- Chainlink price trades around $14.57 on Tuesday after rebounding from its key support level the previous week.

- Chainlink is facilitating the secure exchange of a Hong Kong CBDC and an Australian dollar stablecoin.

- The derivatives data show that LINK’s bullish bets among traders have reached the highest level in over a month.

Chainlink (LINK) price continues to trade in green on Tuesday after rebounding from its key support level the previous week. On Monday, LINK announced that it had facilitated the secure exchange of a Hong Kong Central Bank Digital Currency (CBDC) against an Australian dollar stablecoin, highlighting its growing role as a trusted oracle network in financial infrastructure. The derivative data also projects a bullish outlook, as LINK’s bullish bets among traders have reached their highest level in over a month.

Chainlink’s growing role as a trusted oracle network in financial infrastructure

Chainlink announced on Monday that it has successfully enabled CBDC and stablecoin swaps between Hong Kong and Australia, involving major players such as Visa, Fidelity, and China AMC. The cross-border exchange involved the Hong Kong CBDC (e-HKD) against an Australian dollar stablecoin (A$DC), utilizing Chainlink’s Cross-Chain Interoperability Protocol (CCIP).

This growing development highlights LINK’s role as a trusted oracle network in critical financial infrastructure, marking a significant step in blockchain-based cross-border payments. This news drove Chainlink’s price up 4.59% on Monday, closing above $14.36.

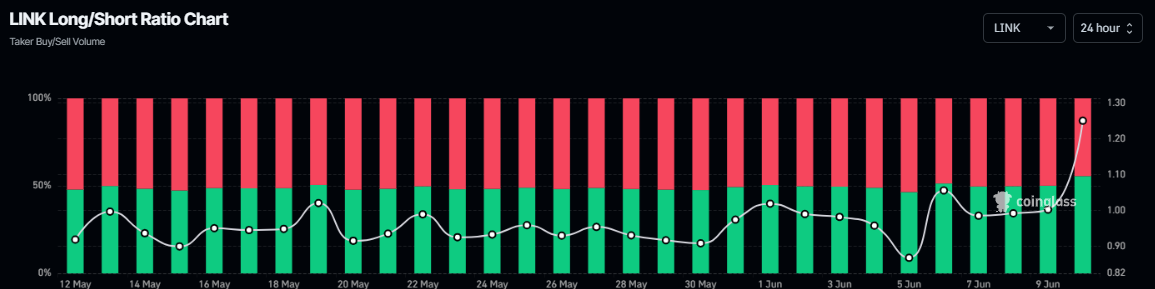

Another bullish sign is Coinglass’s LINK long-to-short ratio, which reads 1.25, the highest level in over a month. This ratio, above one, reflects bullish sentiment in the markets, as more traders are betting on the asset price to rise.

LINK long-to-short ratio chart. Source: Coinglass

Chainlink Price Forecast: LINK bulls aim for higher leg

Chainlink price found support around its daily level of $12.59 on Saturday and rebounded by 11.40% as of Monday. At the time of writing on Tuesday, it continues to trade higher at around $14.55.

If LINK continues its upward trend, it could extend the rally to retest its May 29 high of $16.19. A successful close above this level could extend additional gains toward its weekly resistance at $18.81.

The Relative Strength Index (RSI) on the daily chart reads 49 and points upward toward its neutral level of 50, indicating fading bearish momentum. If the RSI moves above its neutral level and continues its upward trend, it would indicate strength in bullish momentum. The Moving Average Convergence Divergence (MACD) indicator is about to flip a bullish crossover on the daily chart. If the MACD generates a bullish crossover, it will provide a buying signal and indicate an upward trend.

LINK/USDT daily chart

However, if LINK faces a correction, it could extend the decline to retest its daily support at $12.59.

Related news

- Circle stock extends rally following T-Rex, ProShares and Bitwise filings for ETFs based on CRCL

- Bitcoin spikes above $110K after account of Paraguay’s president claims BTC legal tender

- Why the US should care about GENIUS Act as stablecoin market hits new record in 2025

Share:

Read the full article here