With the approval of an Ethereum (ETH) spot ETF potentially on the horizon in May, the second largest cryptocurrency by market cap is on many traders and investors eyes given how it could stand to benefit

However, despite the excitement, ETH has been struggling to keep pace with Bitcoin (BTC) in recent times. This 3-year low ETH/BTC exchange rate challenges what enthusiasts call “the flippening”- a hypothetical scenario where Ethereum surpasses Bitcoin as the dominant cryptocurrency by market capitalization.

Several factors are contributing to this underperformance. One key reason is the decline in activity on Ethereum’s network. The number of active users and the overall transaction volume on ETH’s decentralized applications (DApps) have both dropped significantly.

This decline is concerning because DApps are the heart of the Ethereum ecosystem. They are the platforms that enable users to interact with decentralized finance (DeFi), non-fungible tokens (NFT), and other blockchain-based functionalities.

When user engagement with DApps drops, it suggests that there might be underlying issues with the Ethereum network itself, or a lack of innovation and development within the DApp ecosystem.

Adding to ETH’s woes is the rise of Solana (SOL). This competing blockchain has been grabbing market share in the DeFi space, particularly fueled by recent trends in memecoins and stablecoin transfers.

Forecasting ETH’s potential trajectory

Leveraging machine learning algorithms, financial analysts project a cautiously bullish outlook for Ethereum’s price. These artificial intelligence (AI)-driven tools forecast a continuation of the positive trend, potentially propelling ETH to $3,633 by the end of April.

This translates to a potential rise of 3.15% from its current price. While positive, the upward trend is expected to be relatively modest.

Ethereum price analysis

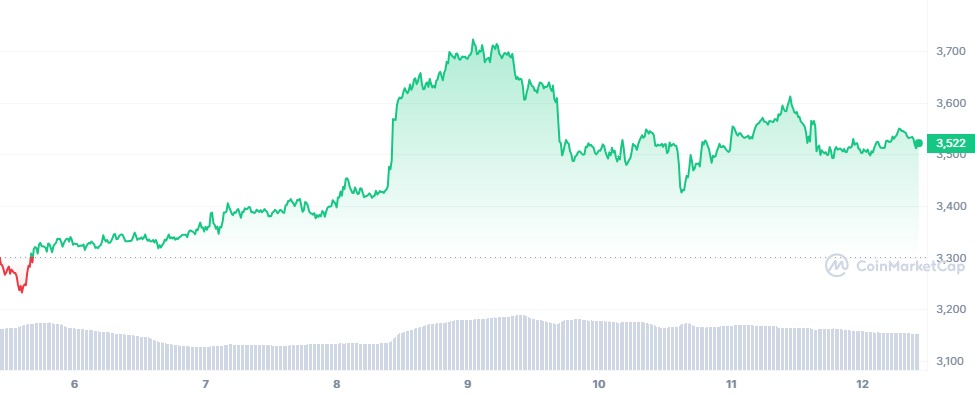

At press time, Ethereum’s price today stands at $3,522. Despite experiencing a slight decline of 2.08% for the day, ETH has seen an increase of 6.71% over the past week.

However, this upward momentum contrasts with a decrease of 11.48% over the past month.

Nevertheless, ETH had 17 green days in the last 30 days, accounting for 57% of the month. Additionally, the price has increased by 88.14% over the year.

Despite recent fluctuations, the overall trend suggests resilience and potential for further growth in the near future.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here