that the U.S. SEC might be looking to give the greenlight for the trading of spot ETH ETFs. Notably, the securities regulator asked exchanges such as Nasdaq and Cboe to quickly review their 19b-4 filings. While this does not translate to an approval of filings from issuers, the bullish sentiments have triggered the recent rally.

Nonetheless, Bollinger pointed out that the favorable news had driven significant buying interest, reducing the discount at which Ethereum was trading. For context, Ethereum’s bearish phase over the past few days saw it trading at a discounted price below $3,000 at some point. ETH slumped to a low of $2,860 on May 14.

ETH Currently Oversold

The recent rally has all but trimmed this discount. However, Bollinger expressed caution about the rally’s future prospects, suggesting that the price movement had become over-extended. As a result, he decided to reduce his holdings, implying that the current price level might not be sustainable in the short term.

Market data conforms to the legendary trader’s sentiments, with the relative strength index (RSI) spiking from a low of 37.84 on May 14 to the current value of 71.10, as shown in the chart below.

Ethereum Daily RSI

While such a spike in RSI indicates growing strength, an RSI above 71.10 suggests ETH is overbought and could be due for a retracement. At press time, Ethereum changes hands at $3,762, down 0.75% this morning. It could leverage the support at $3,606 to defend against further drops in the ensuing correction.

Bollinger Expresses Short-Term Concern on Bitcoin

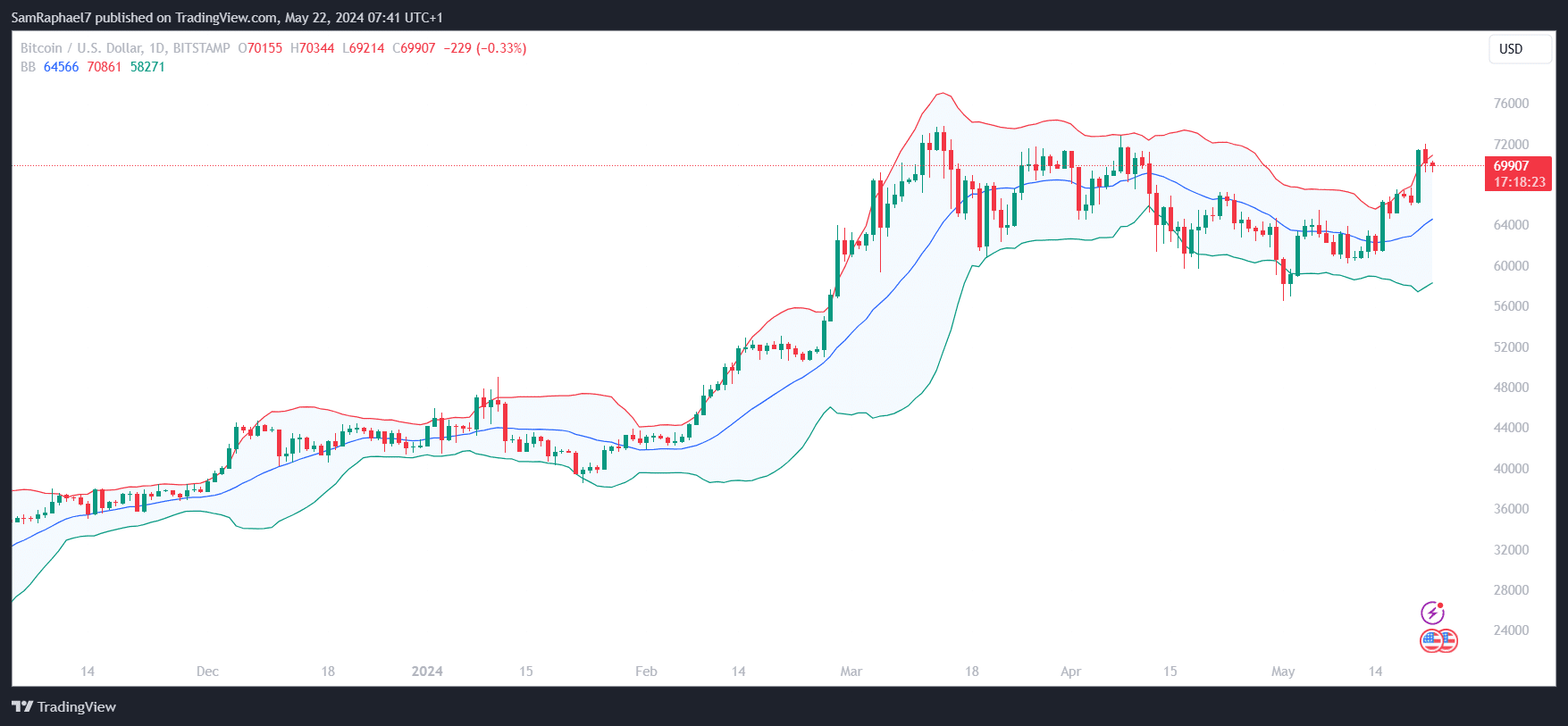

John Bollinger also shared his perspective on Bitcoin’s price action. He observed a two-bar reversal pattern forming at the upper Bollinger Band for Bitcoin. This signal, according to Bollinger, indicates the potential for a period of consolidation or a short-term pullback in Bitcoin’s price.

I am not fond of the two-bar reversal at the upper Bollinger Band for $btcusd Suggests a consol or a pullback. Not bearish here, just short-term concerned. https://t.co/4567TCglIy

— John Bollinger (@bbands) May 21, 2024

However, he clarified that he is not bearish on Bitcoin overall. Instead, he expressed a short-term concern, suggesting that while it might experience a brief pause or slight decline, the long-term outlook remains unchanged. Bitcoin currently trades for $69,907, looking to breach the $70,861 resistance at the upper Bollinger band.

Bitcoin Bollinger Bands

Read the full article here