Bitcoin

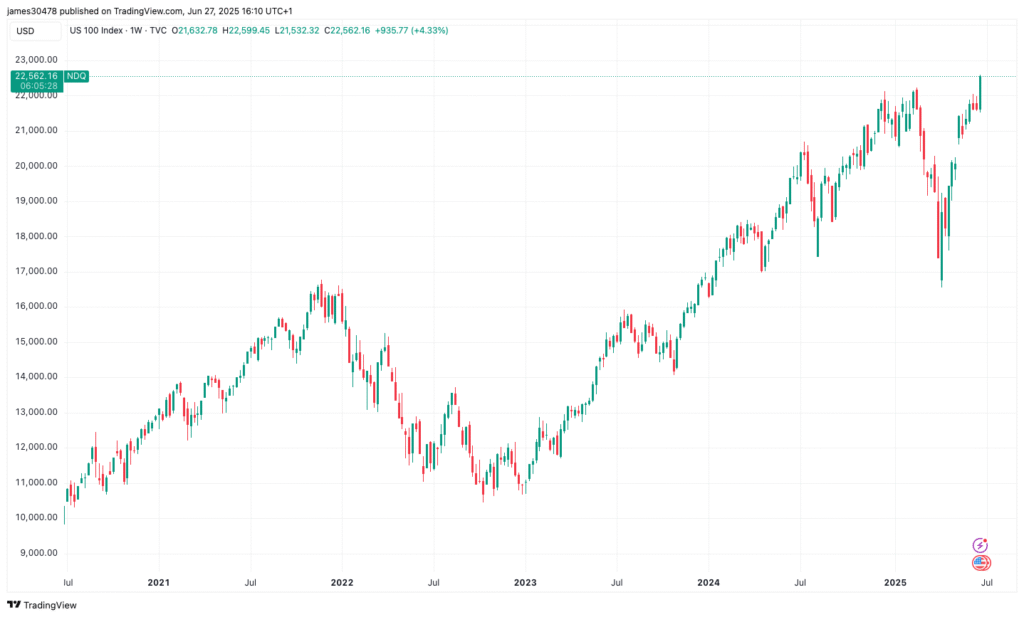

continues to consolidate in the $102,000 to $108,000 range and gold is lower by 2% today and roughly 7% from its record high. Meanwhile, the Nasdaq 100 has reached new all-time highs.

A couple of U.S. macroeconomic data points Friday morning — though nearly two months old at this point — might have added to the modestly negative tone for BTC and gold. Personal income in May came in at -0.4%, falling short of the expected increase of 0.3%. Personal spending month over month printed at -0.1%, missing the forecast of a 0.1% increase.

Maybe of more import to markets, the core PCE price index in the US, which excludes volatile food and energy prices and is the Federal Reserve’s chosen gauge of underlying inflation, rose by 0.2% in May compared to expectations of a 0.1% increase. On a year-over-year basis, core PCE prices rose 2.7% versus 2.6% expected.

This data further supports the view that the economy may be heading toward stagflation. Noted goldbug and no-coiner Peter Schiff: “Traders continue to sell gold even as this morning’s release of weak economic data and stronger-than-expected inflation data pushed the dollar index to new lows. Stagflation and a tanking dollar are bullish for gold, regardless of any superficial trade deals ‘negotiated’ by Trump.”

Read the full article here