Litecoin (LTC) has recently experienced a surge in whale activity. Its large investors, holding over 10,000 LTC, have accumulated coins worth $30 million over the past seven days.

This surge in buying pressure coincides with growing anticipation surrounding the potential launch of a Litecoin spot exchange-traded fund (ETF).

Litecoin Whales Fill Their Bags

According to Santiment, since January 9, Litecoin’s large investors, who hold more than 10,000 LTC, have acquired 250,000 coins valued at $30 million at current market prices. This brings the group’s total holdings to 49 million LTC, its highest in the past 30 days.

This whale accumulation has triggered a rally in LTC’s value. Trading at $117.55 at press time, the altcoin has noted a 15% uptick in the past seven days.

When whales increase their coin accumulation, it signals confidence in the asset’s future performance. This behavior reduces circulating supply, creating upward price pressure, and often influences smaller investors to follow suit.

LTC’s current momentum is fueled by growing optimism around the potential approval of a spot Litecoin exchange-traded fund (ETF) in the US. On January 15, Canary Capital filed an amendment to its S-1 registration form with the Securities and Exchange Commission (SEC), signaling progress toward this approval.

In a post on X, Bloomberg analyst James Seyffart noted that the amendment indicates the SEC is actively reviewing the proposal. Bloomberg’s Eric Balchunas also noted that recent reports suggest the SEC has provided feedback on the Litecoin S-1, strengthening hope around the ETF’s chances of approval.

“This looks to confirm that which bodes well for our prediction that Litecoin is most likely to be the next coin approved,” Balchunas wrote on X.

LTC Price Prediction: Can It Break $124 Resistance and Reach $147?

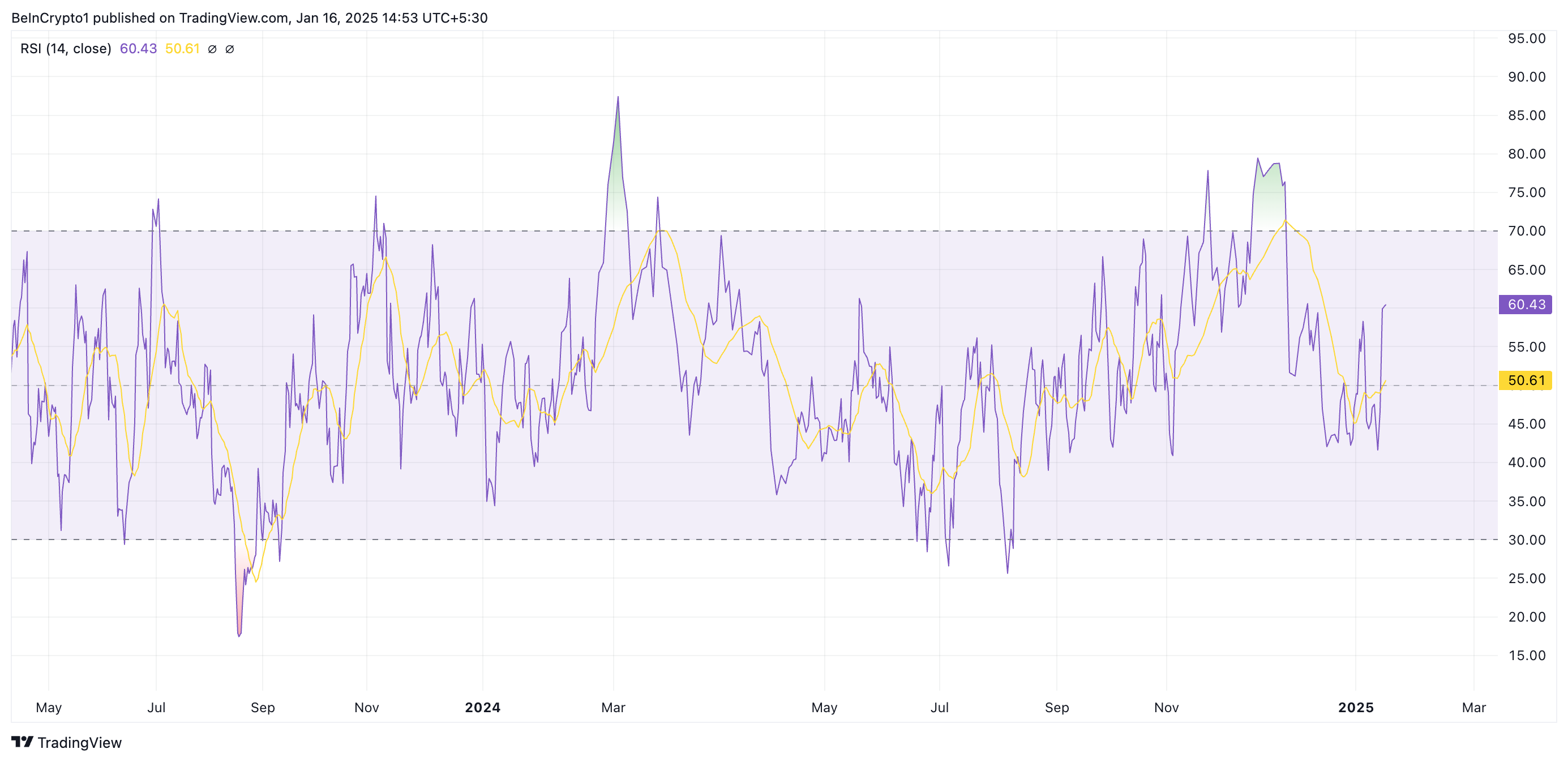

On the daily chart, LTC’s Relative Strength Index (RSI) confirms the rising demand for the altcoin. At press time, it is in an uptrend at 60.43.

This momentum indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a correction. Conversely, values below 30 suggest that the asset is oversold and may witness a rebound.

At 60.43, LTC’s RSI suggests it is experiencing bullish momentum, with more buying pressure than selling pressure. If this continues, its price could break above the resistance at $124.03 to revisit the three-year high of $147.

However, if the whales stall on their accumulation and selloffs resume, LTC’s price could drop to $109.81.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here