Japanese Bitcoin treasury firm Metaplanet has surpassed mining company Cleanspark in becoming the fifth-largest corporate holder of Bitcoin after buying another 1,005 BTC for $108 million.

The firm now holds 13,350 BTC acquired for around $1.31 billion at around $97,832 per Bitcoin. At current market prices, the treasury is worth $1.45 billion.

Bitcoin mining company CleanSpark holds 12,502 BTC, according to BiTBO. The firm has eclipsed Tesla, Hut 8, Coinbase and Block Inc. in Bitcoin treasury size and now only trails Strategy, Marathon Digital, Twenty One Capital and Riot Platforms.

Metaplanet CEO Simon Gerovich said the aggregate price per coin for its latest purchase was $107,601, and the firm has achieved a BTC yield of 349% year-to-date.

$208 million in bonds to buy more Bitcoin

The latest purchase also comes after announcing a bond refinancing strategy to fund more purchases.

Metaplanet’s strategic bond refinancing involved issuing 30 billion yen ($208 million) in 0% ordinary bonds from its EVO fund to purchase additional Bitcoin.

Related: Bitcoin price stuck as OGs are ‘dumping on Wall Street’: Analyst

With this issuance, the firm will also buy back and cancel its third series ordinary bonds worth 1.75 billion yen ($12 million), which carried an annual interest rate of 0.36%, so it has effectively secured an interest-free loan and cash float for more BTC.

“Funds raised through the issuance of the new bonds will be partially allocated to the buyback and cancellation, with the remainder used for the purchase of Bitcoin,” the disclosure stated.

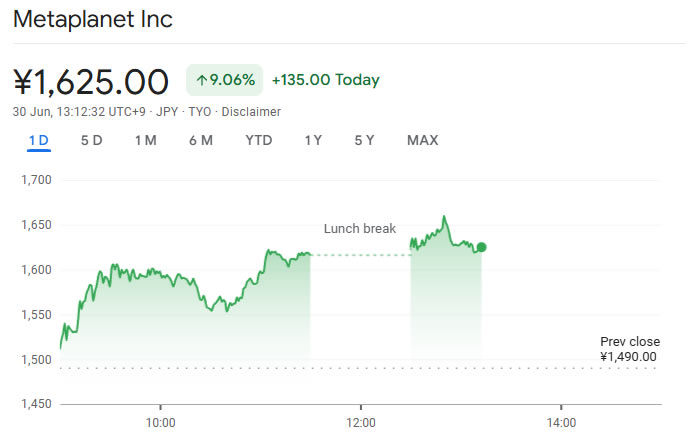

Metaplanet stock jumps 9%

Earlier this month, Metaplanet revised its accumulation strategy with plans to hold 100,000 BTC by 2026, increasing its target from 21,000 BTC.

The firm also announced plans to raise $5.4 billion and acquire a whopping 210,000 Bitcoin by 2027. This would make it the world’s second-largest corporate holder of the asset if the current standings remain.

There was a strong reaction for the company’s stock in Japan on Monday, with a 9% jump in price. Shares in the firm have skyrocketed more than 350% since the beginning of 2025, according to Google Finance.

Saylor hints at more

Meanwhile, Strategy founder Michael Saylor has hinted at another Bitcoin purchase with his regular weekend post of the portfolio tracker, which has preceded a Monday acquisition in previous weeks.

“In 21 years, you’ll wish you’d bought more,” Saylor said, captioning the chart.

“We buy every day. And still, I know I’ll look back wishing we had moved even faster,” Simon Gerovich replied.

Magazine: Bitcoin ‘bull pennant’ eyes $165K, Pomp scoops up $386M BTC: Hodler’s Digest

Read the full article here